Bitcoin rally alongside gold fuels decoupling narrative

Key Takeaways

- Bitcoin and gold are rallying together as investors move away from USD risk assets.

- This simultaneous rise fuels the narrative of Bitcoin's potential decoupling from traditional markets.

Bitcoin’s recent rally, moving in tandem with gains in spot gold while diverging from the downward trend in tech stocks, is once again reviving discussions around its potential decoupling from traditional risk assets.

Both gold and Bitcoin have shown strength since the start of the week. The leading digital asset rose 3% to $87,500, while gold edged close to $3,400 during early Asian trading on Monday.

On April 22, gold futures broke through the $3,500 mark for the first time, while spot gold came close, reaching $3,498 and posting a year-to-date gain of over 30%, according to TradingView data.

Bitcoin also climbed to a high of $88,800 during early Asian trading on Tuesday. At the time of writing, the digital asset soared past $89,000, up around 37% year-to-date.

Market analysts suggest that gold’s extended rally has been fueled by slumping stock markets, a weaker dollar, and growing investor unease after President Trump intensified pressure on Fed Chair Jerome Powell.

Against this backdrop of heightened market uncertainty, Bitcoin’s behavior—mirroring gold rather than tech stocks, with which it has historically been closely correlated—suggests early signs of the digital asset increasingly behaving as an independent, safe-haven-like class.

According to QCP Group’s latest report, Bitcoin’s surge to its highest levels since early April was supported by strong spot demand during US trading hours.

US-listed spot Bitcoin ETFs attracted around $381 million in net inflows on Monday, their highest level since late January. This strong performance meant renewed institutional interest in Bitcoin.

Analysts point to Bitcoin’s strength alongside the safe-haven metal as evidence that it may be evolving into a more independent asset class, viewed as a store of value rather than a speculative risk trade.

“As capital rotates into safe-haven and inflation-hedging assets, BTC and gold are proving to be key beneficiaries of the exodus from USD risk,” per QCP Group’s report.

It is still too early to declare a full decoupling, but some market observers view the parallel rallies as a sign that Bitcoin’s role in global financial infrastructure is maturing.

Continued correlation with gold could bolster arguments for Bitcoin’s long-term resilience, particularly amid ongoing macroeconomic uncertainty.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer’s philosophy of branding.

App delays and launch sniping: Base co-founder’s token issuance sparks community dissatisfaction

While most major altcoins are showing weakness, Jesse has chosen to issue a token at this time, and the market may not respond positively.

"Crypto bull" Tom Lee: The crypto market correction may be nearing its end, and bitcoin is becoming a leading indicator for the US stock market.

"Crypto bull" Tom Lee stated that on October 10, an abnormality in the cryptocurrency market triggered automatic liquidations, resulting in 2 million accounts being liquidated. After market makers suffered heavy losses, they reduced their balance sheets, leading to a vicious cycle of liquidity drying up.

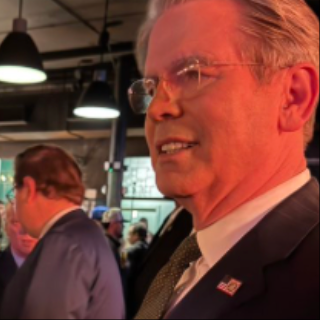

Besant unexpectedly appears at a "Bitcoin-themed bar," crypto community "pleasantly surprised": This is the signal

U.S. Treasury Secretary Janet Yellen made a surprise appearance at a bitcoin-themed bar in Washington, an act regarded by the cryptocurrency community as a clear signal of support from the federal government.