Ethena (ENA) Shrugs Off 40 Million Token Unlock as Bulls Step In

Despite a large token unlock, Ethena (ENA) held steady with minimal price impact as traders boosted futures activity and showed strong demand for longs.

Earlier today, over 40 million ENA tokens were unlocked, sparking widespread expectations of a sharp price pullback.

However, the anticipated sell-off did not materialize, with Ethena’s native token displaying notable resilience. With a strengthening bullish bias, the altcoin could register new gains.

Traders Pile Into ENA as 40 Million Tokens Unlock

According to Tokenomist, nearly 41 million ENA tokens, valued at over $12 million at current market prices, were unlocked around 7:00 a.m. UTC on Monday.

Despite the Ethena token unlock representing a significant increase in circulating tokens, ENA has only slipped by a modest 1% over the past 24 hours. This muted reaction suggests bullish sentiment among token holders has helped absorb the additional supply, preventing a deeper decline.

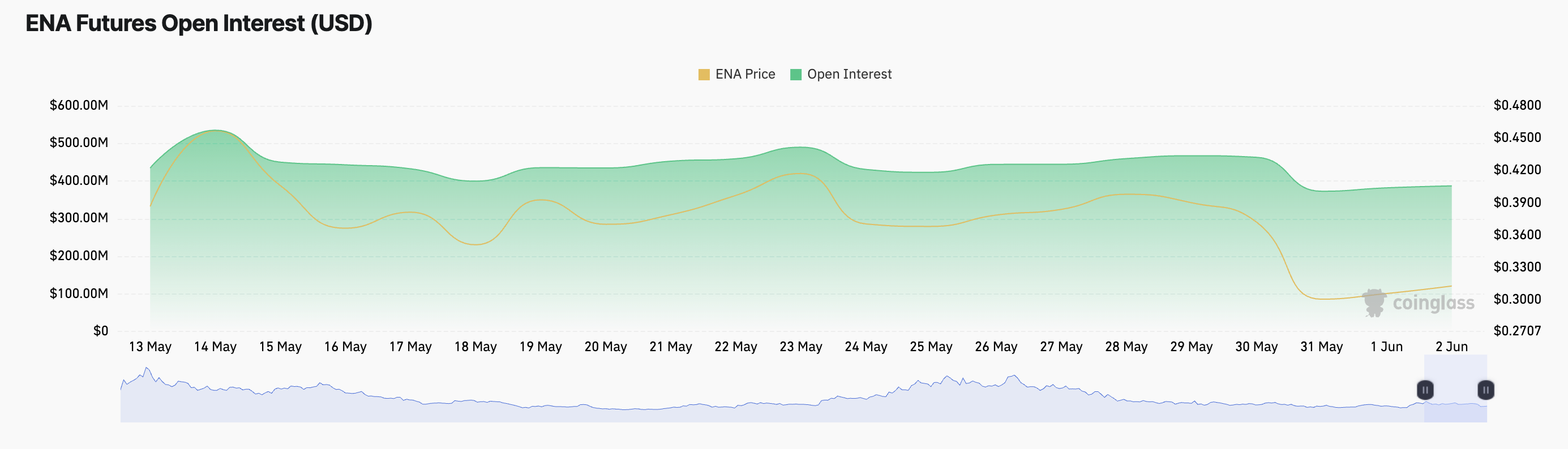

As of this writing, ENA’s futures open interest is up 2%, signaling increased trader participation. It currently stands at $387 million.

ENA Open Interest. Source:

Coinglass

ENA Open Interest. Source:

Coinglass

Open interest refers to the total number of outstanding derivative contracts, such as futures or perpetual swaps, that have not yet been settled. A rise in OI indicates that new money is entering the market, which can reflect growing interest and conviction among traders.

In ENA’s case, the uptick in OI suggests that traders are opening more positions, likely in anticipation of a rebound or sustained stability despite the token unlock.

Furthermore, the token’s funding rate is positive, indicating a high demand for long positions. At press time, ENA’s funding rate was 0.0059%.

ENA Funding Rate. Source:

Coinglass

ENA Funding Rate. Source:

Coinglass

Funding rates are periodic payments exchanged between long and short traders in perpetual futures markets to keep the contract price aligned with the spot market. When funding rates are positive, traders with long positions are paying those with short positions.

ENA’s Next Move: Support Retest or Rally Toward $0.41?

ENA currently exchanges hands at $0.30, trading above the support floor formed at $0.24. If bullish pressure strengthens, the token could climb toward $0.37.

If this resistance breaks, it could propel ENA’s price to $0.41.

ENA Price Analysis. Source:

TradingView

ENA Price Analysis. Source:

TradingView

However, if selloffs gain momentum, ENA’s price decline could deepen to $0.24.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After a 1460% Surge: Re-examining the Value Foundation of ZEC

Are ZEC's miner economic model, network security, and on-chain activity truly sufficient to support an FDV of over 10 billions USD?

Glassnode: BTC drops to 89,000, risk aversion remains strong in the options market

In the short term, the $95,000 to $97,000 range may form a local resistance. If the price can reclaim this range, it indicates that the market is gradually returning to balance.

Is the Base co-founder launching a token this time reliable?

How should we view this celebrity token from Base?

Data Insight: Bitcoin's Year-to-Date Gains Turn Negative—Is a Full Bear Market Really Here?

The market has entered a comprehensive defensive phase.