$55 Million HBAR Liquidations Loom as Bearish Crossover Hits After 7 Weeks

HBAR’s momentum shifts bearish after a MACD crossover, with $55 million in liquidations looming if price falls below $0.172. Holding key support at $0.182 is vital for recovery.

HBAR has recently lost momentum, with price action showing little bullish strength over the past few days.

The altcoin’s decline has erased its prior gains, signaling a complete loss of bullish momentum. This shift suggests potential losses ahead for traders holding long positions.

HBAR Is Falling Down

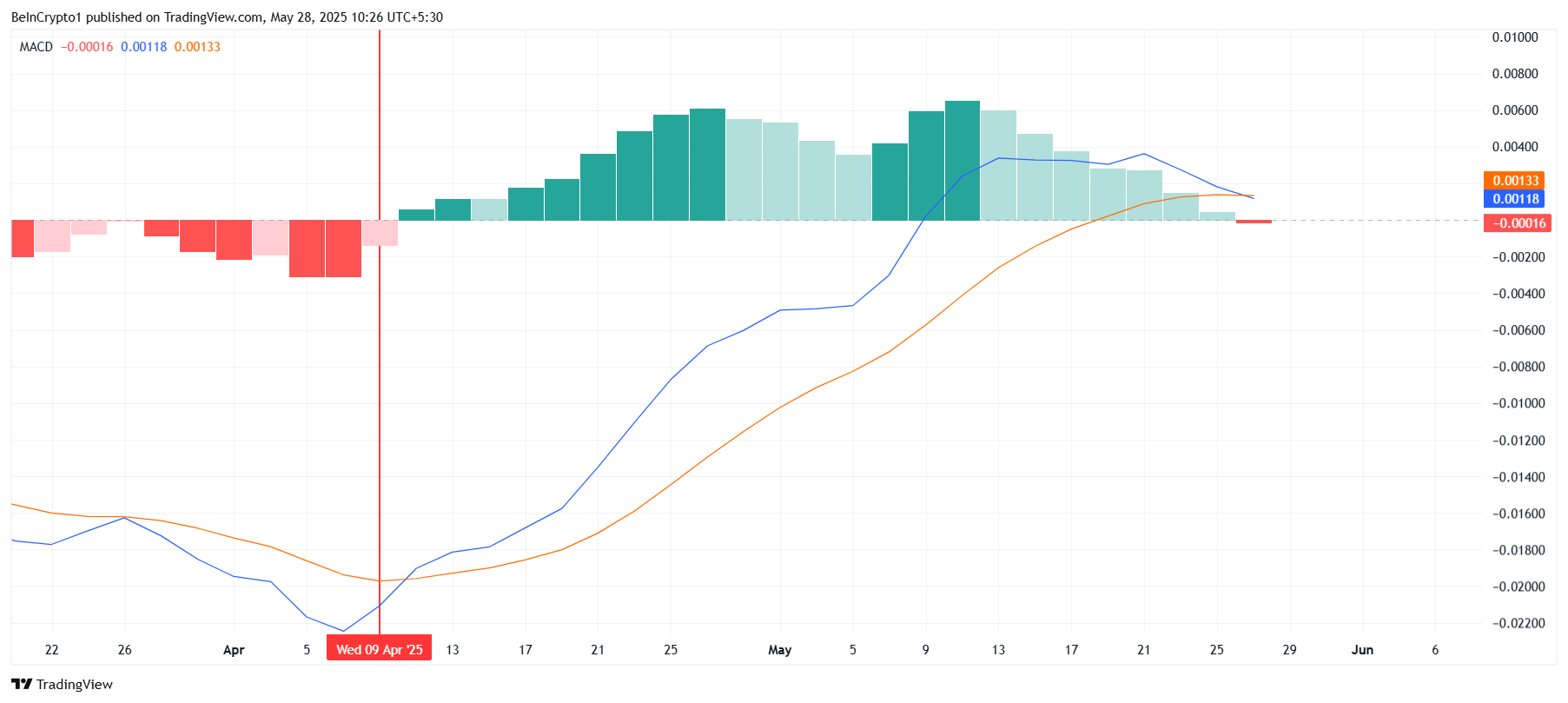

The Moving Average Convergence Divergence (MACD) has registered its first bearish crossover in nearly seven weeks. The signal line crossing above the MACD line, accompanied by a red bar on the histogram, confirms this shift in momentum. This transition from bullish to bearish territory raises concerns about the near-term outlook for HBAR.

