Fidelity Global Macro Analyst Predicts S&P 500 Recovery After Pricing in ‘Enough Pain’ – But There’s a Big Catch

Fidelity Investments’ global macro director Jurrien Timmer believes the S&P 500 is now in a position to witness a market recovery after dropping about 20% from its all-time high this year.

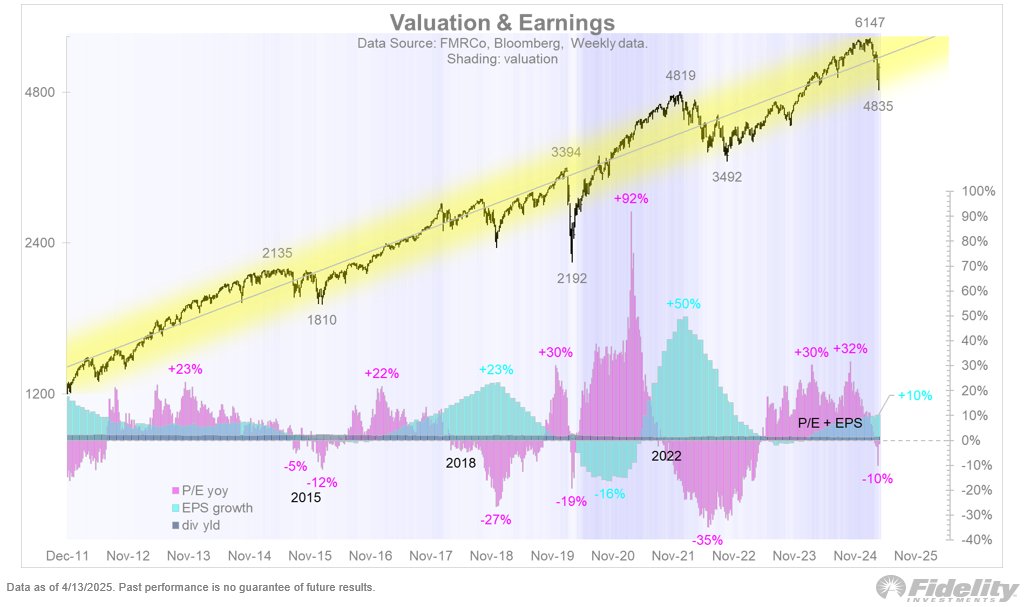

In a new thread on the social media platform X, Timmer says that the S&P 500 has been swinging above and below a rising trendline as far back as December of 2011.

According to the analyst, the latest correction has driven the stock market well below the rising trendline, and it is now at a point where it could stage a comeback.

“Should the S&P 500 index overtake that breakdown point, it would happen after the index has fully swung from one extreme to another.

The chart below shows the index with its rising trendline (exponential regression). Like a pendulum, the market is always moving from one end to the next, and in this case, it went from well above the line to well below. That suggests that investors have priced in enough pain to make it worth taking the other side.”

Source: Jurrien Timmer/X

Source: Jurrien Timmer/X

While Timmer believes that equities are primed for an upswing, he warns that the S&P 500’s long-term uptrend – one that started in 2009 – may be entering the home stretch. According to Timmer, investors are likely to reassess their positions in the US stock market amid a changing global order.

Timmer believes that investors will now look at fundamentally sound and undervalued stocks, even if those names are outside of the US markets.

“There is no getting around questioning the bullish secular regime in which we have been since the financial crisis ended in 2009. The timing of the cyclical drawdown raises questions about the state of the secular bull, which in my view is in its final years. If a new world order of de-globalization and de-dollarization is afoot, it could change the landscape for years to come, and that could very well usher in a new secular regime.

This is an existential question not only in terms of the kind of returns we can expect in the coming years, but also the leadership within the markets. With the Mag 7 dominance now more than 10 years old and fraying, a rotation to value and international is likely to happen in a diminished secular beta regime.”

Source: Jurrien Timmer/X

Source: Jurrien Timmer/X

As of Friday’s close, the S&P 500 is trading at 5,282 points.

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Has sector rotation in the crypto market really failed?

With BTC maturing first, ETH lagging behind, and SOL still needing time, where are we in the cycle?

Prospects of Ethereum Protocol Technical Upgrade (1): The Merge

This article will interpret the first part of the roadmap (The Merge), explore what technical design improvements can still be made to PoS (Proof of Stake), and discuss ways to implement these improvements.

DYDX Boosts Market Moves with Strategic Buyback Decision

In Brief DYDX increases revenue allocation for token buybacks from 25% to 75%. Price gains expected due to reduced supply pressure and strategic decisions. Increased buybacks viewed as a crucial financial strategy amidst volatile conditions.

Corporate Crypto Treasuries Shift as Bitcoin Loses Ground to Altcoins