Hedera (HBAR) Leads Made In USA Coins in Weekly Losses – What’s Next?

HBAR's slight recovery after hitting a 30-day low may be short-lived. Technical indicators point to continued bearish momentum unless buying surges.

A dip in overall crypto trading activity last week sent Hedera’s native token, HBAR, tumbling to a 30-day low of $0.16 on May 31. Although the token has managed to climb around 3% over the past 24 hours, the recovery may not mark a true bullish reversal.

Technical indicators suggest the rebound may be a classic dead cat bounce—a temporary relief in a prevailing downtrend. This analysis explains why this may be the case.

Persistent Selling Pushes HBAR Below Key Technical Level

Hedera dropped over 10% in the past week, facing the worst loss among the top 10 made in USA coins.

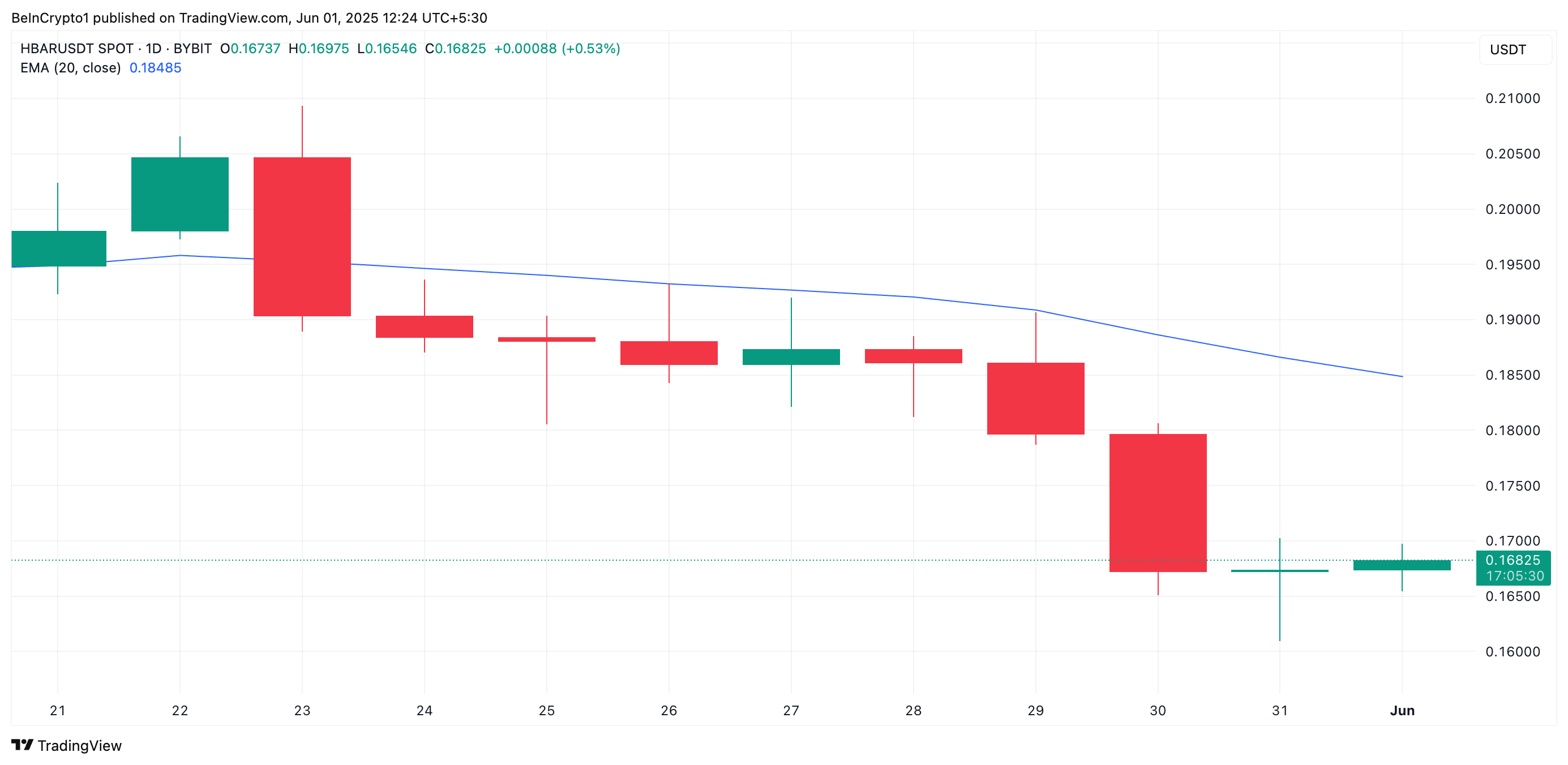

HBAR’s steady decline over the past week has pushed the token’s price below its 20-day exponential moving average (EMA). This breakdown confirms the presence of strong selling pressure among spot market participants.

HBAR 20-Day EMA. Source:

TradingView

HBAR 20-Day EMA. Source:

TradingView

The 20-day EMA measures an asset’s average trading price over the past 20 trading days, giving weight to recent price changes.

When an asset falls below this key moving average, it signals a shift in short-term momentum from bullish to bearish. This breach typically suggests that recent selling pressure in the market outweighs buying interest, potentially triggering further downside.

Therefore, for HBAR, slipping below this key support level reinforces bearish sentiment and increases the likelihood of continued price weakness.

