Circle CEO: Going public to demonstrate financial transparency, seeking collaboration rather than competition with banks

According to ChainCatcher, as reported by Yahoo Finance, Circle President and former CFTC Chairman Heath Tarbert stated in an interview with Yahoo Finance that when Circle launched USDC from 2017 to 2018, they aimed to create a new foundational currency layer for the internet that could circulate at internet speed and endure over time. As a publicly listed U.S. company, going public and subjecting Circle to the highest standards of transparency and corporate governance is an essential part of its identity and a necessary next step according to Circle.

Compared to traditional financial institutions, Circle is a neutral platform with both the compliance genes of traditional financial services and the philosophy of Web3. Banks are ideal partners for Circle and do not compete with them. Going public also signals to banks and tech companies that their funds are now open and, with regulatory approval, they can engage in significant business with Circle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 index futures rise 0.2%

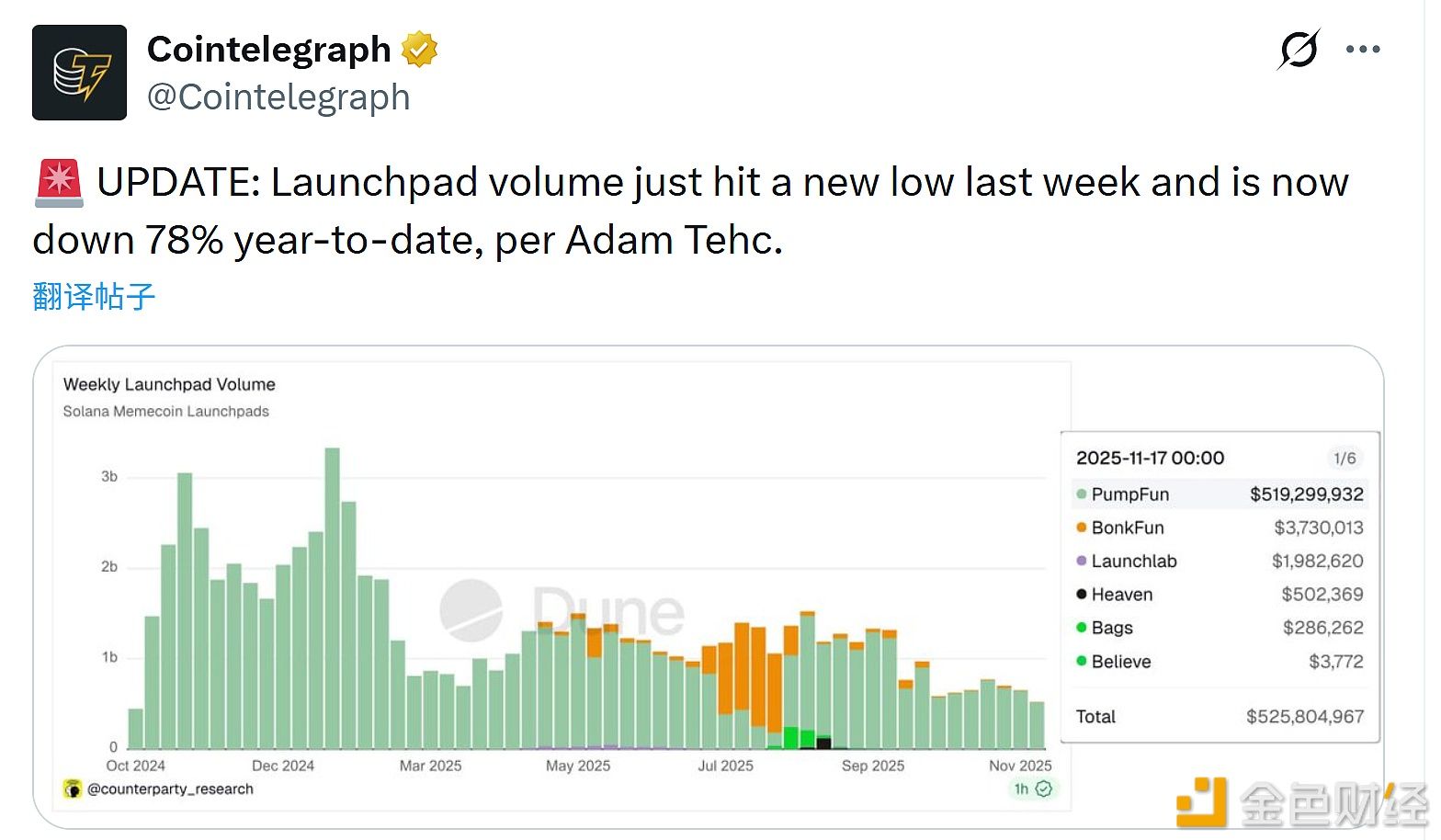

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93