In a surprising pivot, Toncoin’s recent surge points to underlying market dynamics and liquidity pressures that could reshape trading strategies.

-

Toncoin has experienced a remarkable uptick, creating significant buzz within the crypto community amid high trading volume.

-

Traders are advised to exercise caution as the liquidation heatmap indicates potential risks of a market pullback.

Toncoin’s unexpected rally highlights liquidity challenges and market sentiments, sparking debate among traders on optimal strategies moving forward.

The Implications of Toncoin’s Recent Price Movement on Market Trends

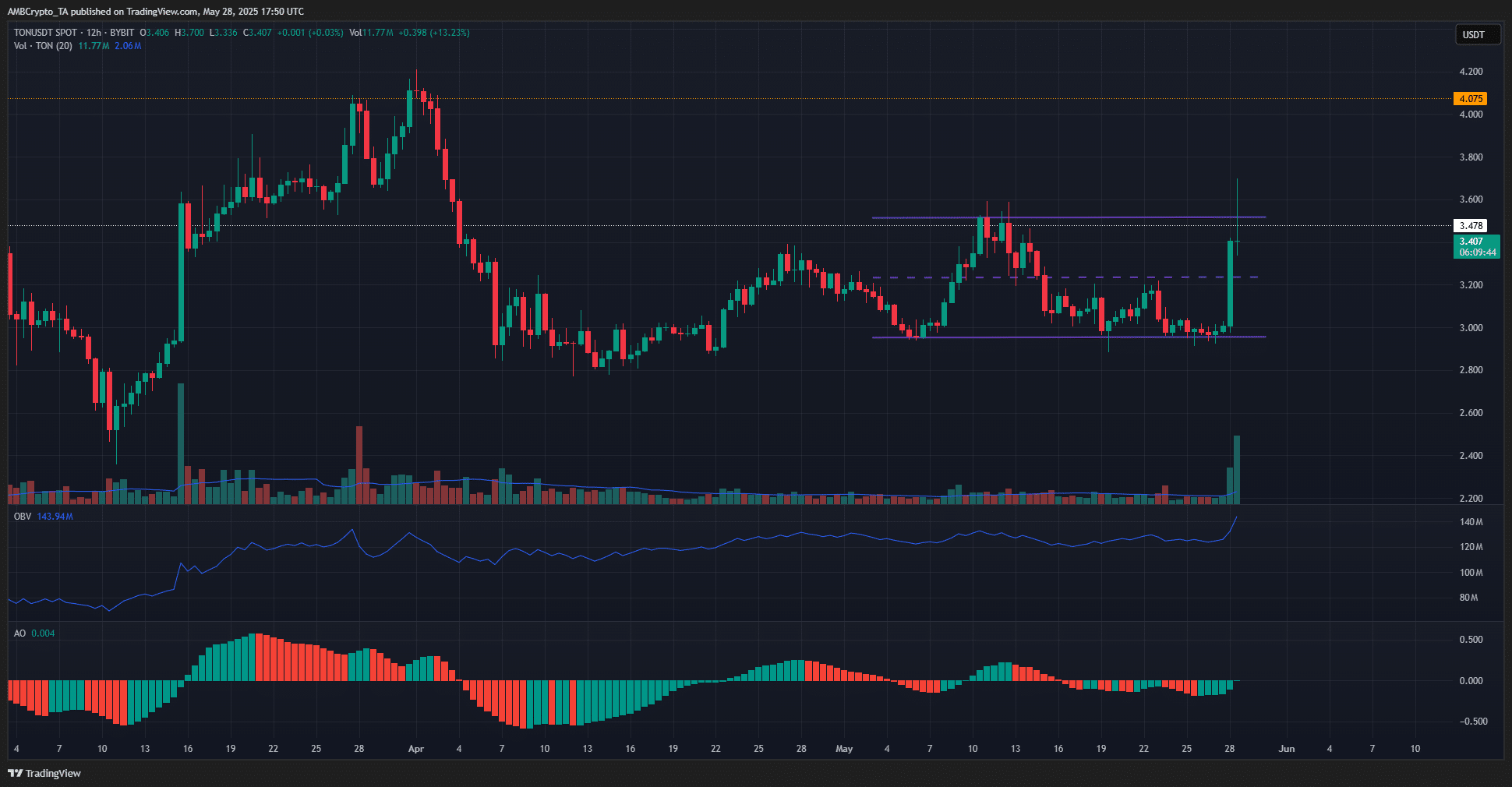

Toncoin [TON] has recently surged by 13.7% following the appointment of former VISA executive Nikola Plecas as Vice President of the TON Foundation. This substantial increase has placed the altcoin in a precarious position as it tests the $3.35-$3.5 resistance zone for the third time in just five weeks. Such repeated encounters with resistance may indicate a potential range formation that could affect short-term trading strategies. It is advisable that traders consider taking profits amid this volatility.

Understanding the Range Formation and Its Risks for Traders

The recent trading patterns of Toncoin suggest that the price has been locked within a defined range between $2.95 and $3.5, with the pivotal mid-range level identified at $3.23. Despite recovering from recent lows to reach a peak of $3.7 within 36 hours, the upward momentum faltered just above critical resistance levels. This behavior signals a classic liquidity hunt, particularly in a market environment where Bitcoin [BTC] struggles to maintain upward momentum. The price retracement after the rally lends credence to the need for a cautious approach among investors.

Source: TON/USDT on TradingView

Market Sentiment and Future Outlook for Toncoin

As Toncoin contemplates its trajectory amid mixed signals, the recent liquidation heatmap indicates zones of liquidity buildup, particularly around $3.6-$3.66. This has been characterized as significant, considering the RV derived from price dynamics following the latest price movements. With the potential for further volatility, traders should remain alert. A swift move to flip the $3.5 region into support is essential; otherwise, there may be a shift in sentiment leading to a bearish reversal among short-term holders.

Source: Coinglass

Conclusion

In conclusion, Toncoin’s recent price surge, intertwined with liquidity challenges, represents a multifaceted issue for traders. Vigilance is necessary, with potential for profit-taking as the market evolves. Should Toncoin successfully navigate these waters and establish a foothold above the critical $3.5 mark, it may open the door for bullish sentiment. However, entrenched liquidity levels present risks that demand careful consideration. Traders are encouraged to stay informed and adaptable in this dynamic environment.