Bloomberg Strategist: Bitcoin-to-Gold Ratio May Signal Risk Assets to Bottom Out This Year

Bloomberg commodity strategist Mike McGlone shared an analysis on the X platform, stating that the Bitcoin/gold ratio may be leading the market's downward trend. He pointed out that the current near-unprecedented premium level in U.S. stocks is showing signs of peaking and may return to normal levels, while the equivalent ounce ratio between gold and Bitcoin can serve as an important reference indicator.

McGlone emphasized that since 2008, the S&P 500 Total Return Index has only experienced two annual declines, and such situations often put pressure on the cryptocurrency market. His model suggests that risk assets may reach a cyclical low in 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

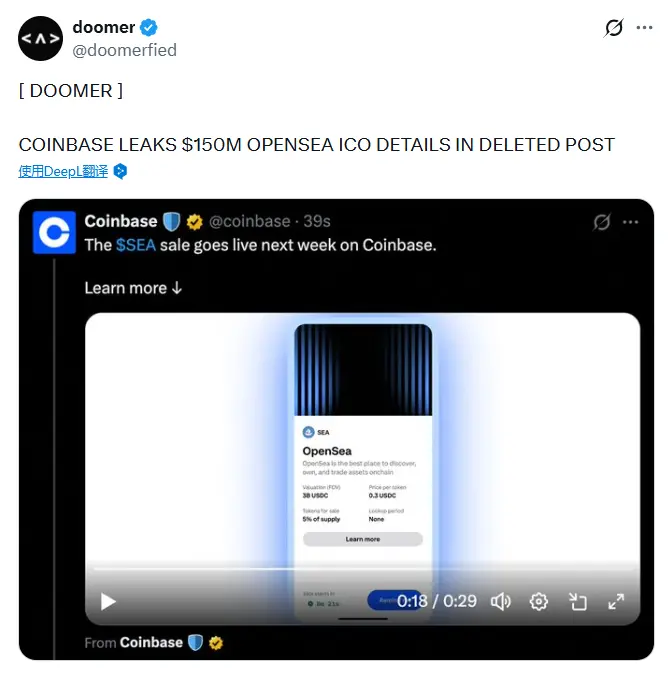

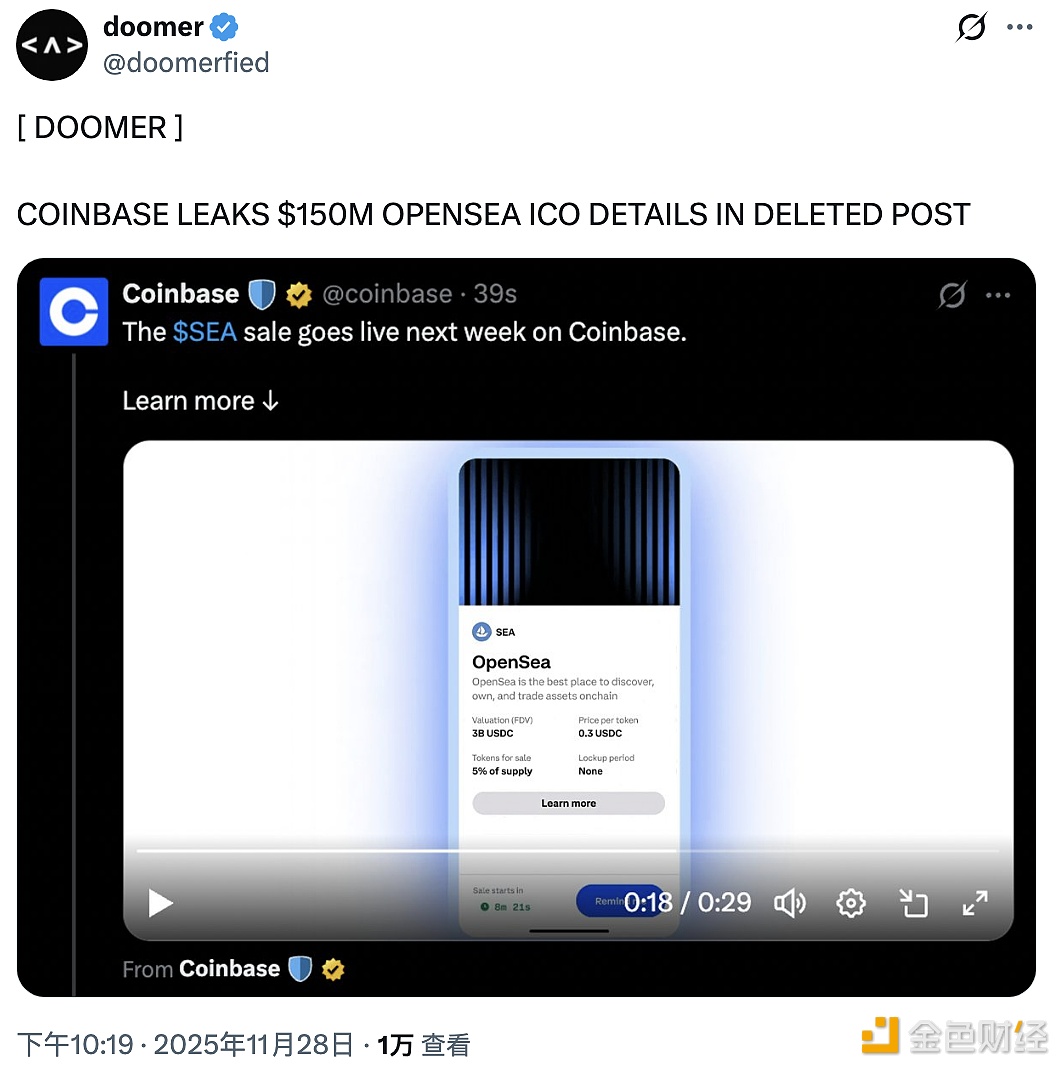

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.