Avalanche (AVAX): Balance Under Pressure, Upcoming Direction? Analysis Of May 29, 2025

After a marked correction, Avalanche stagnates below key levels: between selling pressure and a latent bullish bias. Find our complete technical analysis and AVAX outlook.

In brief

- Technical analysis: AVAX stabilizes around $23.50 in a neutral and unengaged market, with limited recovery and still weak momentum.

- Technical levels: AVAX trades between supports at $21 / $19 and resistances at $27 / $29; a breakout from the $22–35.3 range could trigger a strong directional move.

- Derivatives analysis: AVAX shows a consolidating market, dominated by moderate selling pressure despite a slight bullish bias on funding.

- Forecasts: Bullish bias above $21, with potential of +63%, but a break would expose AVAX to a drop of up to -37%; the macro and geopolitical context will remain key.

Technical Analysis of Avalanche (AVAX)

| Spot Price | ≈ $23.50 | The price rises slowly while remaining in a waiting zone with no real recovery signal. |

| Last Weekly Changes | ≈ +2% | Slight gain over the week, sign of a market trying to stabilize. |

| Last Weekly Spot Volumes | ≈ 756M (+0.33%) | Stable volumes, indicating moderate interest without strong momentum. |

| Long-term Trend (SMA 200) | Neutral | Trend in a stabilization phase after a long decline, awaiting a recovery signal. |

| Medium-term Trend (SMA 50) | Neutral | Structure with no clear direction, reflecting a period of waiting and consolidation. |

| Short-term Trend (SMA 20) | Bullish | Rebound showing active short-term buyer flow, however progression remains limited. |

| Momentum | Neutral | Weak and stable momentum, with slight buying pressure without clear acceleration. |

The spot price of AVAX stabilizes around $23.50, showing a slight weekly increase of about 2%, in a context of nearly unchanged volumes around 756 million dollars. The long-term trend remains neutral, marking a transition phase after a prolonged bearish period. In the medium term, the market moves without a clear direction, reflecting a lack of conviction. In the short term, a buying dynamic is visible, although progress remains contained. Momentum remains weak but balanced, without notable acceleration, indicating a watchful market where flows are present but lightly engaged.

Avalanche (AVAX) Technical Levels

| Resistances | $27 / $29 / $38 / $45 | Potential distribution zones; surpassing them would open the way for bullish extension. |

| Supports | $21 / $19 / $17 / $14.5 | Historic demand zones; breaking them would expose to a risk of continued decline. |

| Monthly Pivot Point | $19.5 | Reference level for the monthly trend. |

| High Value Area | $35.3 | High volume zone; upper boundary of a market balance, beyond which an imbalance may emerge. |

| Low Value Area | $22 | High volume zone; lower limit of a market balance, beyond which an imbalance may emerge. |

AVAX faces several major technical levels. Resistances at $27, $29, $38, and $45 correspond to potential distribution zones, whose crossing could favor a bullish recovery. Supports at $21, $19, $17, and $14.5 represent historic demand zones, and their break would increase the risk of a continued decline. The monthly pivot point at $19.5 serves as a benchmark for the underlying trend. The low value area at $22 marks the lower boundary of a market equilibrium, while the high value area at $35.3 forms the upper boundary. Breaking either boundary could cause an imbalance likely to trigger a significant directional move.

AVAX/USD Daily Chart

AVAX/USD Daily Chart

The current technical analysis was carried out in collaboration with Elyfe , and 0xhugzer , investors and educators on the cryptocurrency market.

Derivatives Analysis (AVAX/USDT)

| Open Interest | Stable | Position stability, reflecting a consolidating or waiting market. |

| CVD | Sell-side dominance | Sell dominance: aggressive sell orders dominate trading. |

| Liquidation | Low, long side | Low liquidations, but oriented longs, consistent with dominant selling pressure. |

| Funding Rate | Slightly positive | Slight bullish bias, moderate premium for long positions. |

Open positions on AVAX/USDT contracts remain stable, a sign of a waiting or consolidating market. Flows reveal sell-side dominance with aggressive sell orders. Liquidations remain low but mainly affect longs, consistent with this bearish pressure. Despite this, the slightly positive funding rate reflects a persistent slight bullish bias among traders.

Open Interest / Liquidations / CVD & Funding rate

Open Interest / Liquidations / CVD & Funding rate

| Indicator | Status | Comment |

| Sell-side liquidation zone | ≈ $24.90 / $25.20 – $25.50 / $26 – $26.30 / $26.80 – $27.20 | Order concentration zone; reaching these levels could cause increased volatility. |

| Buy-side liquidation zone | ≈ $22 – $21 / $20.70 – $20.50 / $20.30 – $20 / $19.10 – $18 | Order concentration zone; reaching these levels could cause increased volatility. |

