-

The Aptos community is actively assessing governance proposal AIP-119, which aims to significantly cut staking rewards from 7% to approximately 3.79%.

-

This proposal has sparked debate, with supporters arguing it could foster innovation, while critics warn it threatens smaller validators’ sustainability and network decentralization.

-

“Smaller validators might be pushed out,” cautioned Yui, COO of Aptos-based game Slime Revolution, echoing concerns within the community regarding the proposal’s potential impact.

As Aptos explores proposed reductions in staking rewards, stakeholders debate the potential for innovation versus risks to decentralization in its governance structure.

Aptos Eyes Trimming Staking Rewards to Fund New Initiatives

The proposal AIP-119 characterizes staking rewards as a “risk-free” benchmark within the ecosystem, akin to conventional finance’s interest rates. The authors contend that the existing yield of 7% might be excessively high, leading to stagnant capital allocation rather than fostering growth and innovation.

By lowering the staking yield to around 3.79%, the aim is to motivate users to engage in more dynamic economic activities beyond merely passive staking. This strategic shift is expected to catalyze demand for participation in various innovative projects, such as restaking, MEV extraction, and deeper involvement in DeFi.

“I expect any lowered staking demand [to] be offset by the reduction in inflation from this AIP and new reward-generating opportunities launching in the next 6 months, and other sources of DeFi rewards,” noted Moon Shiesty on X.

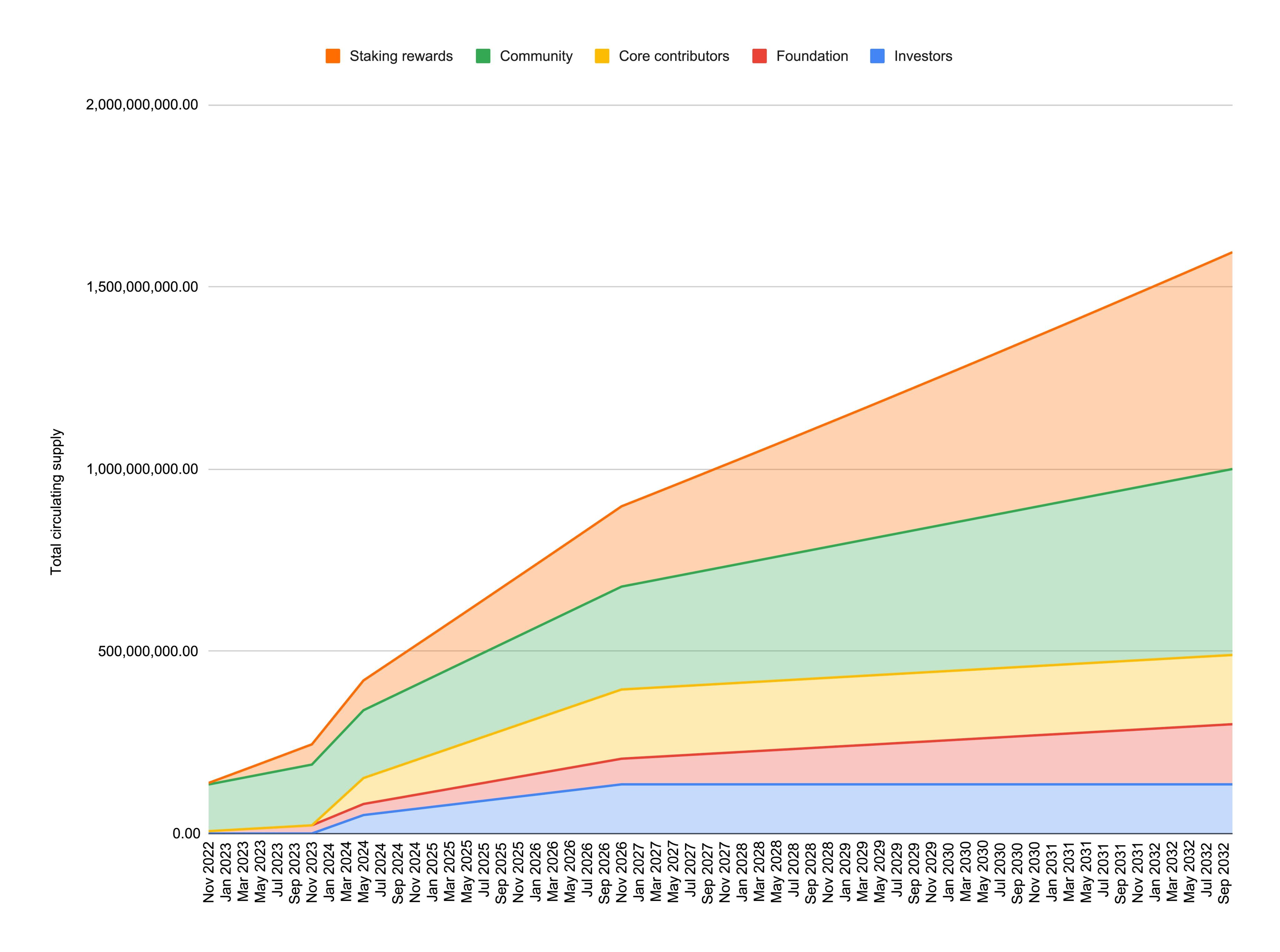

Aptos Total Circulating Supply. Source: X/Shiesty

Furthermore, Shiesty indicated that the savings generated from reduced staking rewards could be redirected to support various initiatives, such as liquidity incentives and gas fee subsidies, particularly benefiting early-stage Layer 1 stablecoin programs.

However, the proposed reductions in rewards have raised alarms regarding the viability of smaller validators. Operating a validator node incurs yearly costs ranging from $15,000 to $35,000, which could pose a substantial burden under the new rewards structure.

Currently, more than 50 validators manage under 3 million APT each, representing about 9% of the total network stake. To counteract the potential issues stemming from these changes, the proposal incorporates a delegation program aimed at supporting smaller validators. This initiative intends to allocate resources and delegate tokens to ensure the network’s decentralization and geographical diversity.

The community’s response to AIP-119 is characterized by mixed opinions.

Yui, COO of the Telegram game Slime Revolution, emphasized the necessity of maintaining a balanced approach that encourages innovation while safeguarding decentralization. “While it could drive innovation, I’m concerned about the potential impact on smaller validators and decentralization. We need to ensure the move doesn’t push out smaller participants! Aptos should focus on balance and long-term resilience,” Yui remarked on X.

Conversely, Kevin, a researcher at BlockBooster, provided a counterpoint by suggesting that the adjustments might enhance Aptos’s position in the long term. According to him, high inflation rates can often mask underlying weaknesses in product-market fit. Conversely, a reduction in inflation compels developers to create sustainable demand.

Kevin further posited that dwindling token emissions could elevate APT’s scarcity, potentially improving its market price and offsetting lower staking yields. “We expect APT’s price to grow due to the reduced inflation rate, and validators’ actual returns may offset the APY decline through price appreciation, forming a positive cycle,” he concluded.

Conclusion

The ongoing discussions surrounding AIP-119 reflect a pivotal moment for the Aptos ecosystem, balancing innovation against the critical need for sustainability among validators. The path forward will be observed closely by stakeholders, as the outcomes could determine the future structure and success of the network. As changes unfold, community engagement and feedback will be vital in navigating this transformative phase.