Solana Sell Off Hits 2-Month High – How Will SOL Price React?

Solana's recent recovery is at risk due to increasing selling pressure and bearish technical indicators. The $154 resistance will be key for any short-term rally.

Solana (SOL) recently experienced a sharp decline, dropping from $176 to $141 in just eight days. After this significant downturn, many traders hoped for a recovery.

However, the altcoin’s path to regaining lost ground now faces challenges, mainly due to a shift in investor behavior that could slow down or prevent further price gains.

Solana Investors Are Selling

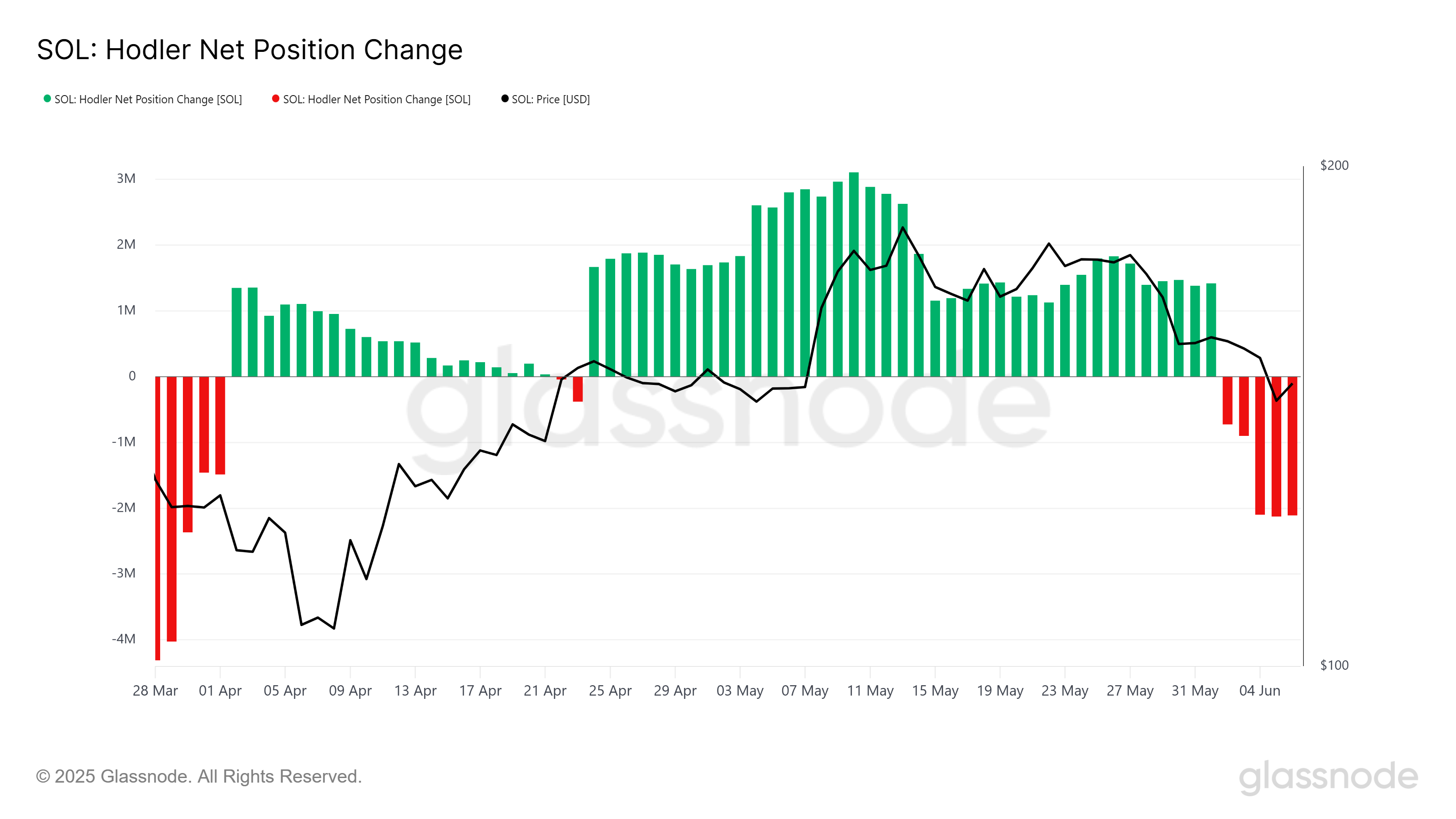

Long-Term Holders (LTHs) have shifted from being staunch buyers to becoming sellers. Outflows from LTH wallets have recently surged to a two-month high, a move that hasn’t been seen in the past month.

This change in behavior signals a significant shift in the market, as LTHs are often considered the backbone of an asset’s price stability.

The consistent selling from these investors raises doubts about Solana’s price stability in the short term. Since LTHs are generally seen as more patient investors, their decision to sell signals a potential loss of confidence.

Solana HODLer Position Change. Source:

Glassnode

Solana HODLer Position Change. Source:

Glassnode

The macro momentum for Solana remains concerning as key technical indicators continue to signal bearish market conditions.

The 50-day Exponential Moving Average (EMA) and 200-day EMA, which have been closely watched by traders, are showing signs of continued bearishness. The Death Cross, which began in March, is still in play.

Although the 50-day EMA came close to crossing over the 200-day EMA in late May, it failed to do so, indicating that recovery may not be imminent. This continued bearish trend puts Solana’s recovery in jeopardy.

If the Death Cross persists and the EMAs continue to diverge negatively, it could signal further price declines.

Solana EMAs.. Source:

TradingView

Solana EMAs.. Source:

TradingView

SOL Price Needs A Push

Solana’s price recently dropped by 18% in just eight days but saw a slight recovery, rising 5% in the last 24 hours. Currently trading at $152, SOL faces significant resistance at the $154 level.

This barrier is crucial for any potential bullish move in the short term. If the price fails to break through this resistance, further declines may be on the horizon.

Considering the current market sentiment and technical indicators, Solana’s price may struggle to breach the $154 resistance. Instead, it could see a pullback toward $144. If this support fails to hold, the price could drop further to $136.

Solana Price Analysis.. Source:

TradingView

Solana Price Analysis.. Source:

TradingView

However, if broader market conditions improve, Solana could experience a rally. A breakout above the $154 resistance would push the price towards $161. Reaching this level would end the Death Cross pattern, helping to restore investor confidence and invalidate the bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens

Polygon Exec Predicts Surge to 100,000 Stablecoins, Banks Scramble to Retain Capital