BONK price is currently testing a crucial pennant support level, with on-chain metrics suggesting a potential trend reversal.

-

BONK’s recent setup hints at a possible recovery; however, traders are advised to wait for confirmation before declaring a reversal or rally.

-

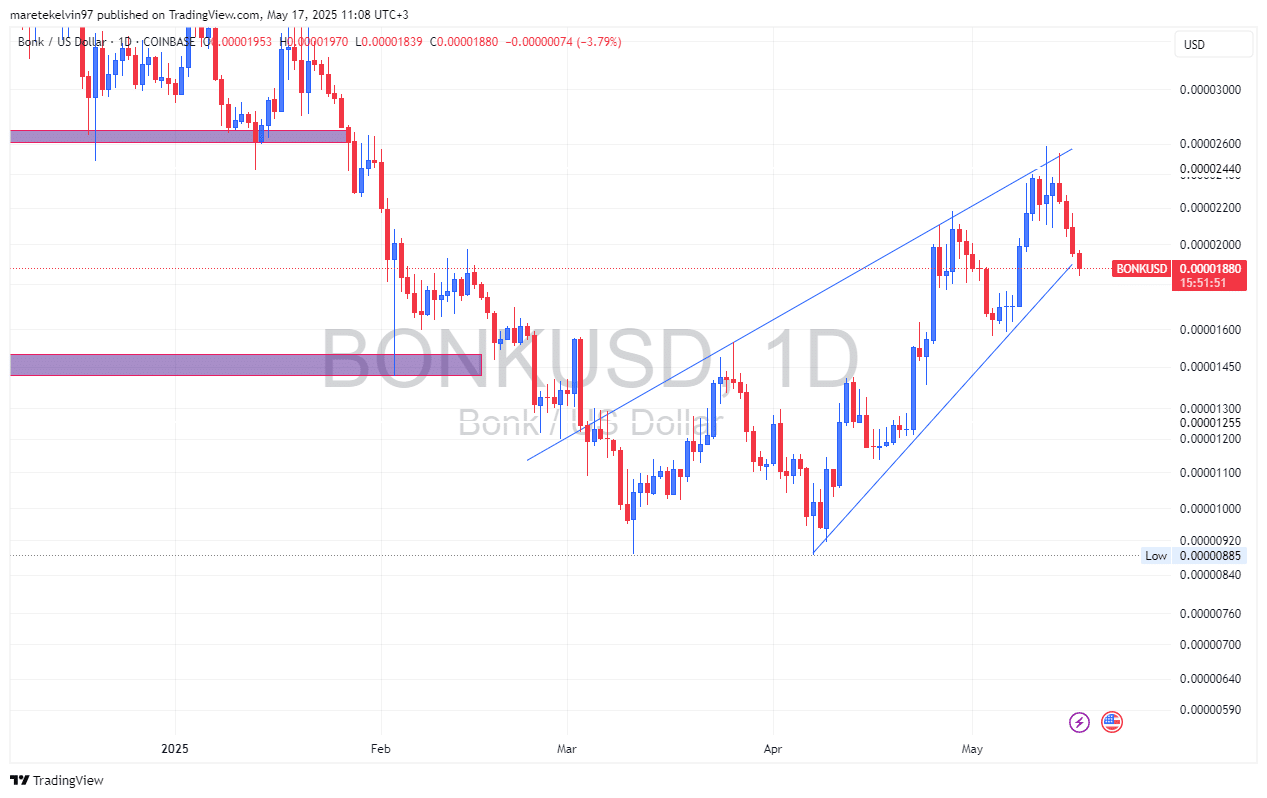

Funding rates have remained within a modest range of 0% to 1%, reflecting a cautious market sentiment without excessive leveraged longs.

The BONK [BONK] market is at a pivotal point, with price fluctuations highlighting crucial support levels and funding rate indicators hinting at future movements.

Market Dynamics and Current Positioning of BONK

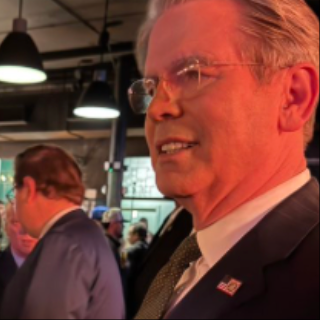

The recent market behavior surrounding BONK has showcased a notable decline, with the price dropping by 11.64% in the past 24 hours, marking the fourth consecutive day of losses. This downtrend has pushed the memecoin’s price to a critical support level of $0.00001883, aligning with a major pennant support zone.

This pennant formation is historically significant, representing a make-or-break moment for the asset. If the support holds, it could signal a bounce-back; however, a breach by bearish forces may drive the price to lower support levels.

Source: TradingView

Funding Rates Reflect Caution in the Market

Analyzing BONK’s on-chain metrics, recent data from CoinGlass reveals a conservative outlook in the derivatives markets as funding rate figures remain between 0% to 1%. This modest funding demonstrates a cautious investor sentiment, indicating that while some traders are willing to hold long positions, they are doing so with restraint.

Source: CoinGlass

This tempered optimism suggests that investors are waiting for a confirmed trend reversal before committing further to long positions. The absence of heavy leverage also indicates a market that is not overextended, allowing for potential upward movement if demand increases.

Liquidity Clusters Indicate Potential Price Magnetism

Moreover, the Liquidation Heatmap from CoinGlass presents a more favorable perspective. A concentration of liquidity has been identified around the $0.0000233 level. Such liquidity clusters often serve as price magnets, especially under conditions where market makers target high-volume interests.

Should BONK maintain its position above $0.00001883, combining this with any bullish pressure could see the price gravitate towards the $0.0000233 mark as a short-term target.

Source: CoinGlass

Future Perspective: Cautious Optimism for BONK

Currently, BONK finds itself at a crossroads, teetering between the possibility of further correction and a bounce back rally. The breakout point around $0.00001883 serves as a crucial pivot. If bullish momentum prevails, movement towards the $0.0000233 zone may soon follow.

However, it is essential to note that neither funding rates nor liquidity indicators present a definitive confirmation of a reversal at this stage. While the metrics suggest potential for a rebound, confirmation remains imperative for traders considering entering the market.

Conclusion

In conclusion, the performance of BONK in the near term hinges on its ability to hold critical support levels and respond to funding rates and liquidity signals. Traders should remain vigilant and await concrete signs of recovery before making strategic moves.