Trump’s EU Tariff Threat Leads to Sharp Correction in the Crypto Market

Trump's proposed 50% tariffs on EU goods sent shockwaves through crypto markets, triggering $567M in liquidations and heightened volatility.

US President Donald Trump announced plans to impose a 50% tariff on all goods imported from the European Union, effective from June 1. The announcement has caused some nervousness in the crypto market, as earlier bullish momentum has corrected.

The proposed tariffs come in response to what Trump described as persistent trade imbalances and regulatory barriers. He accused the EU of maintaining unfair trade practices that have harmed US businesses.

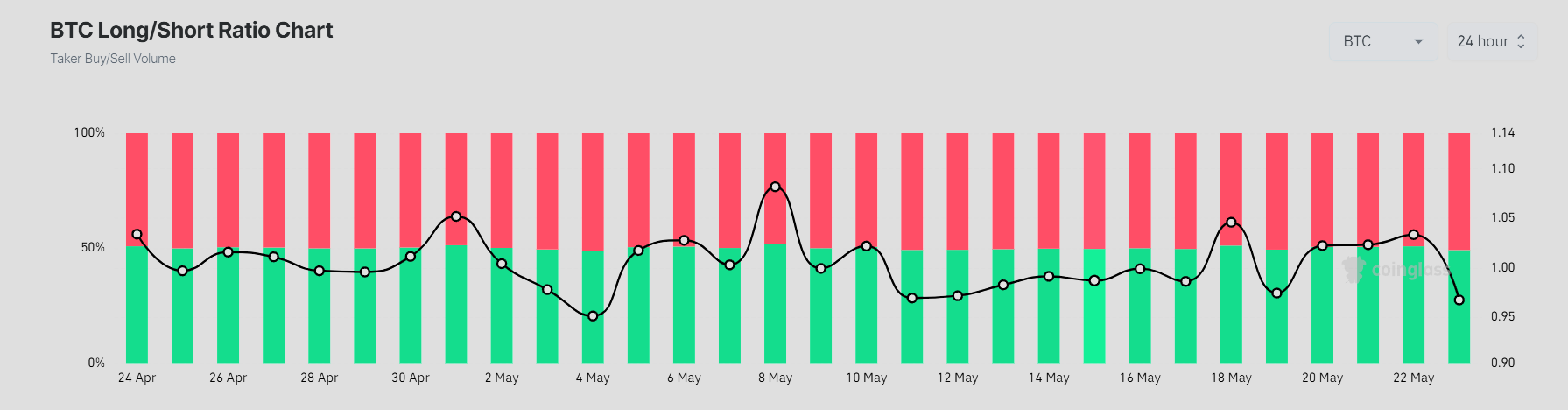

Long-Short Ratio Shows Market Confusion

Bitcoin dropped to $108,000 following the announcement, down from a session high of $111,000. It has since recovered to around $109,000 but remains under pressure. The overall crypto market is down 4% over the past 24 hours.

Bitcoin price Chart Today. Source:

TradingView

Bitcoin price Chart Today. Source:

