Hedera (HBAR) Price Climbs, But Diverging Indicators Suggest a Pullback Looms

Despite a recent price increase, Hedera's (HBAR) technical indicators point to weakening demand, signaling a possible pullback unless new momentum emerges.

HBAR has posted a 4% gain over the past seven days, benefiting from the broader rebound across the crypto market over the past few days.

However, despite the price uptick, technical indicators are flashing warning signs that the rally may lack strong support and could witness a reversal.

Hedera’s Rally May Be on Shaky Ground

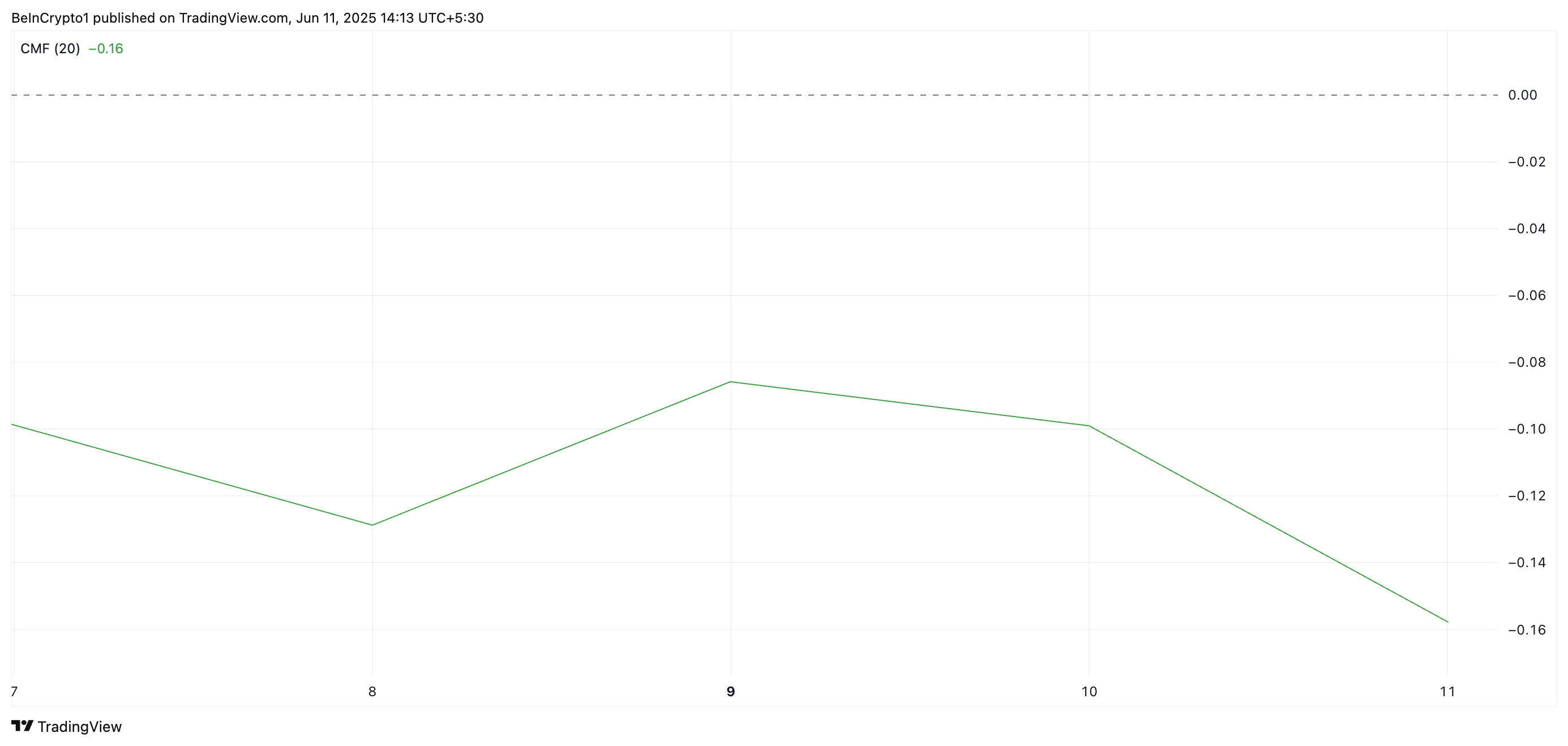

HBAR’s Chaikin Money Flow (CMF) shows a steady decline even as the token’s price has rallied in recent days. As of this writing, the momentum indicator rests below the zero line at -0.16.

This forms a bearish divergence with the token’s price signaling weakening buying pressure behind the uptrend.

HBAR CMF. Source:

TradingView

HBAR CMF. Source:

TradingView

The CMF measures the volume-weighted money flow into or out of an asset over a specific period, helping gauge buying or selling pressure. A bearish divergence occurs when the asset’s price rises while the CMF trends downward, indicating weakening demand and potential for a reversal.

This trend suggests that HBAR’s recent rally is not driven by sustained demand from market participants and risks a correction in the near term.

