Q1 2025 Data Reveal Sky-High Costs and a New Pecking Order in Bitcoin Mining

Q1 2025 tested Bitcoin miners with rising costs and lower margins post-halving. Riot, Cango, and Core Scientific stood out with strategic pivots and output leadership.

In Q1 2025, the Bitcoin mining industry faced numerous challenges due to the halving event and the increased network difficulty.

This analysis will use data from publicly listed Bitcoin mining companies such as Cipher Mining, Riot Platforms, Core Scientific, Hut 8 Corp, TeraWulf, Bitfarms, and Cango to summarize, compare, and evaluate their financial performance, mining output, and development strategies.

Financial Performance

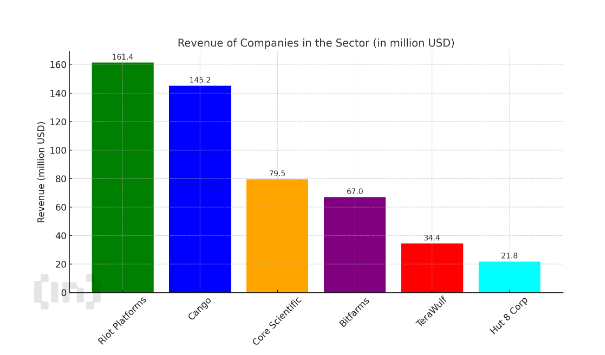

Bitcoin mining companies in Q1 2025 exhibited significant disparities in financial performance.

Riot Platforms recorded the highest revenue at $161.4 million, primarily from Bitcoin mining ($142.9 million), with an output of 1,530 BTC. However, per-unit mining costs surged to $43,808/BTC from $23,034/BTC year-over-year, reflecting the impact of the halving and increased network difficulty.

Core Scientific reported an impressive net profit of $581 million, largely driven by non-cash valuation adjustments ($622 million). Revenue dropped 55.7% to $79.525 million, and adjusted EBITDA was negative at $6.107 million.

Bitfarms saw a 33% revenue increase to $67 million, but its gross profit margin fell from 63% to 43%, with a net loss of $36 million. Cango achieved revenue of $145.2 million, with $144.2 million from Bitcoin mining, producing 1,541 BTC at a high average cost of $70,602/BTC.

Meanwhile, Hut 8 Corp and TeraWulf faced significant challenges, with revenues declining by 58% ($21.8 million) and $34.4 million, respectively, alongside substantial net losses ($134.3 million and $61.4 million).

Revenue of mining companies

Revenue of mining companies

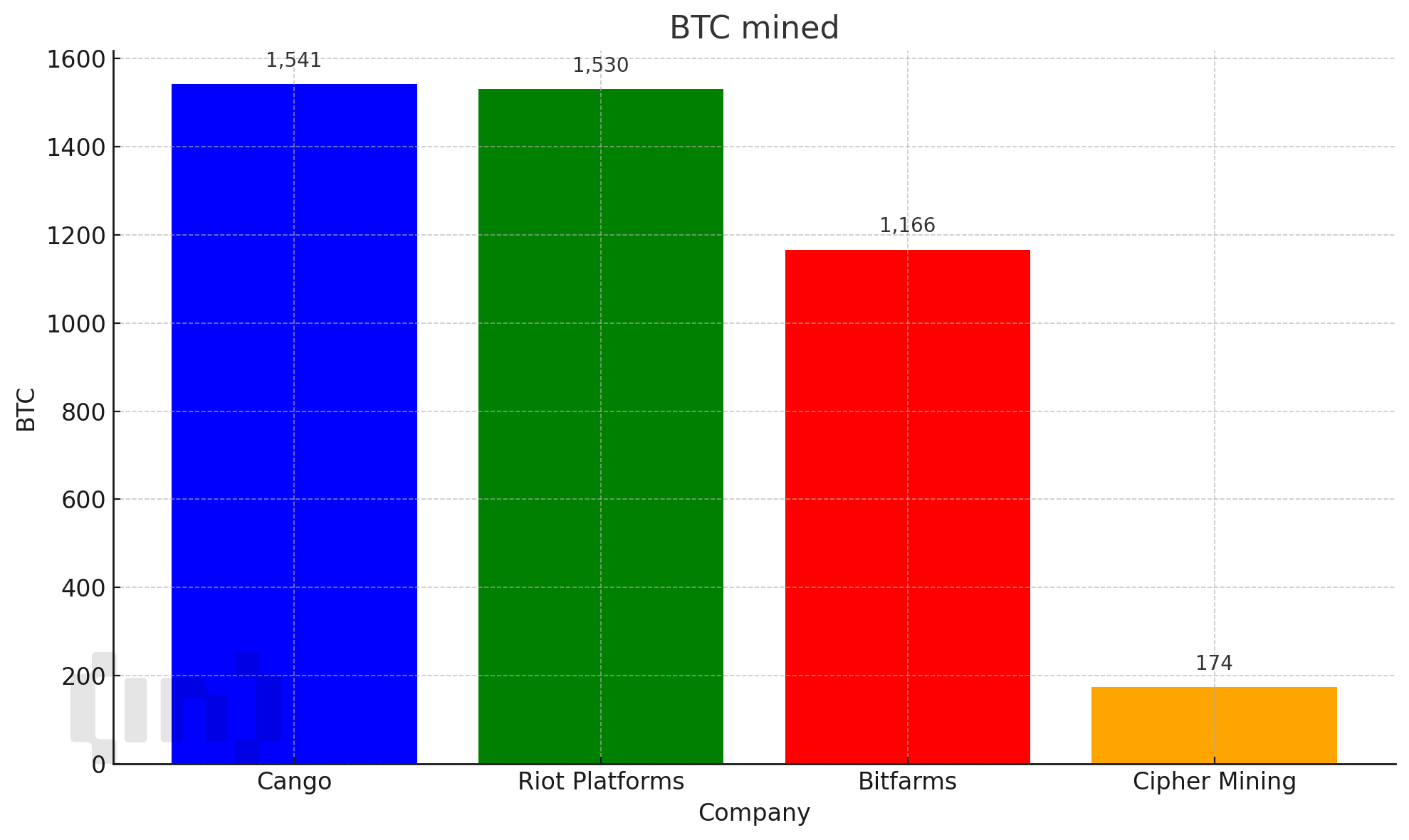

Mining Output and Bitcoin Holdings

Regarding mining output, Cango led with 1,541 BTC, followed by Riot Platforms (1,530 BTC) and Bitfarms (1,166 BTC). Cipher Mining mined 174 BTC in April but sold 350 BTC, reducing its holdings to 855 BTC, of which 379 BTC were collateralized.

Production of mining companies

Production of mining companies

Riot Platforms held the largest Bitcoin reserve with 19,223 unrestricted BTC, Bitfarms held 1,166 BTC, and Cango maintained significant cash and short-term investments ($347.4 million).

Core Scientific did not disclose specific Bitcoin holdings but focused on expanding managed services with a 250MW contract for CoreWeave, expected to generate $360 million in revenue by 2026.

Q1 2025 was challenging for Bitcoin mining companies due to the Bitcoin halving and increased network difficulty. Riot Platforms and Cango led in output and revenue, but high mining costs posed challenges. Core Scientific and Hut 8 are pivoting toward sectors like AI to reduce reliance on mining.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.