Hyperliquid’s HYPE Sets Another All-Time High: Will the Rally Continue?

Hyperliquid's HYPE remains above $40 with top-tier momentum and perps market leadership. Technicals suggest a pause, but bulls still lead.

Hyperliquid (HYPE) has been trading at all-time highs for the past few days and is currently holding above the $40 mark. The token is up nearly 70% over the past 30 days, taking place as one of the top 10 cryptocurrencies by market cap, excluding stablecoins and wrapped assets.

This surge comes as Hyperliquid continues to dominate the perpetuals market and posts some of the highest revenues in crypto. With strong momentum and bullish technicals, HYPE remains firmly in the spotlight.

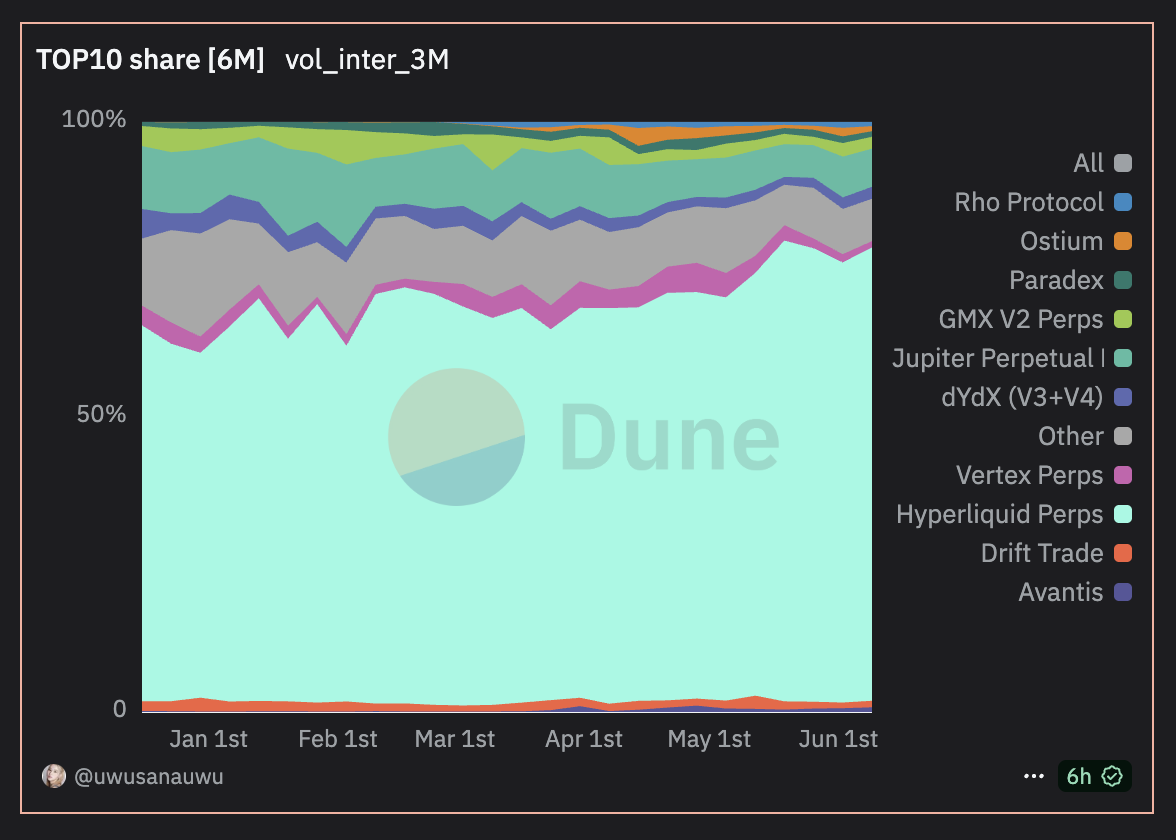

Hyperliquid Dominates Perps Market With Unmatched Volume

Hyperliquid has firmly established itself as the dominant force in crypto perpetuals, with its market share soaring from 63.7% in December 2024 to a staggering 76.9% today.

With weekly volumes ranging between $50 and $75 billion—dwarfing the $4 to $7 billion range of its closest competitor, Jupiter—Hyperliquid is now in a league of its own in terms of perps trading activity.

Perps Market Share. Source:

Dune.

Perps Market Share. Source:

Dune.

It generated nearly $65 million in revenue over the past 30 days, ranking just behind stablecoin giants Tether and Circle while outperforming established names like Tron, PancakeSwap, Axiom, and Pump.

Protocols and Chains by Revenue (30 days). Source:

DeFiLlama.

Protocols and Chains by Revenue (30 days). Source:

DeFiLlama.