Such a bearish crossover often signals growing selling pressure. For HBAR, it suggests that the altcoin could face downward movement, undermining investor confidence.

HBAR MACD. Source:

TradingView

HBAR MACD. Source:

TradingView

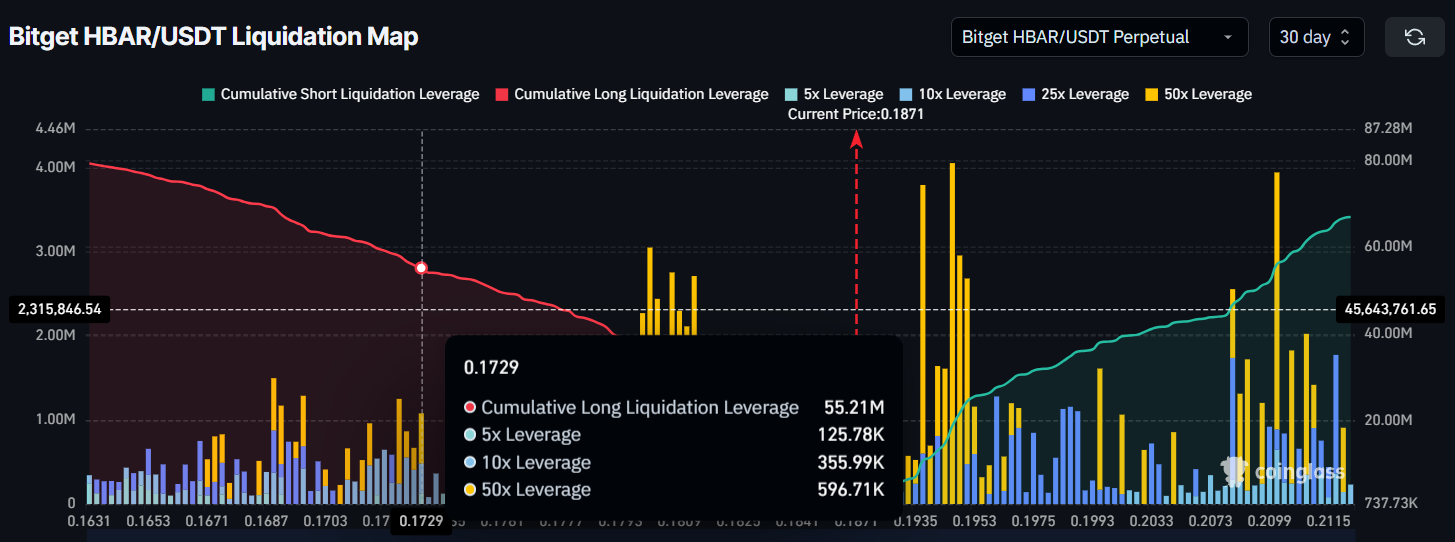

Examining the broader momentum, the MACD indicator reveals that even a slight drop to the next support level could have severe consequences. According to the liquidation map, a fall to $0.172 could trigger over $55 million in liquidations. This would represent a significant sell-off, deterring bulls and possibly accelerating the downtrend.

The looming liquidation risk also adds pressure on HBAR’s price. Market participants are likely to react cautiously and be aware of the potential for increased volatility if the price tests this key support level.

HBAR Liquidation Map. Source:

Coinglass

HBAR Liquidation Map. Source:

Coinglass

HBAR Price Decline May Intensify

HBAR’s price declined 8.5% over the last week, currently trading at $0.187. While the token remains above the immediate support at $0.182, the risk of further downside persists.

The bearish MACD crossover heightens the risk of a break below $0.182. Such a move could drive the price down to $0.172, triggering the $55 million long liquidation event. This scenario would likely push many bullish traders to exit their positions.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

Conversely, if HBAR manages to hold above $0.182 and broader market sentiment improves, a rebound is possible. The altcoin could then climb back toward $0.200. Breaching this level would invalidate the bearish thesis and signal renewed strength for HBAR.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The storm behind BTC's plunge: dual catalysts of macro headwinds and on-chain leverage

Vitalik Discusses Quantum Threat Theory Again: Is the Foundation of Cryptocurrency Really at Risk?

This will always be the most dangerous threat to the entire industry.

What key signals did the U.S. "sleepless night" reveal to the market?

According to the latest data from Polymarket, the probability that the Federal Reserve will not cut interest rates in December this year has risen to 67%.

The "To VB" project secures new investment, as Ethereum veterans jointly launch a "compliant privacy pool"

0xbow is essentially a compliant version of Tornado Cash.