Bitcoin ETFs See Biggest Net Inflows in 3 Months | ETF News

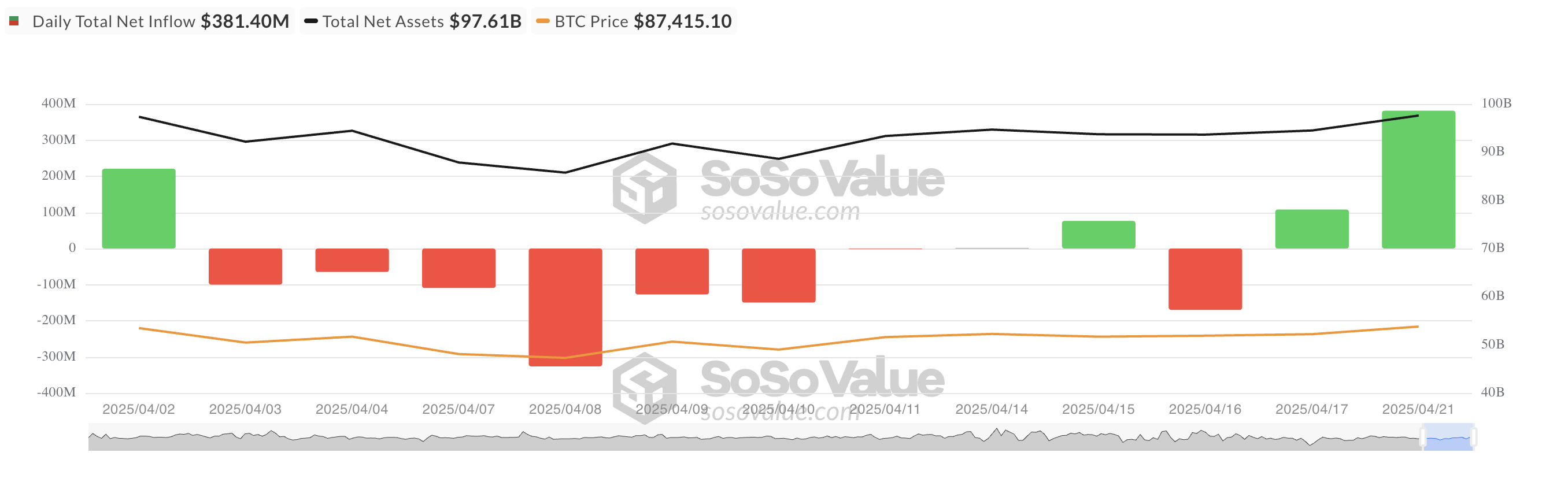

Bitcoin ETFs experienced a major surge in capital inflows, with $381 million flowing into the market on Monday. This surge, driven by renewed institutional interest, coincides with a rising bullish sentiment in Bitcoin's futures market.

This week kicked off on a positive note for Bitcoin ETFs, as institutional investors are making a strong comeback. On Monday, Bitcoin ETFs recorded over $380 million in net inflows, marking their largest single-day inflow since January 30.

The spike in capital inflow signals a renewed wave of institutional confidence in the leading coin, following an extended period of subdued activity in the ETF market.

Bitcoin ETFs Record Strong $381 Million Inflows

On Monday, net inflows in BTC ETFs totaled $381.40 million. The last time Bitcoin ETFs saw such a substantial injection of funds in a single day was nearly 13 weeks ago, making this latest surge notable.

The influx of capital reflects a resurgence in bullish bias among institutional investors toward BTC, at a time when broader sentiment has remained relatively cautious.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Yesterday, Ark Invest and 21Shares’ ETF ARKB recorded the largest daily net inflow, totaling $116.13 million, bringing its total cumulative net inflows to $2.60 billion.

Fidelity’s ETF FBTC came in second place with a net inflow of $87.61 million. The ETF’s total historical net inflows now stand at $11.37 billion.

