Research Report | In-depth Analysis of PumpBTC & PUMP Market Valuation

Project Overview

PumpBTC is a Bitcoin liquid staking protocol built on Babylon. Users can stake BTC derivatives such as BTCB and WBTC to mint $pumpBTC, a 1:1 pegged token with liquidity that can be used in DeFi scenarios while continuously earning native yield distributed by the Babylon protocol. Unlike traditional PoS staking models, PumpBTC introduces a yield mechanism for BTC, addressing the lack of native interest-bearing opportunities for BTC in DeFi.

The protocol does not custody user assets directly. Instead, it partners with custodians like Cobo and Coincover to hold BTC on the native chain and stake on behalf of users via Babylon, thereby avoiding bridge risks and liquidity fragmentation. Currently, PumpBTC supports BSC and Ethereum, with plans to expand to Berachain, Base, and other chains.

The project has integrated with over 70 other projects and completed a $10 million seed round in October 2024, with participation from SevenX, Mirana, Mantle, and others. Overall, PumpBTC occupies a structurally significant position in the BTCFi narrative, with its growth prospects closely tied to the development of the Babylon mainnet.

Project Highlights

Establishing a Native Yield Path for BTC

PumpBTC builds a bridge between BTC derivatives and Babylon staking, allowing assets like BTCB and WBTC to maintain on-chain liquidity while earning native yield from the Babylon protocol. Compared to the passive use of BTC in traditional DeFi, this model introduces an interest-bearing mechanism similar to Ethereum's LSTs, potentially forming a foundational, stable yield path within BTCFi.

Staking Architecture Without Bridge Dependency

Most BTC DeFi applications rely on cross-chain bridges, locking BTC and issuing wrapped assets on target chains, which introduces significant systemic risk. PumpBTC avoids this by collaborating with custodians like Cobo and Coincover to hold BTC directly on the mainnet and stake it via Babylon on behalf of users. This non-bridged approach mitigates common bridge-related security issues and reduces asset fragmentation and liquidity silos.

Scalable Liquid Token System

The $pumpBTC token received after staking BTCB/WBTC is a transferable liquid token that can be used across chains and in DeFi scenarios such as lending and liquidity mining. Currently deployed on BSC and Ethereum, the protocol plans to expand to Berachain, Base, Scroll, and more, offering strong horizontal scalability and a unified yield entry point for BTC across multi-chain ecosystems.

Stable Early Performance and Ecosystem Integration

Since the launch of its mainnet, PumpBTC has seen a steady increase in total staked volume and has integrated with over 70 projects across DeFi, infrastructure, wallets, and other verticals. The project completed a $10 million seed round in October 2024, with backing from SevenX, Mirana, Mantle, and others, positioning it ahead of peers in terms of capital support and ecosystem rollout.

Market Valuation Outlook

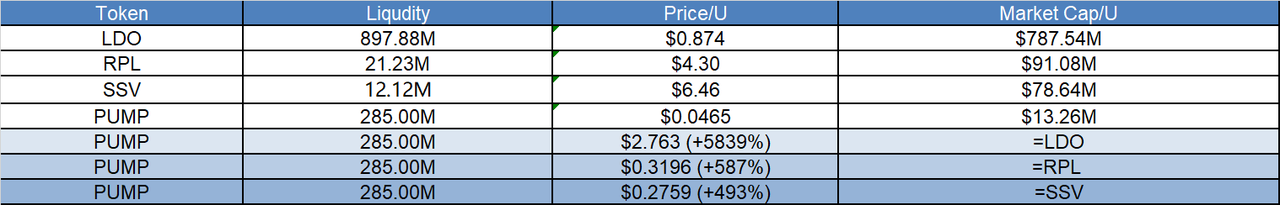

PUMP is the liquid staking asset for BTC within the Babylon ecosystem. By staking BTCB, WBTC, and other derivatives, users mint $pumpBTC and earn native staking rewards from Babylon. Its structure is similar to Lido (LDO), Rocket Pool (RPL), and ssv.network (SSV) in the Ethereum ecosystem, combining "liquid staking + infrastructure" as a core narrative. As BTCFi is still in its early stages, PUMP, as a foundational module, is expected to be revalued as TVL grows and the ecosystem matures.

Currently, PUMP is priced at $0.0465 with a circulating supply of 285 million tokens, giving it a market cap of approximately $13.26 million. If its valuation reaches levels comparable to other LSD projects, there remains significant upside potential in token price.

Tokenomics

PUMP has a total supply of 1 billion tokens, with an initial circulating supply of 28.5%.

Token distribution is as follows:

Community & Ecosystem: 38% (6% unlocked at TGE, 32% linearly vested over 4 years)

Initial Claim: 9%, unlocked at TGE

Marketing: 5%, unlocked at TGE

Liquidity: 3.5%, unlocked at TGE

Contributors: 19.5%, 1-year lockup followed by 36-month linear vesting

Investors: 20%, 1-year lockup followed by 36-month linear vesting

IDO: 5%, unlocked at TGE

Token Utility:

PUMP serves multiple purposes within the PumpBTC ecosystem, including governance rights, airdrop boosts, fee discounts, and staking rewards.

Additionally, the token burn mechanism allocates:

30% of protocol revenue for PUMP buyback and burn

70% distributed to vePUMP holders

Team & Funding

Team:

PumpBTC is developed by a team of seasoned professionals from DeFi, cross-chain, and asset custody sectors. Core members hail from Babylon, Cobo, Coincover, and various early EVM ecosystem projects.

- Babylon supports the technical architecture, focusing on BTC asset integration with PoS consensus

- Security architecture is provided by Cobo MPC and Coincover, both with compliant custody credentials

- The marketing and ecosystem team has experience in CeFi and on-chain integrations, having led multiple EVM chain integrations, NFT campaigns, and community airdrop initiatives

Funding:

PumpBTC has completed a $10 million seed round focused on BTCFi and multi-chain infrastructure.

On October 29, 2024, PumpBTC announced the close of its $10 million seed round led by SevenX Ventures and Mirana Ventures.

Other participants include UTXO Management, Mantle Ecosystem Fund, Arcane Group, and more.

Potential Risks

PumpBTC’s yield is derived from the Babylon protocol. If Babylon’s mainnet rollout is delayed or staking participation is below expectations, it could negatively impact $pumpBTC’s native yield, reducing staking appeal and token demand.

According to the disclosed tokenomics, both investor and contributor allocations are subject to a 1-year lockup followed by 36-month linear vesting. The community ecosystem allocation will be released over 4 years, which is relatively moderate. However, the initial airdrop allocation is as high as 9%, which may cause early market selling pressure. The actual incentive effect will depend on ecosystem development.

Official Links

Website: https://mainnet.pumpbtc.xyz/

Twitter: https://x.com/Pumpbtcxyz

Discord: https://discord.com/invite/pumpbtc

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne

Arthur Hayes Warns Monad Could Face Sharp Downturn as Debate Grows Over High-FDV Tokens