Bitcoin Accumulation Whales Usually Never Fails

🐳 As May progresses, Bitcoin's key stakeholders are mostly moving in the right direction if you're rooting for $100K $BTC in the near future.

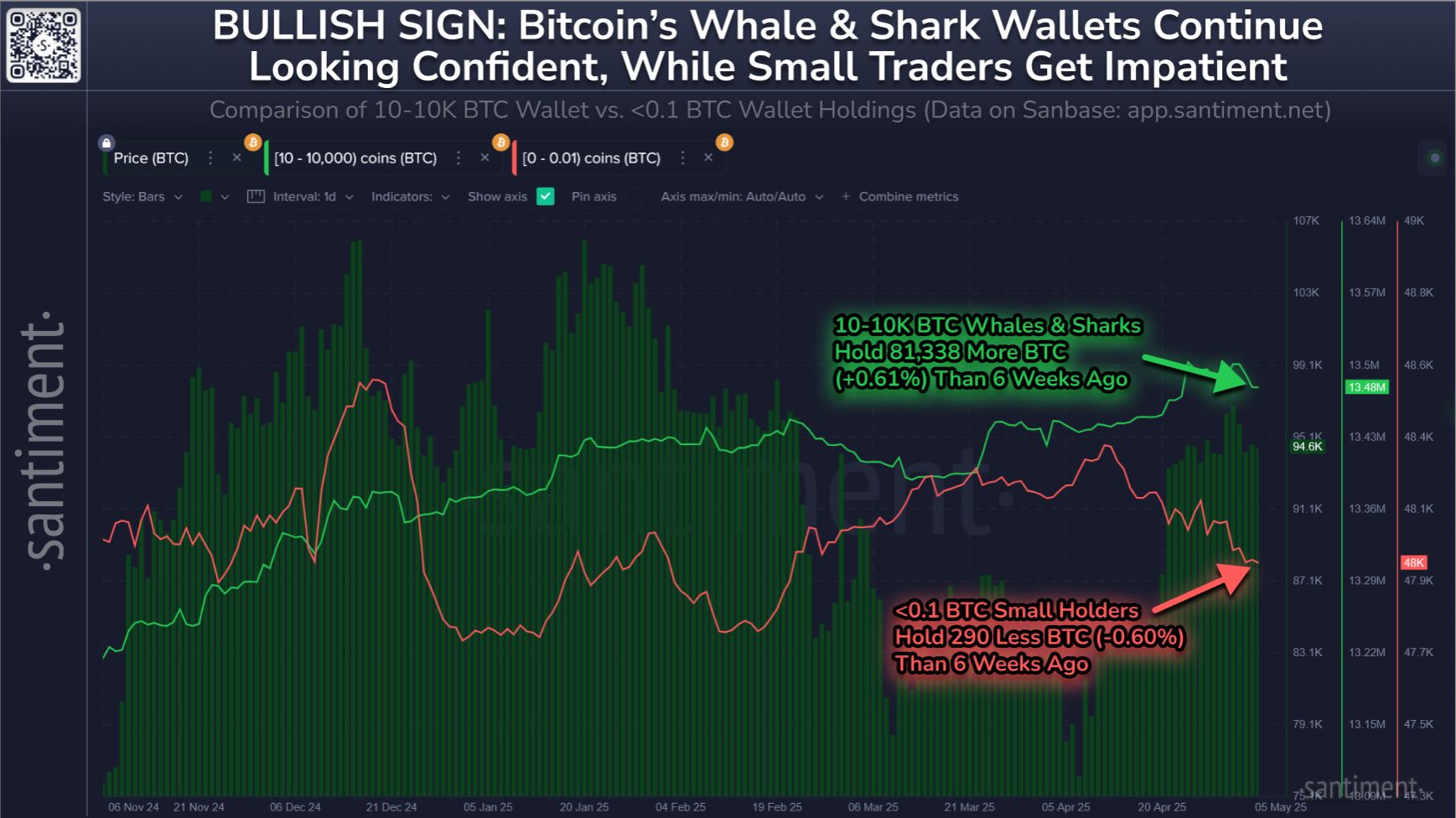

Wallets with the highest correlation with crypto's overall market health (10-10K BTC wallets) have accumulated a combined 81,338 more BTC (+0.61% of their holdings) during these past 6 weeks of volatility.

Meanwhile, small wallets that tend to have an inverse, lagging correlation to price (<0.1 BTC wallets) have dumped 290 BTC (-0.60% of their holdings) in the past 6 weeks.

When large wallets gradually accumulate in tandem with retail panic selling/selling out of boredom, it is generally a strong long-term sign of prices biding their time before another breakout. 👍

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin plunges 30%. Has it really entered a bear market? A comprehensive assessment using 5 analytical frameworks

Further correction, with a dip to 70,000, has a probability of 15%; continued consolidation with fluctuations, using time to replace space, has a probability of 50%.

Data Insight: Bitcoin's Year-to-Date Gains Turn Negative, Is a Full Bear Market Really Here?

Spot demand remains weak, outflows from US spot ETFs are intensifying, and there has been no new buying from traditional financial allocators.

Why can Bitcoin support a trillion-dollar market cap?

The only way to access the services provided by bitcoin is to purchase the asset itself.

Crypto Has Until 2028 to Avoid a Quantum Collapse, Warns Vitalik Buterin