Ethereum Drops to $1,874: Are Bears Pushing for a Breakdown Below Key Support?

Ethereum has dropped to $1,874, testing a key support level as selling pressure intensifies across the broader crypto market. With prices inching dangerously close to critical liquidation thresholds around $1,805, analysts warn that a sharper correction could be on the horizon.

This downturn places $238 million worth of ETH at risk, as two major MakerDAO whales face potential liquidation. As the market braces for volatility, traders are closely watching whether bulls can defend current levels—or if bears are preparing to force a deeper breakdown.

Whales at Risk: $238M ETH Faces Liquidation

The latest ETH sell-off is testing the resilience of highly leveraged DeFi positions. According to blockchain analytics firm Lookonchain , two large Ethereum holders on MakerDAO are on the verge of liquidation. Combined, they hold 125,603 ETH, currently valued at $238 million.

As Ethereum trades near $1,874, their positions are approaching liquidation triggers at $1,805 and $1,787. The health rate of these vaults—a key indicator of collateral stability—has now dropped to 1.07, raising the likelihood of forced asset sales.

If ETH falls below these levels, the Maker protocol will automatically liquidate collateral, potentially flooding the market with ETH and triggering a broader wave of sell pressure across DeFi.

This scenario could amplify bearish momentum and rattle confidence in leveraged on-chain strategies.

Ethereum Price Action Signals Further Weakness

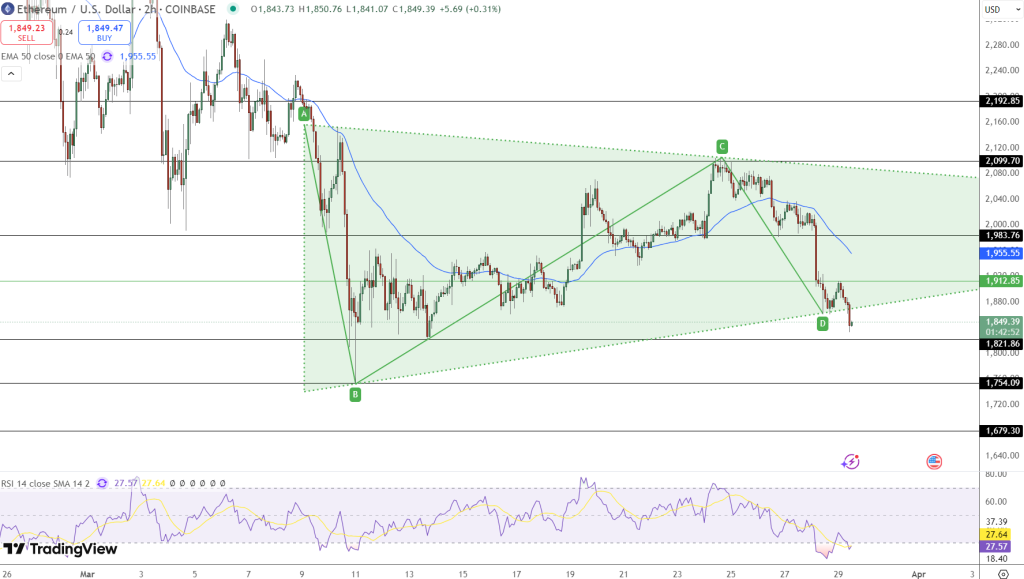

Ethereum has broken below its symmetrical triangle support near $1,880, a key level that had held for weeks. The current price action around $1,850 suggests increasing selling pressure. Technical indicators provide little comfort for bulls:

- Relative Strength Index (RSI) has plunged to 28, signaling extreme oversold conditions.

- The 50-period EMA on the 2-hour chart sits at $1,955, well above current price levels.

- An ABCD harmonic pattern completed near the recent low, hinting at continuation of the bearish move.

If Ethereum breaks decisively below $1,822, the next support zones lie at $1,754 and $1,680. Only a recovery above $1,880 and a close above $1,955 would indicate a meaningful trend reversal.

Market Outlook: DeFi Liquidations in Focus

The potential liquidation of whale-sized positions highlights a persistent risk in decentralized finance—automated liquidations with no manual stop-losses. While DeFi offers transparency, its rigid mechanics can lead to sharp, sudden moves during periods of volatility.

Key Points to Watch:

- A breakdown below $1,805 could trigger liquidation of 125K ETH.

- RSI suggests conditions are oversold, but recovery remains uncertain.

- ETH must reclaim $1,880–$1,955 to regain bullish structure.

While oversold readings could prompt a temporary bounce, the looming threat of major liquidations suggests downside risks remain elevated unless sentiment shifts swiftly.

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that automatically rewards holders with real Bitcoin when BTC hits key price milestones. Unlike traditional meme tokens, BTCBULL is built for long-term investors, offering real incentives through airdropped BTC rewards and staking opportunities.

Staking Passive Income Opportunities

BTC Bull offers a high-yield staking program with an impressive 119% APY, allowing users to generate passive income. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting strong community participation.

Latest Presale Updates:

- Current Presale Price: $0.002435 per BTCBULL

- Total Raised: $4.2M / $4.8M target

With demand surging, this presale provides an opportunity to acquire BTCBULL at early-stage pricing before the next price increase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.