Pi Network (PI) Bears Target All-Time Low With 100 Million Tokens Set for April Release

With 100 million PI tokens set to be unlocked in April, bearish sentiment and technical indicators suggest the altcoin may revisit its all-time low of $0.40.

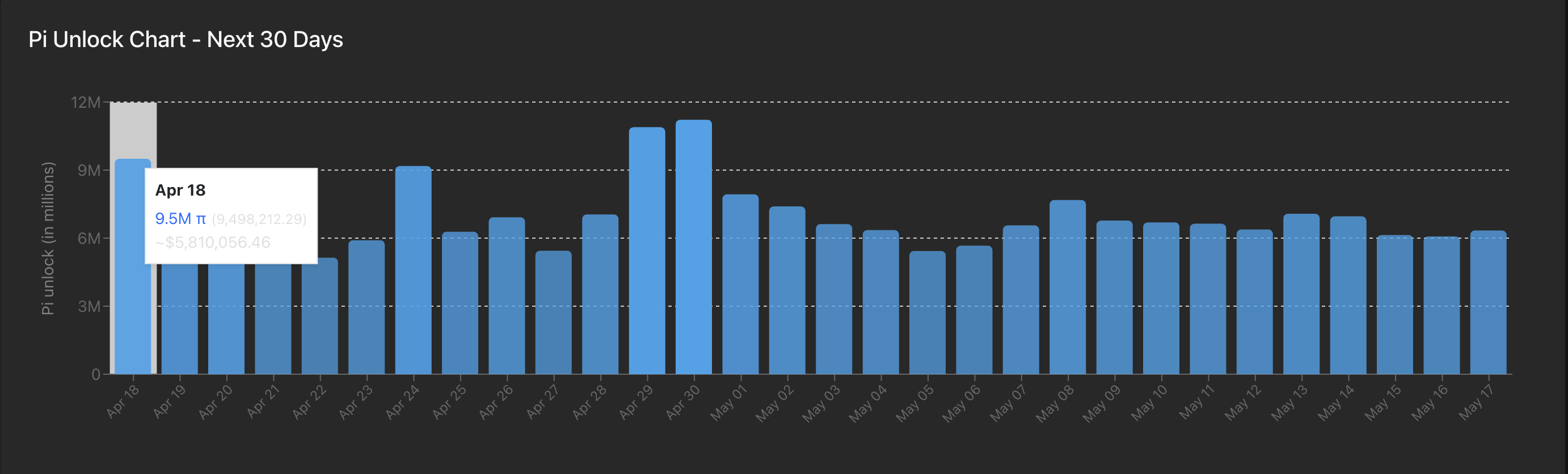

One hundred million Pi Network (PI) tokens, valued at approximately $60 million, is about to be unlocked through the remainder of April.

This may intensify the already bearish momentum that has plagued the token in recent weeks, raising concerns of a further slide toward its all-time low.

PI Struggles Under Bearish Sentiment

According to PiScan, 9.5 million tokens worth $5.76 million at current market prices are due to be released into circulation today. This is part of a broader schedule that will see over 1.56 billion PI tokens released over the next 12 months.

PI Unlock Chart. Source:

PiScan

PI Unlock Chart. Source:

PiScan

With recent broader market headwinds, this month’s tranche of tokens to be unlocked could trigger heightened selling activity, especially given the current lack of strong demand for the altcoin.