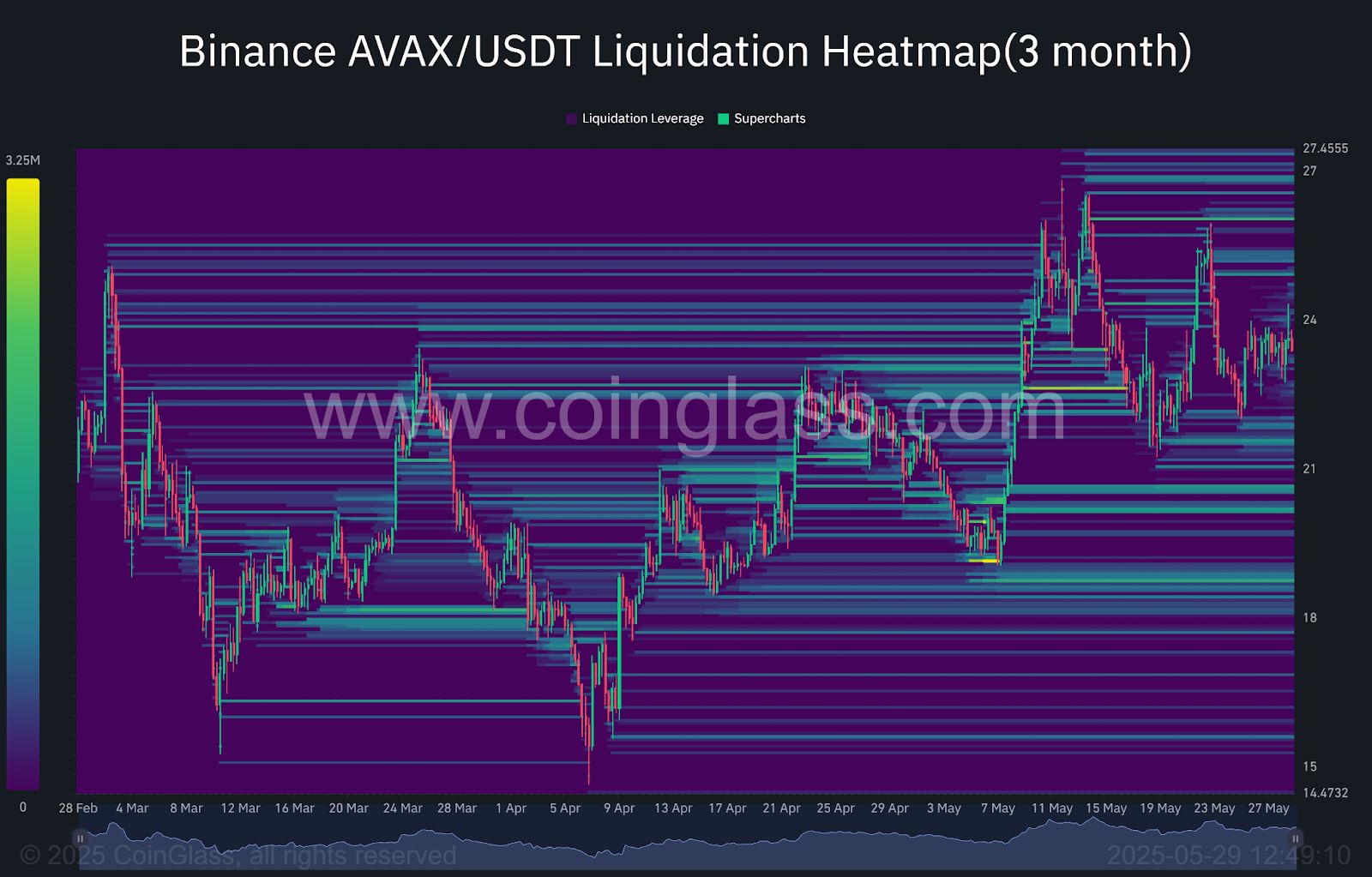

Several liquidation zones are identified on the market that could amplify volatility if approached. On the sell side, order concentration levels are at $24.90, then between $25.20 and $25.50, $26 and $26.30, as well as between $26.80 and $27.20. On the downside, buy-side liquidation zones are at $22 – $21, $20.70 – $20.50, $20.30 – $20, and finally between $19.10 and $18. Reaching these key levels could trigger rapid market reactions.

Liquidation Heatmap

Liquidation Heatmap

Forecasts for Avalanche (AVAX) Price

Bullish scenario:

- Conditions: Maintaining above $21.

- Targets: $27 / $29 / $36 – $38.

- Potential: Approximately +63% from current level.

Bearish scenario:

- Conditions: Break of the $21 support.

- Targets: $18 / $15.5 – $14.6.

- Potential: Drop up to -37% from current level.

Comment:

The bias remains bullish, but US macroeconomic indicators as well as news related to the global geopolitical context will be decisive to confirm this scenario.

Conclusion

AVAX moves in a fragile balance, with dominant selling pressure despite a persistent bullish bias. Interest remains moderate and without clear momentum, while several sensitive zones could amplify volatility if triggered. The macroeconomic and geopolitical context will play a key role in the future market direction. In this context, it will be essential to closely monitor price reactions at strategic levels to confirm or adjust current forecasts.

Finally, remember that these analyses are based solely on technical criteria, and cryptocurrency prices can change rapidly according to other more fundamental factors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.