-

The cryptocurrency market is showing signs of distress as Bitcoin experiences a notable price dip, hinting at the potential arrival of a bear market.

-

Recent trends indicate a shift in holder sentiment, with Short-Term Holders (STHs) beginning to face unrealized losses.

-

“In the past, such transitions have often been precursors to extended downtrends,” says a report from COINOTAG.

Bitcoin’s price dip raises concerns about an oncoming bear market as Short-Term Holders incur losses, highlighting shifting market dynamics.

Understanding Bitcoin’s Price Correction and Its Implications

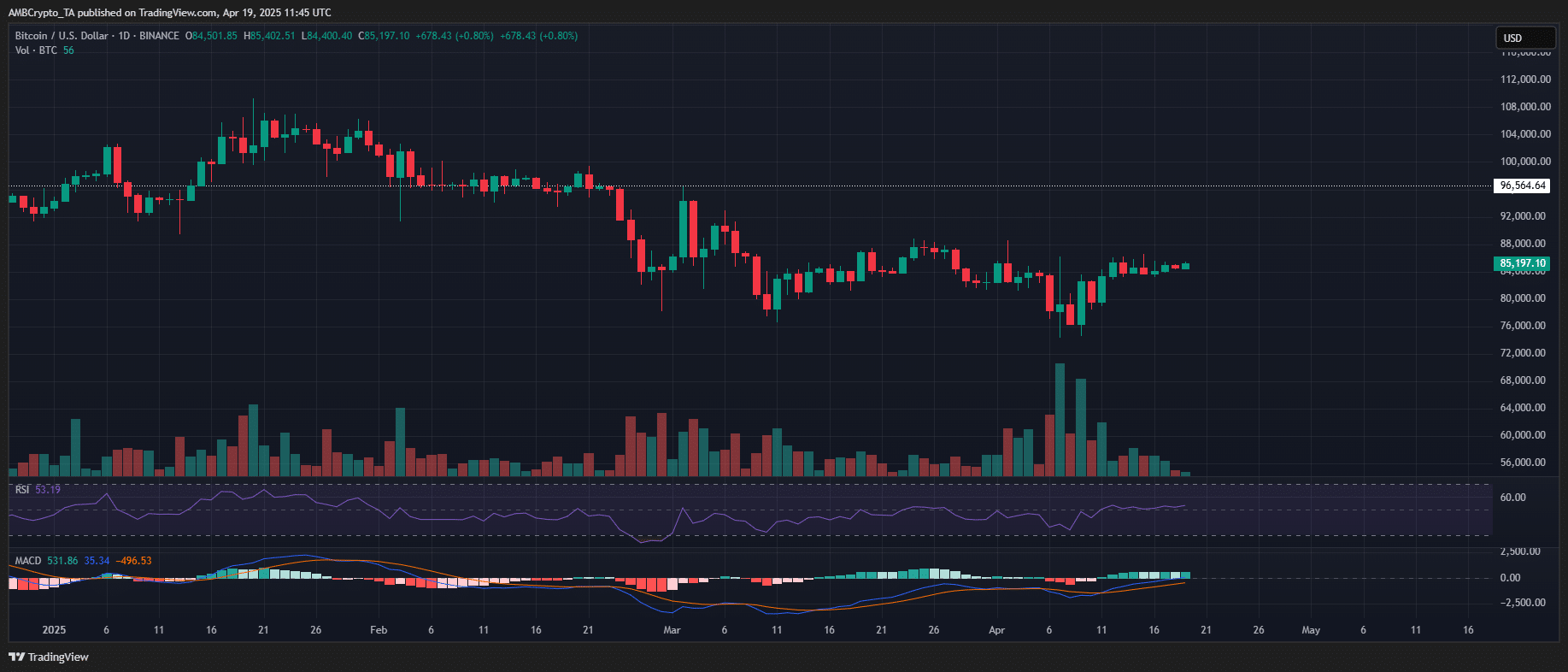

Bitcoin’s recent price correction to $74,000 has sparked discussions about a potential shift in market dynamics. Short-Term Holders (STHs) are encountering significant unrealized losses, while Long-Term Holders (LTHs) continue to remain profitable despite the downturn. This market behavior is critical, as historically, similar patterns have foreshadowed the onset of bear markets.

Unrealized Losses Signal Potential Market Turbulence

The emergence of over 3.6 million STH addresses currently experiencing unrealized losses could lead to increased selling pressure. According to analysis by COINOTAG, this situation merits careful monitoring. Should STHs begin to liquidate their positions in significant numbers, it would amplify the prevailing bearish sentiment and may catalyze a prolonged downtrend.

Impact of STH and LTH Dynamics on Market Sentiment

The shift in dynamics between STHs and LTHs is indicative of potential market pressures. STHs, who primarily capitalize on short-term fluctuations, may soon transition to LTHs if they decide to hold their Bitcoin. However, if the market continues to deteriorate, this transition could reflect a deeper malaise, typically seen at the onset of bearish trends.

Current Market Behavior and Future Outlook

As Bitcoin struggles to reclaim the vital $96k support level, the behavior of STHs suggests a precarious situation. The prolonged holding by these addresses, reflecting a loss state, might also indicate a possible bullish setup. However, if STHs begin to convert into LTHs en masse, this shift is frequently witnessed just before significant market corrections or at the commencement of bear phases.

Profit-Taking and Market Corrections: An Intricate Relationship

Should Bitcoin rally back to previous resistance levels, profit-taking could become a pronounced factor influencing market trends. Historical data suggests that upon breaches of significant resistance, profit-taking often leads to notable downtrends, particularly if concerns about market health remain elevated.

Source: TradingView (BTC/USDT)

Conclusion

As Bitcoin navigates this challenging phase, market participants are urged to remain vigilant. The intricate dynamics between STHs and LTHs could dictate future price movements and overall market stability. A clear understanding of these trends is essential for investors looking to navigate potential volatility effectively.