In the past 24 hours alone, Hyperliquid brought in $2.5 million in revenue, as its native token surges to new all-time highs, despite recent controversy around James Wynn trades. Recently, HYPE was listed on Binance US and analysts are now speculating if it could be listed next on Binance.

HYPE Cools Off After RSI Peaks, But Momentum Remains

Hyperliquid’s native token, HYPE, has seen its Relative Strength Index (RSI) cool off to 67.27 after reaching 77.63 yesterday, though it’s still significantly higher than the 50.85 reading from two days ago.

The RSI is a momentum oscillator that ranges from 0 to 100, typically used to identify overbought or oversold conditions. Readings above 70 suggest an asset may be overbought and due for a pullback, while levels below 30 indicate it might be oversold.

HYPE RSI. Source:

TradingView.

HYPE RSI. Source:

TradingView.

With HYPE currently sitting just below the overbought threshold, this suggests bullish momentum remains, but buyers may be slowing down after a sharp run-up.

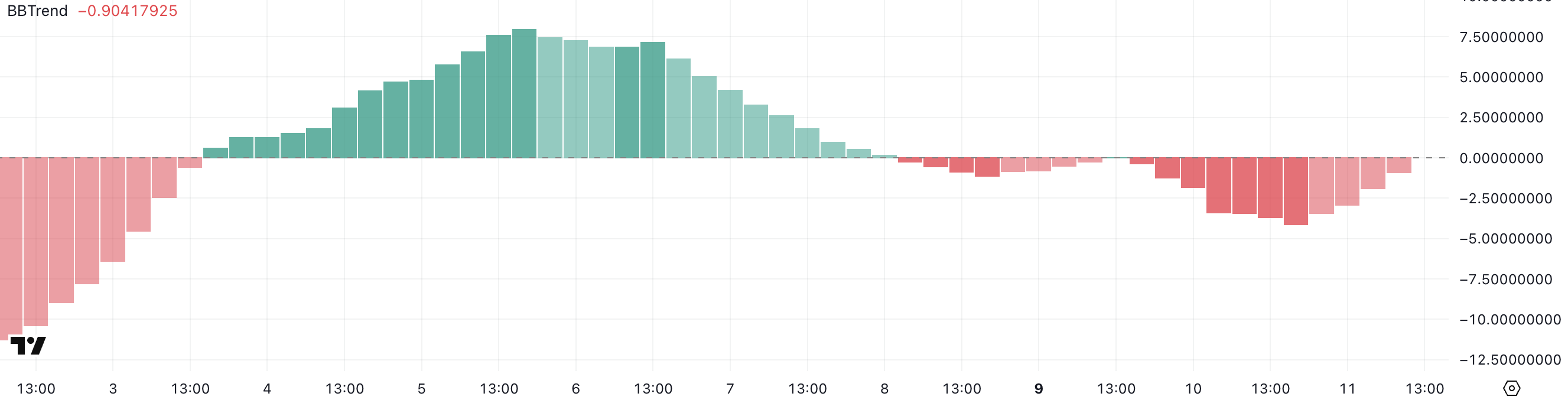

The BBTrend, another key indicator, is currently at -0.9 for HYPE, up from -4.11 just one day ago, though it has remained negative for three consecutive days. BBTrend (Bollinger Band Trend) measures price strength relative to volatility bands, with positive values typically signaling upward trend strength and negative values indicating weakness or consolidation.

HYPE BBTrend. Source:

TradingView.

HYPE BBTrend. Source:

TradingView.

A BBTrend of -0.9 suggests the price is still in a consolidative or weakening phase, but the sharp recovery from lower values hints at stabilizing momentum.

Together, these indicators point to a cooling phase for HYPE, where the strong rally may pause, but signs of renewed strength are beginning to emerge.