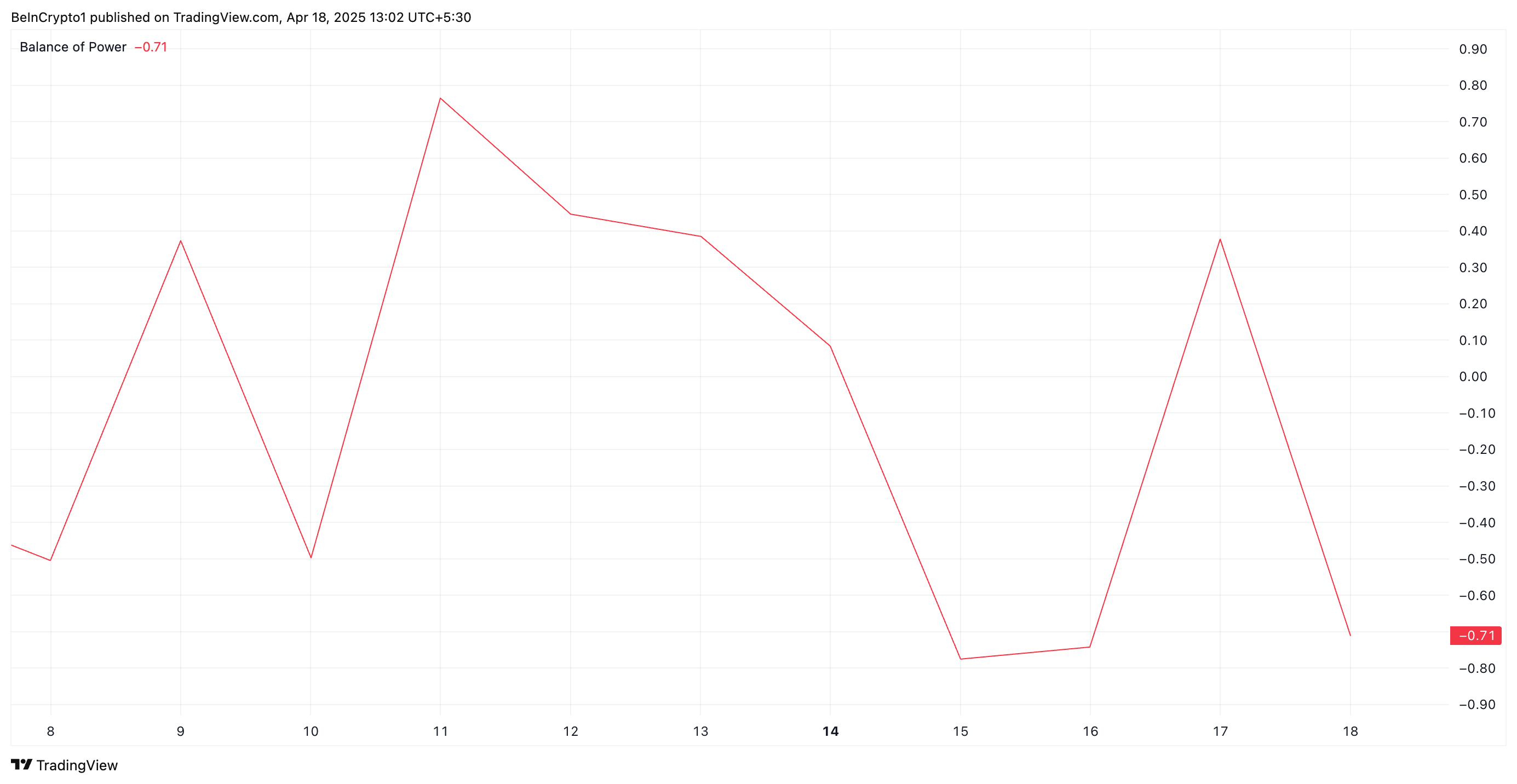

Meanwhile, technical indicators suggest weakening support. For example, PI’s Balance of Power (BoP) is declining at press time, and it is currently below zero at 0.75.

PI BoP. Source:

TradingView

PI BoP. Source:

TradingView

This indicator measures an asset’s buying and selling pressures. When it falls like this, it indicates that sellers are currently in control, exerting more influence over price action than buyers. This confirms the bearish trend in the PI spot markets and signals continued downward pressure on its price.

