SUI Price Remains Optimistic As 7-Week-Long Death Cross Nears End

SUI has dipped over 10% following a strong rally, but market indicators such as the RSI and nearing golden cross suggest bullish momentum may not be over. Investors are watching for a bounce-back above key levels.

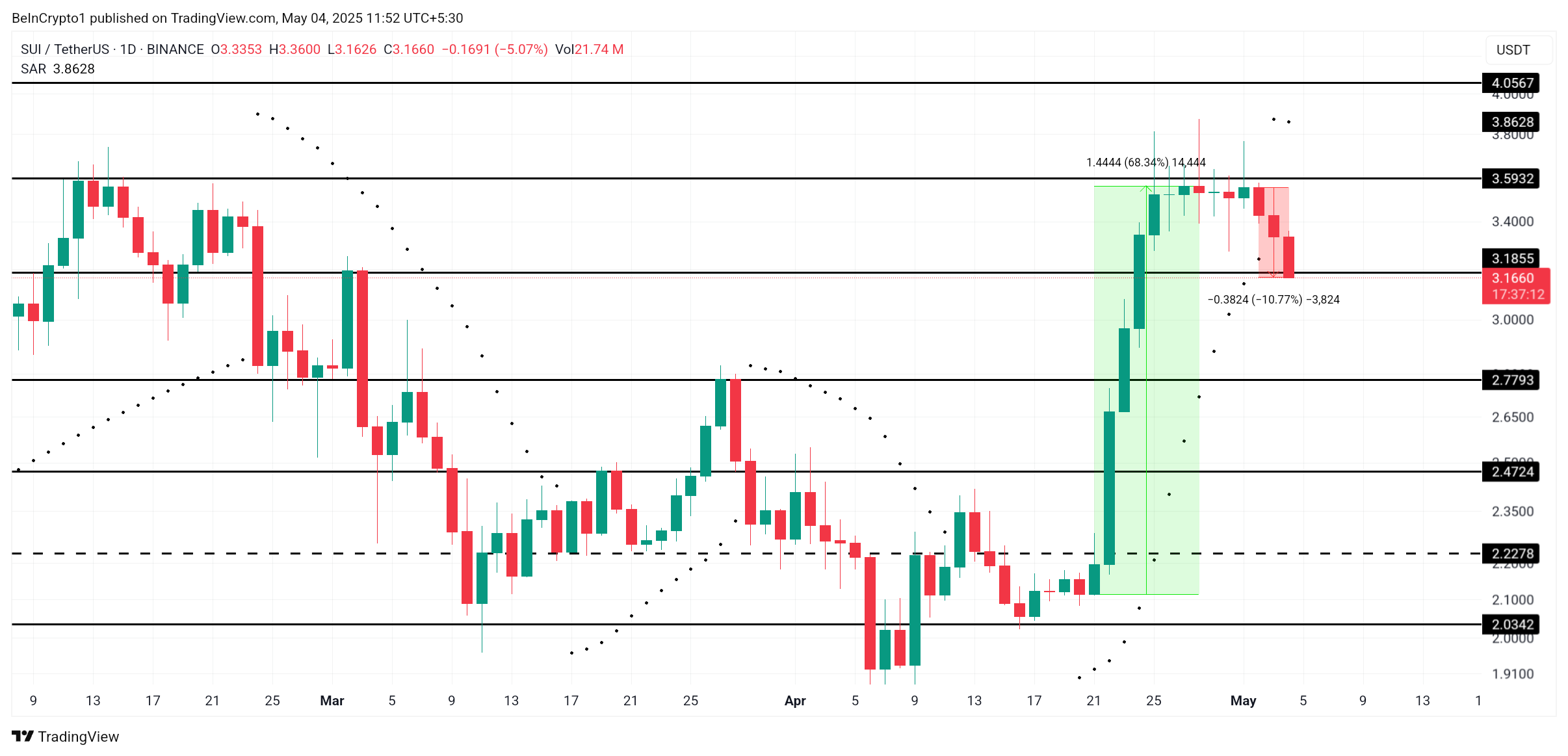

After soaring nearly 70% in recent weeks, SUI has faced a swift correction, shedding 10% of its value over the past three days. Despite strong bullish momentum pushing the altcoin into the spotlight, the sudden pullback hasn’t rattled investors.

The broader outlook for SUI remains intact, with on-chain metrics and market indicators signaling that this drop may be nothing more than a cooldown.

SUI Investors Can Rejoice

The 50-day exponential moving average is on the verge of overtaking the 200-day EMA. This near-crossover suggests SUI could soon witness a golden cross — a strong technical signal indicating a shift in long-term momentum.

Should the crossover complete, it would mark the end of SUI’s death cross that began seven weeks ago.

Such a shift would likely encourage renewed buying pressure. A golden cross often precedes significant rallies, and with SUI’s price having gained nearly 70% prior to the recent drop, bullish sentiment appears far from fading.’