TradingView

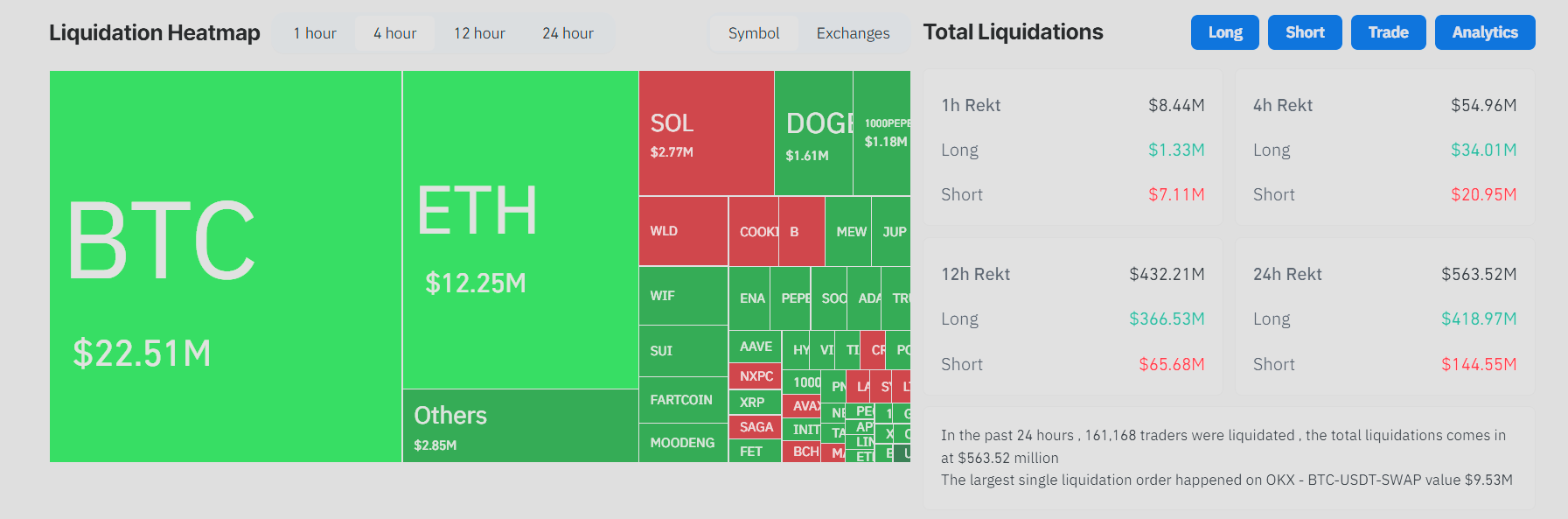

Data from Coinglass shows $64.13 million in crypto liquidations over the last four hours. Long positions accounted for $34.05 million, while short positions made up $30.09 million.

Bitcoin alone saw $24.4 million in liquidations, with Ethereum at $15.16 million.

Meanwhile, Bitcoin’s long-short ratio remains almost equal, which shows a short-term uncertainty in the market’s direction. Yesterday, Bitcoin long positions dominated the charts at 54%.

Bitcoin Long-Short Ratio Over the Past Month. Source:

Coinglass

Bitcoin Long-Short Ratio Over the Past Month. Source:

Coinglass

Solana, XRP, and several altcoins also experienced sharp volatility, reflecting heightened volatility across the board.

Most altcoins saw a greater wipeout in long positions, suggesting retail traders were caught off guard by the sudden policy shift.

Rising concern over macro volatility

The US-China trade deal earlier this month provided a much-needed boost to the crypto market. It was an indication that the macroeconomic uncertainty might be priced in. However, Trump’s EU threats have injected renewed concerns.

Analysts warn that the tariff announcement could be the start of broader economic disruption. European stock indices fell sharply, and US tech shares also faced selling pressure.

The trade war is back:After a brief pause, Trump just threatened 50% tariffs on the EU beginning June 1st and 25% tariffs on Apple.In 5 days, the SP 500 has erased -$1.5 trillion of market cap.What's next? Here's why you NEED to watch the bond market.(a thread) pic.twitter.com/8np3sevfA7

— The Kobeissi Letter (@KobeissiLetter) May 23, 2025

In crypto, the liquidation heatmap reflects a market caught between downward fear and upward retracement attempts.

The situation is fluid. If the tariff threat escalates into a full trade dispute, risk assets, including cryptocurrencies, may face additional headwinds. Traders are watching closely for any EU response or signs of negotiation.

Crypto Liquidations Heatmap. Source:

Coinglass

Crypto Liquidations Heatmap. Source:

Coinglass

In the past 24 hours, 162,419 traders were liquidated, totaling $567.65 million. While crypto has often acted as a hedge during traditional market stress, today’s moves show it is not immune to global policy shocks.

Volatility may persist as geopolitical uncertainty mounts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.