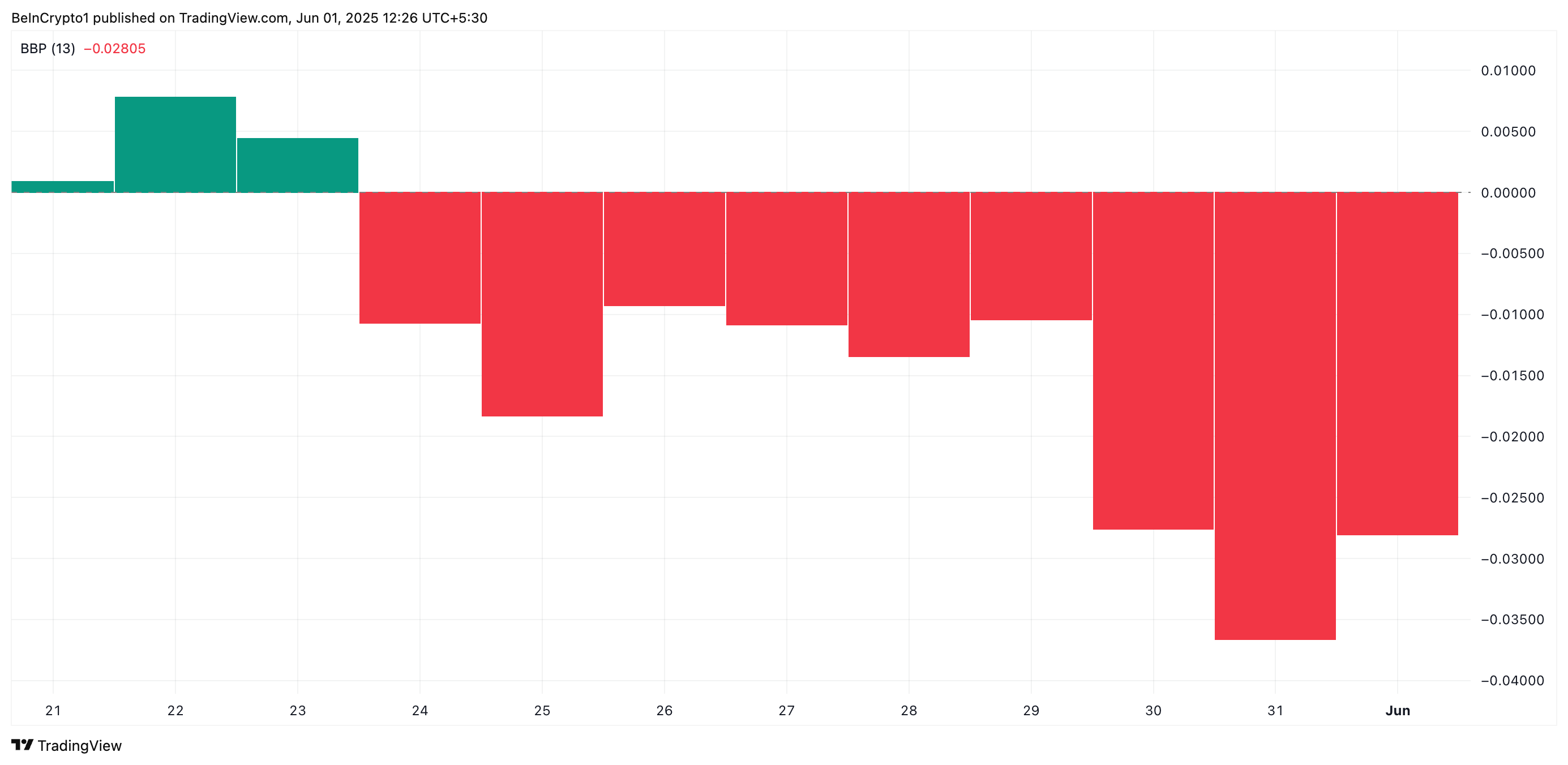

Further, the token’s Elder-Ray Index, which measures the strength of its bulls against the bears, shows continued dominance by sellers. The indicator’s red histogram bars remain below the zero line, printing -0.028 at press time.

HBAR Elder-Ray Index. Source:

TradingView

HBAR Elder-Ray Index. Source:

TradingView

The indicator has persistently returned negative values since May 24, highlighting a lack of bullish power even during the recent price uptick.

Can Bulls Save HBAR? Price Eyes Critical Support at $0.153

HBAR currently trades at $0.168, with its 20-day EMA forming a dynamic resistance above it at $0.184. This suggests that any uptrend may face strong rejection unless buying momentum strengthens significantly.

Without a strong demand for HBAR, it could resume its decline and fall toward the support floor at $0.153. Should the bulls fail to defend this level, the price fall could deepen to reach $0.124.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

However, a resurgence in buying pressure will invalidate this bearish outlook. The token’s price could climb above the 20-day EMA to trade at $0.19 in that scenario.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash News Update: ZEC Price Swings Cause Crypto Whale to Lose $1.17 Million on 10x Short

- A crypto whale's 10x short position on Zcash (ZEC) incurred $1.17M losses as prices fell below $360, triggering partial liquidations. - ZEC's volatility highlights risks in leveraged trading, with lower-cap assets facing manipulation