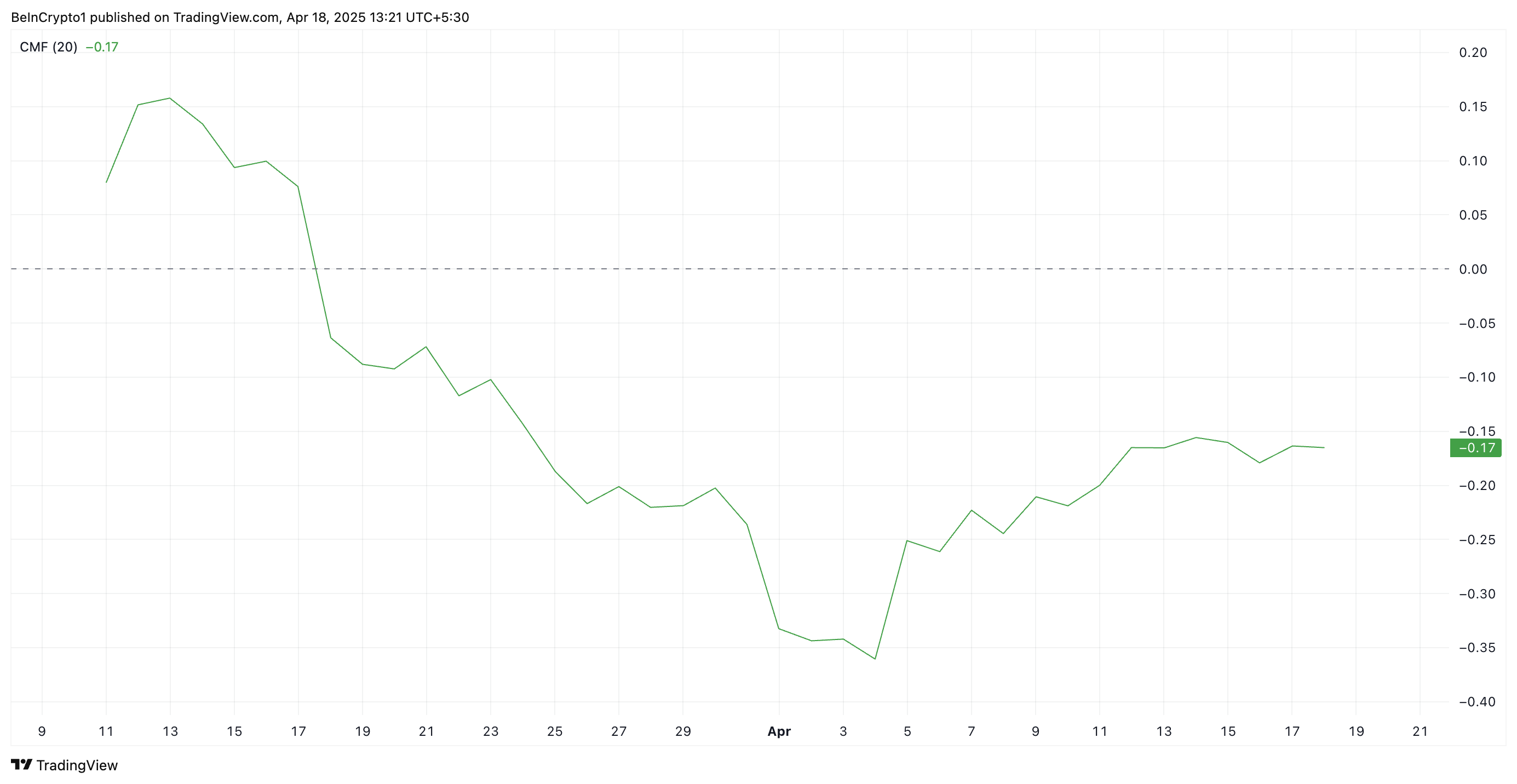

Moreover, PI’s Chaikin Money Flow (CMF) remains firmly below the center line, and has been so positioned since its price decline began on February 26. This momentum indicator currently stands at -0.17.

PI CMF. Source:

TradingView

PI CMF. Source:

TradingView

PI’s negative CMF indicates more selling pressure than buying pressure, meaning money flows out of the asset. This also confirms the bearish sentiment and points to potential further price declines.

PI Could Fall to All-Time Low

PI currently trades below its 20-day Exponential Moving Average, which forms dynamic resistance above its price at $0.70.

The 20-day EMA measures PI’s average price over the past 20 trading days, giving more weight to recent prices. With PI currently trading below this key moving average, it indicates bearish short-term momentum.

It suggests that sellers dominate, and the asset could face continued downward pressure. If the decline persists, PI could revisit its all-time low of $0.40.

PI Price Analysis. Source:

TradingView

PI Price Analysis. Source:

TradingView

Conversely, a resurgence in demand for the altcoin could invalidate this bearish thesis. PI could break above its 20-day EMA and rally toward $0.95 in this scenario.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"AI Godmother" Fei-Fei Li's Latest Interview: I Didn't Expect AI to Become So Popular, the Next Frontier Is Spatial Intelligence

If AI leads humanity into an extinction crisis, it will be humanity's fault, not the machines'. If superintelligence emerges, why would humanity allow itself to be taken over? Where are collective responsibility, governance, and regulation? "Spatial intelligence" may fundamentally change the way we understand the world.

Has the four-year cycle of Bitcoin failed?

The various anomalies in this cycle—including waning sentiment, weakening returns, disrupted rhythms, and institutional dominance—have indeed led the market to intuitively feel that the familiar four-year cycle is no longer effective.

At an internal Nvidia meeting, Jensen Huang admitted: It's too difficult. "If we do well, it's an AI bubble," and "if we fall even slightly short of expectations, the whole world will collapse."

Jensen Huang has rarely admitted that Nvidia is now facing an unsolvable dilemma: if its performance is outstanding, it will be accused of fueling the AI bubble; if its performance disappoints, it will be seen as evidence that the bubble has burst.

After a 1460% Surge: Reassessing the Value Foundation of ZEC

Narratives and sentiment can create myths, but fundamentals determine how far those myths can go.