U.S. Senate Republicans Push to Include Cryptocurrency in Tax and Spending Bill

According to a report by Semafor, Wyoming Republican Senator Cynthia Lummis is pushing to add provisions to her party's tax and spending bill to reform the way the United States taxes cryptocurrencies. The core content includes extending the "wash sale rule" for securities transactions to the cryptocurrency sector, which is expected to generate billions of dollars in tax revenue, while exempting Bitcoin miners from the obligation to report gains and losses. Lummis submitted a tax reform proposal co-drafted with Senator Kirsten Gillibrand to Senate Finance Committee Chairman Mike Crapo. Lummis emphasized the need to amend the current tax system due to its flaws, while Gillibrand believes the timing for legislation is not yet ripe. Members of the Finance Committee have consulted with President Trump on the bill's content, and Louisiana Senator Bill Cassidy revealed that the President is focused on the "work account benefits" provision. If passed, this proposal would become the first systematic cryptocurrency tax framework in the United States.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOL treasury companies and ETF total holdings exceed 24.2 million SOL, equivalent to approximately $3.44 billions

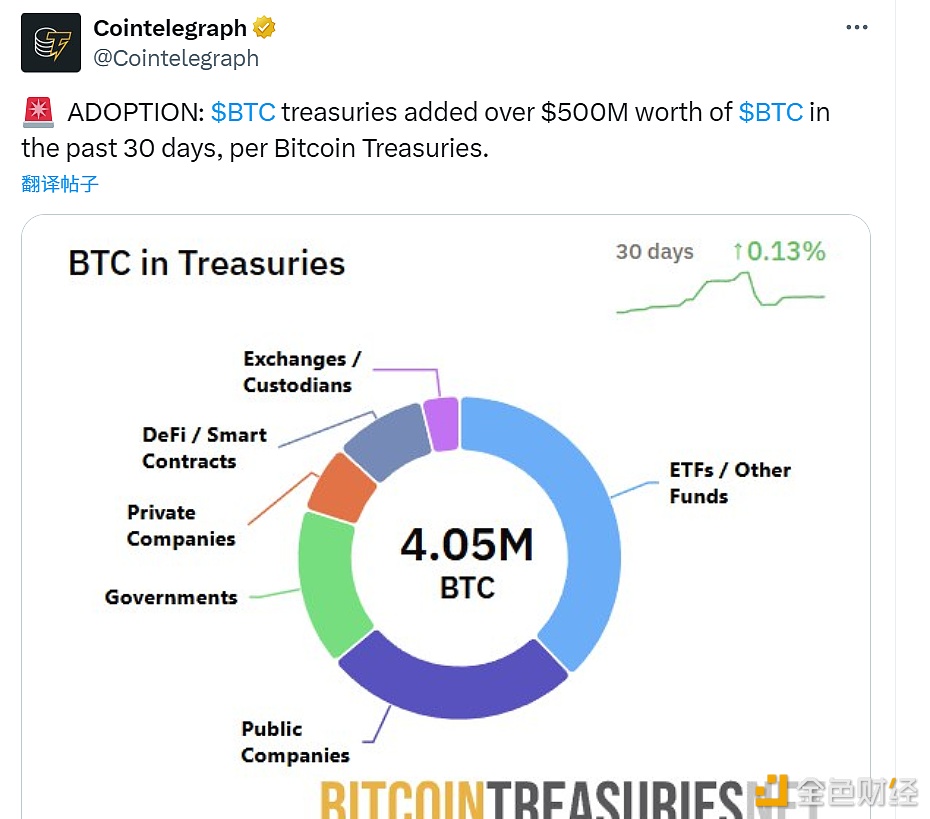

Institutions increased their BTC holdings by over $500 million in the past 30 days

Adam Back: Strategy's leverage ratio is very low, previously only transferred BTC to another custodian and did not sell