Investor Confidence Rises

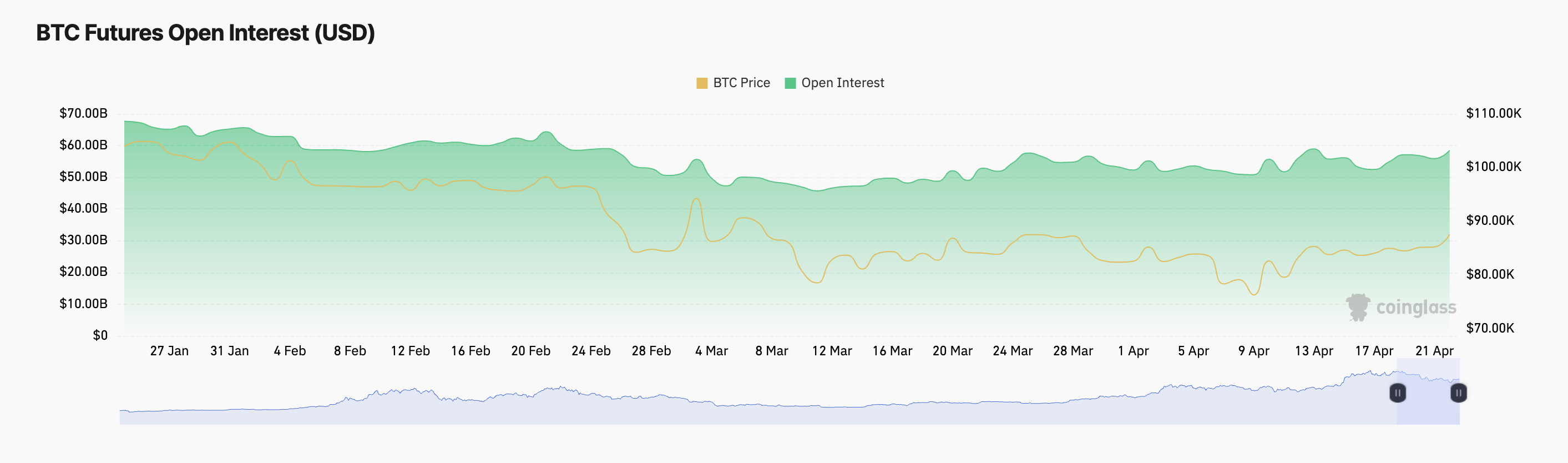

BTC has recorded a modest 1% gain over the past 24 hours. This price surge has prompted an uptick in the count of new open contracts in the coin’s futures market, reflected by its rising futures open interest. At press time, this is at $58.46 billion, climbing 5% over the past day.

BTC Futures Open Interest. Source:

Coinglass

BTC Futures Open Interest. Source:

Coinglass

An asset’s open interest measures its total number of outstanding derivative contracts, such as futures or options that have not been settled or closed.

When BTC’s open interest rises along with its price, it indicates that more traders are entering the market, either opening new long or short positions. This is a bullish signal confirming growing investor interest in the king coin.

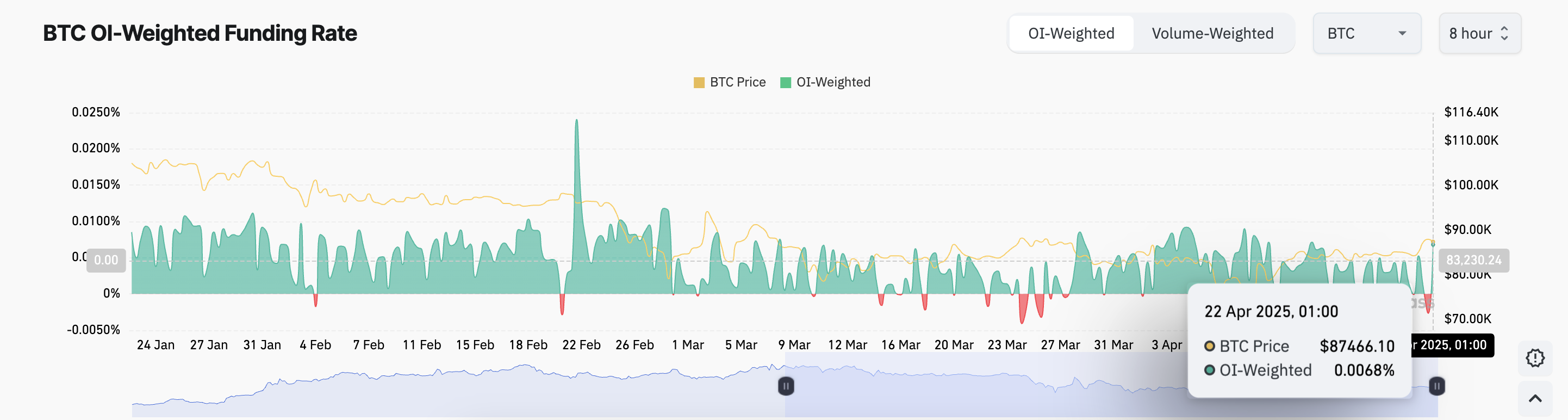

Further, BTC’s funding rate is positive at press time, highlighting the market’s confidence in its future price performance. This currently stands at 0.0068%.

BTC Funding Rate. Source:

Coinglass

BTC Funding Rate. Source:

Coinglass

When an asset’s funding rate is positive like this, long traders pay short traders. This means that more traders are betting on BTC’s going up, reflecting bullish market sentiment.