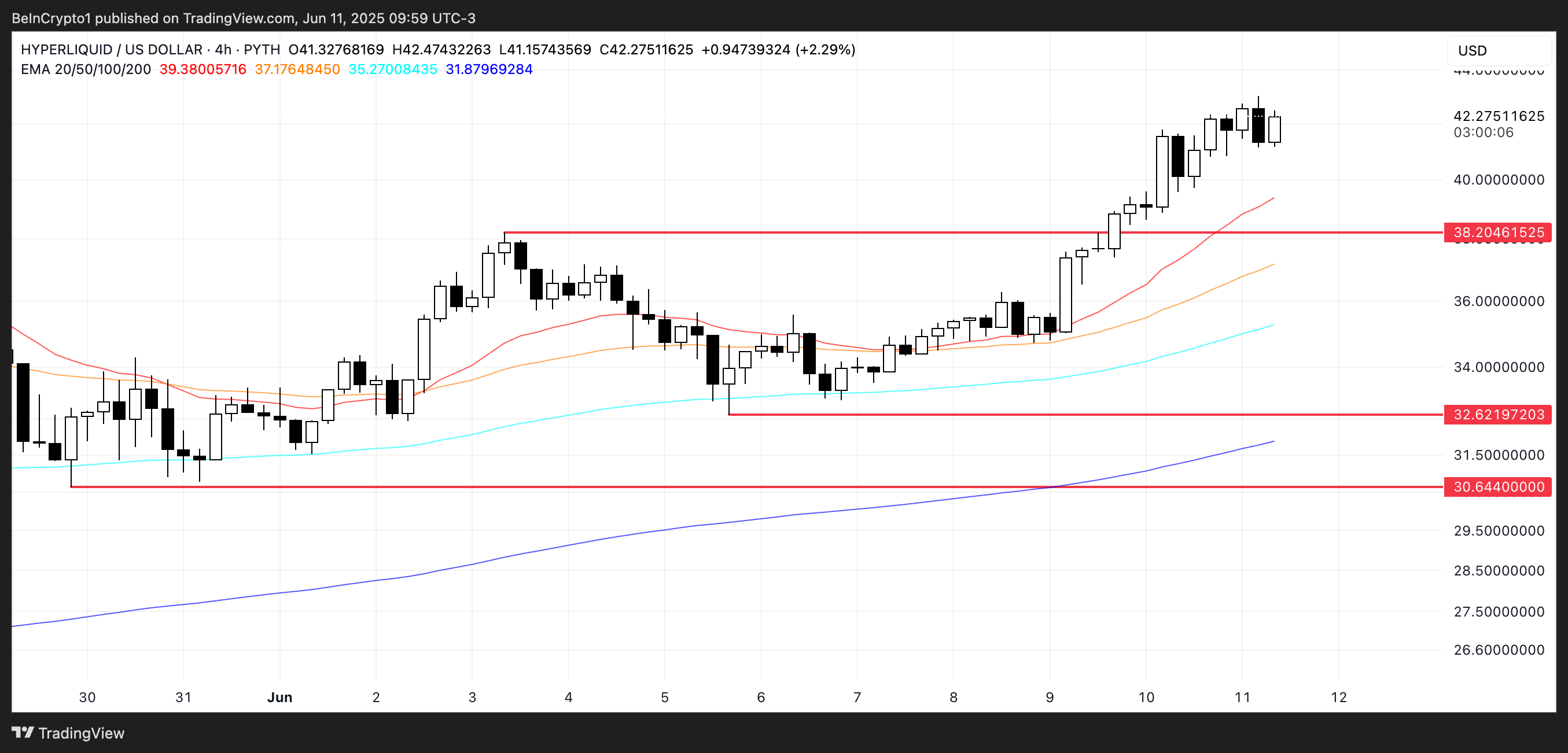

HYPE Bulls Hold Above $40, Eyes on $45 Next

HYPE has maintained its position above $40 since yesterday, supported by a strong EMA structure where short-term lines continue to trend above long-term lines—signaling a sustained bullish momentum.

This alignment reflects healthy market sentiment and indicates that buyers remain in control for now.

HYPE Price Analysis. Source:

TradingView.

HYPE Price Analysis. Source:

TradingView.

As long as this setup holds, upward continuation remains likely, with the next key test for bulls being the $45 region.

However, downside risks are clearly defined. If momentum weakens and HYPE retests the $38.2 support level, a break below could trigger a deeper correction.

In that scenario, price may decline toward $32.62, and if that level also fails to hold under heavy selling pressure, HYPE could drop as low as $30.64.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Kodiak launches Berachain native perpetual contract platform—Kodiak Perps, enhancing its liquidity ecosystem

The native liquidity platform of the Berachain ecosystem, Kodiak, recently launched a new product, Kodiak Perps,...

Mars Morning News | Michael Saylor calls: Buy Bitcoin now

Trump Media & Technology Group’s Q3 losses widened to $54.8 million, and it holds substantial amounts of bitcoin and CRO tokens; US consumer confidence has fallen to a historic low; a whale bought the dip in ZEC and made a profit; a bitcoin whale transferred assets; Michael Saylor called for buying bitcoin; the Federal Reserve may initiate bond purchases. Summary generated by Mars AI. The accuracy and completeness of this content is still being iteratively updated by the Mars AI model.

MEET48: From Star-Making Factory to On-Chain Netflix — How AIUGC and Web3 Are Reshaping the Entertainment Economy

Web3 entertainment is moving from the retreat of the bubble to a moment of restart. Projects represented by MEET48 are reshaping content production and value distribution paradigms through the integration of AI, Web3, and UGC technologies. They are building sustainable token economies, evolving from applications to infrastructure, aiming to become the "Netflix on-chain" and driving large-scale adoption of Web3 entertainment.

Digital Euro: Italy Advocates for a Gradual Implementation