and liquidity crises at platforms like Hyperliquid. - Whale activity intensified as Ethereum whales repositioned $1.39B and $5M in tokens amid regulatory uncertainties and market turbulence. - Leveraged ZEC positions show extreme duality: one whale's $8.28M unrealized gain c

The Emergence of ICP Caffeine AI in Web3 Advancement: Investing Strategically in Blockchain Protocols Powered by AI

- ICP Caffeine AI, developed by Dfinity, democratizes dApp creation via AI-blockchain integration, lowering technical barriers for developers. - The platform drove a 56% ICP token surge in one day and 385% growth over a month, with $237B TVL by Q3 2025 despite 22.4% dApp usage decline. - Strategic Microsoft Azure partnerships expand hybrid cloud utility, but regulatory risks and competition from centralized AI providers persist. - Its deflationary token model relies on sustained app adoption, contrasting w

ICP Soars by 30%: Could This Signal the Beginning of a Major Bull Market?

- ICP's 30% price surge sparks debate between bullish optimism and warnings of short-term volatility driven by macroeconomic factors and speculative trading. - Improved market sentiment from Fed policy expectations contrasts with hawkish comments causing 11% corrections, highlighting fragile macroeconomic foundations. - Technical upgrades like Caffeine and institutional partnerships coexist with declining DApp activity (-22.4%) and unverified adoption metrics, revealing innovation-adoption gaps. - Speculat

Next-Gen Altcoins: 4 Projects Set to Deliver Exceptional Long-Term Returns