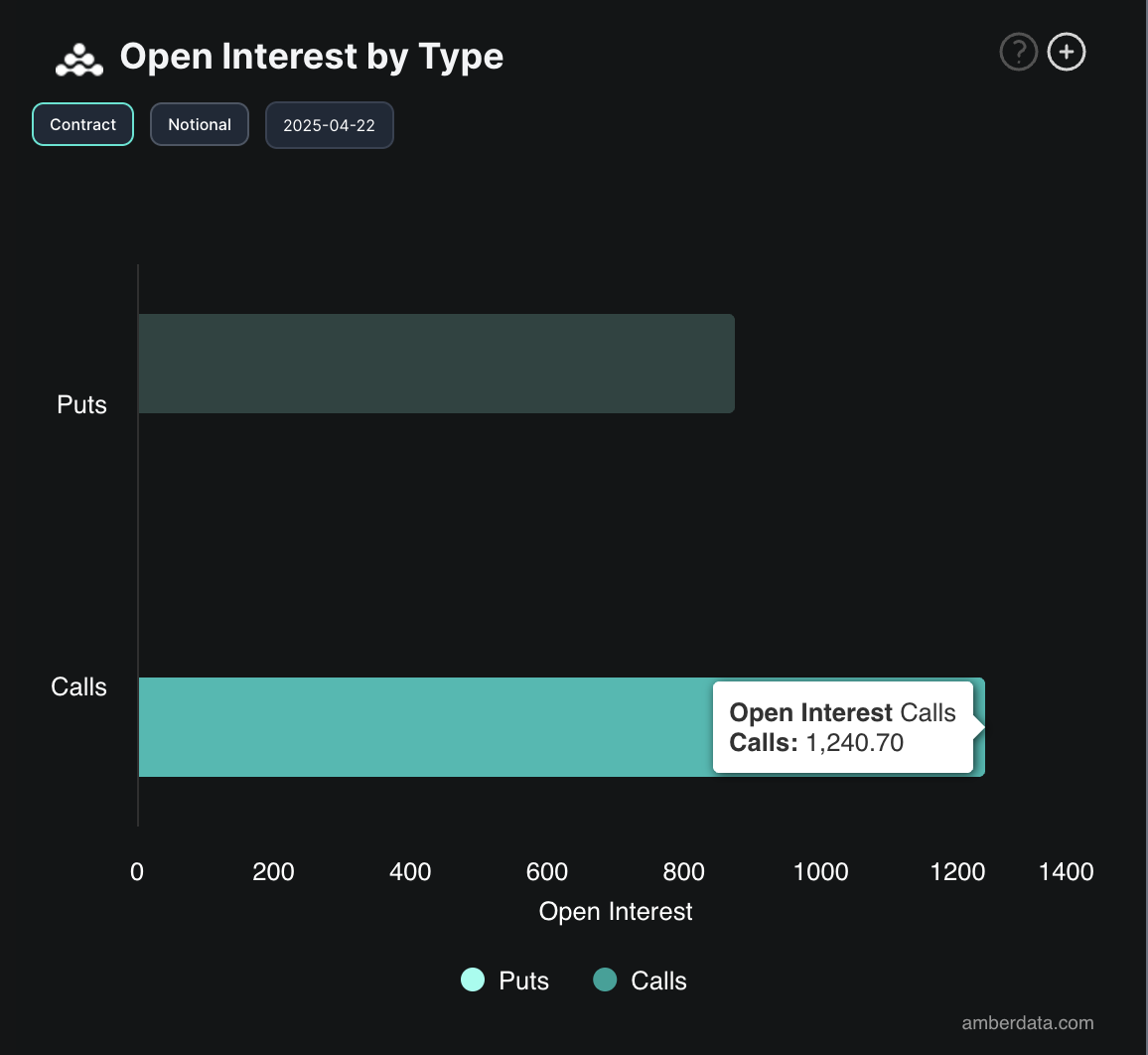

Moreover, today’s high demand for calls in the BTC options market supports this bullish outlook. According to Deribit, BTC’s put-to-call ratio is currently at 0.71.

BTC Options Open Interest. Source:

Deribit

BTC Options Open Interest. Source:

Deribit

This indicates that more call options are traded than puts, suggesting a bullish bias among options traders. This low ratio reflects growing investor confidence and expectations of upward price movement.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve Hawks Speak Out, Asset Price Crash Risk May Become New Obstacle to Rate Cuts

JPMorgan warns that if Strategy is removed from MSCI, it could trigger billions of dollars in outflows. The adjustment in the crypto market is mainly driven by retail investors selling ETFs. Federal Reserve officials remain cautious about rate cuts. The President of Argentina has been accused of being involved in a cryptocurrency scam. U.S. stocks and the cryptocurrency market have both declined simultaneously. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Citibank and SWIFT complete pilot program for fiat-to-crypto PvP settlement.

Pantera Partner: In the Era of Privacy Revival, These Technologies Are Changing the Game

A new reality is taking shape: privacy protection is the key to driving blockchain toward mainstream adoption, and the demand for privacy is accelerating at cultural, institutional, and technological levels.

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer's brand philosophy.