SUI EMAs. Source:

TradingView

SUI EMAs. Source:

TradingView

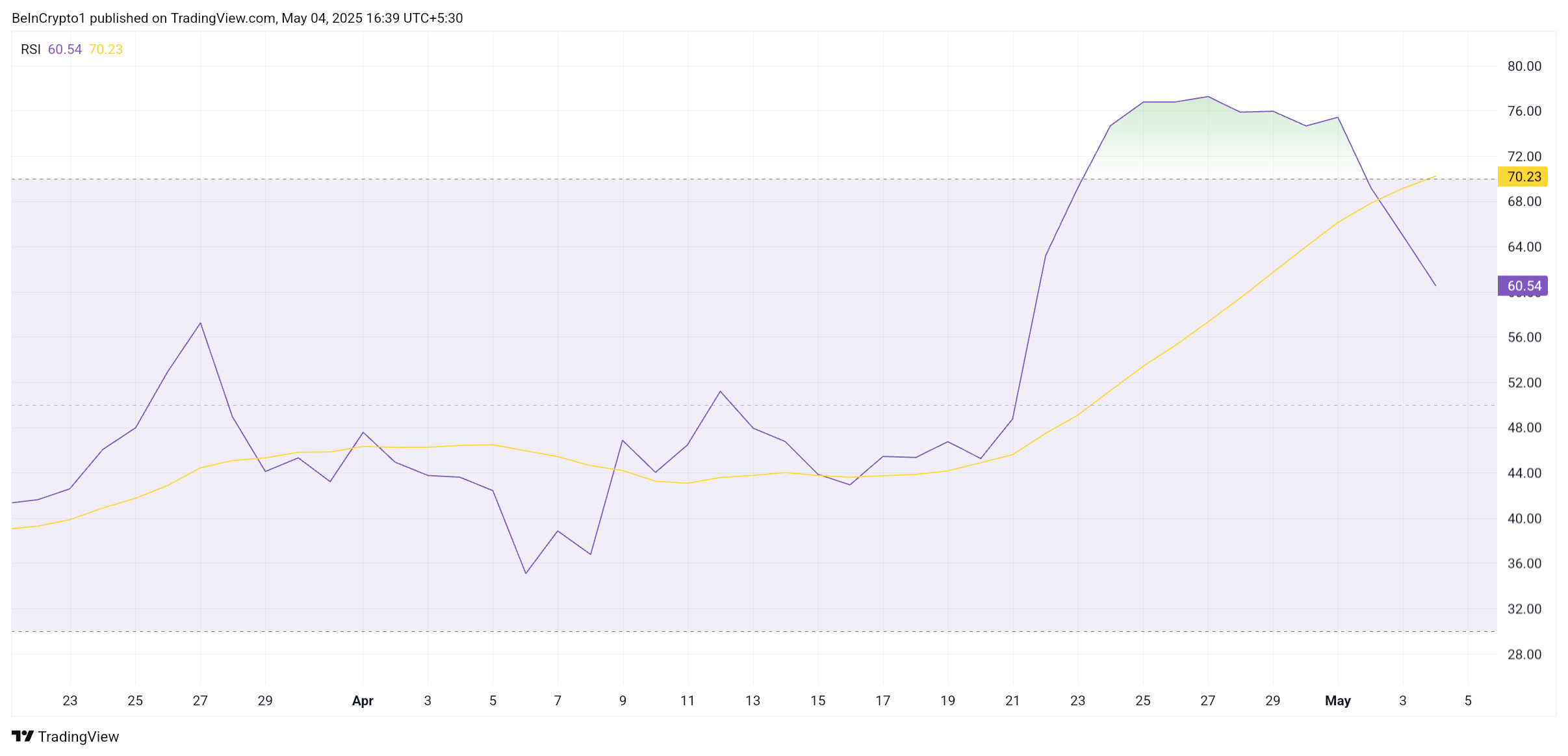

SUI’s relative strength index (RSI) recently breached the overbought threshold, triggering a cooldown as traders took profits. This RSI dip corresponded with the 10% price drop, signaling that the asset was temporarily overheated and needed to stabilize.

Despite the retreat, the RSI remains within bullish territory, hovering just below the overbought zone. This means that while the rally has paused, the overall trend remains intact, and further gains may be on the horizon if buying volume increases again.

SUI RSI. Source:

TradingView

SUI RSI. Source:

TradingView

SUI Price Aims At Bouncing Back

At press time, SUI is trading at $3.16, having slipped below a key support level during the last 24 hours. The 10.77% decline stems from the altcoin’s failure to breach the $3.59 resistance level, compounded by a general market cooldown. Still, the correction is viewed by many traders as temporary.

The broader indicators continue to reflect bullish conditions. The nearing golden cross, resilient RSI, and strong upward momentum all hint that SUI could soon reclaim $3.16 as support. If momentum returns, the asset might retest $3.59 and potentially break past it, resuming its prior recovery path.

SUI Price Analysis. Source:

TradingView

SUI Price Analysis. Source:

TradingView

However, delays in recovery could change the script. Should SUI fail to reclaim $3.16 soon, the altcoin risks slipping further. A failure to breach $3.39 or secure support at $3.18 could send the price tumbling toward $2.77, potentially invalidating the bullish thesis and signaling a trend reversal.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.