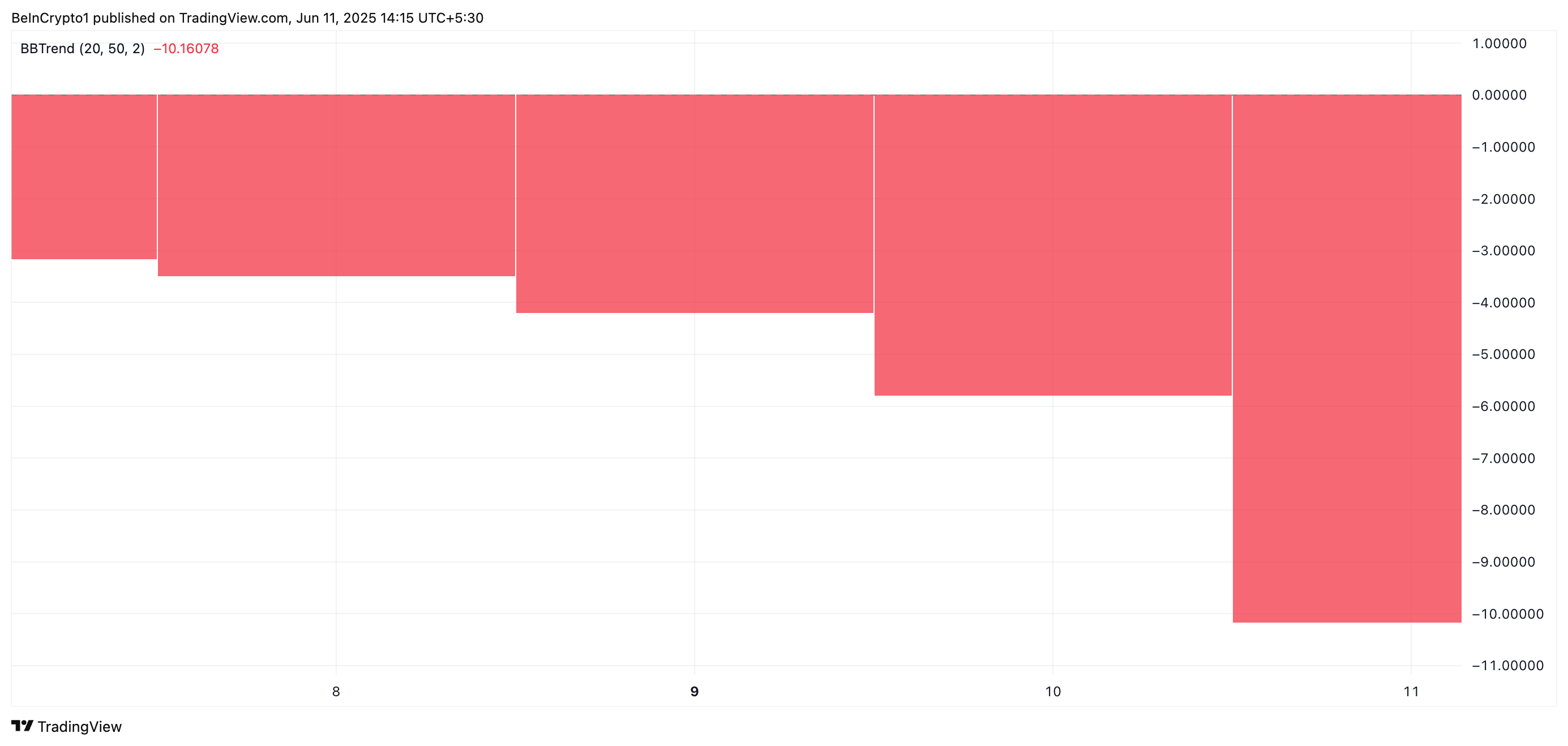

Moreover, readings from the altcoin’s BBTrend indicator support this bearish outlook. Observed on the one-day chart, the indicator currently sits at -10.16, displaying red histogram bars that have been growing in size with each trading session.

HBAR BBTrend. Source:

TradingView

HBAR BBTrend. Source:

TradingView

The BBTrend measures the strength and direction of a trend based on the expansion and contraction of Bollinger Bands. When it returns red bars, the asset’s price consistently closes near the lower Bollinger Band. This reflects sustained selling pressure and hinting at the potential for further downside.

In HBAR’s case, the divergence between its price movements and BBTrend confirms that the upward move lacks strong momentum and may be unsustainable.

HBAR at a Crossroads Between $0.166 and $0.188

HBAR currently exchanges hands at $0.18, trading just above the support level at $0.178. If bullish momentum in the broader crypto market fades and demand fails to climb, HBAR’s rally may lose steam. This could potentially push the price below the $0.178 support.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

In this scenario, the token could slip further to $0.166.

On the other hand, if fresh demand enters the market, HBAR’s rally could regain strength and climb toward the $0.188 resistance level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This year's hottest cryptocurrency trade suddenly collapses—should investors cut their losses or buy the dip?

The cryptocurrency boom has cooled rapidly, and the leveraged nature of treasury stocks has amplified losses, causing the market value of the giant whale Strategy to nearly halve. Well-known short sellers have closed out their positions and exited, while some investors are buying the dip.

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.

Ripple raised another $500 million—are investors buying $XRP at a discount?

The company raised funds at a valuation of $40 billions, but it already holds $80 billions worth of $XRP.

CoinShares: Net outflow of $1.17 billion from digital asset investment products last week.