Crypto Funds Hit With Record Outflows, But Altcoin Buyers Smell Opportunity

Crypto asset investment products experienced another challenging week as capital outflows continued for a second consecutive period. According to the latest report from CoinShares, a total of $584 million exited crypto-focused investment vehicles, pushing the two-week cumulative outflows to $1.2 billion.

This movement coincides with investor uncertainty surrounding the likelihood of interest rate cuts by the US Federal Reserve this year, which James Butterfill, Head of Research at CoinShares, believes is contributing to waning sentiment in the market.

Butterfill attributed the investor pullback to growing skepticism about macroeconomic policy shifts, particularly rate reductions. At the same time, exchange-traded product (ETP) activity hit a new low, with global ETP volumes falling to just $6.9 billion, marking the weakest weekly trading volume since the launch of spot Bitcoin ETFs in the United States earlier this year.

Bitcoin and Ethereum Bear the Brunt of The Crypto Outflows

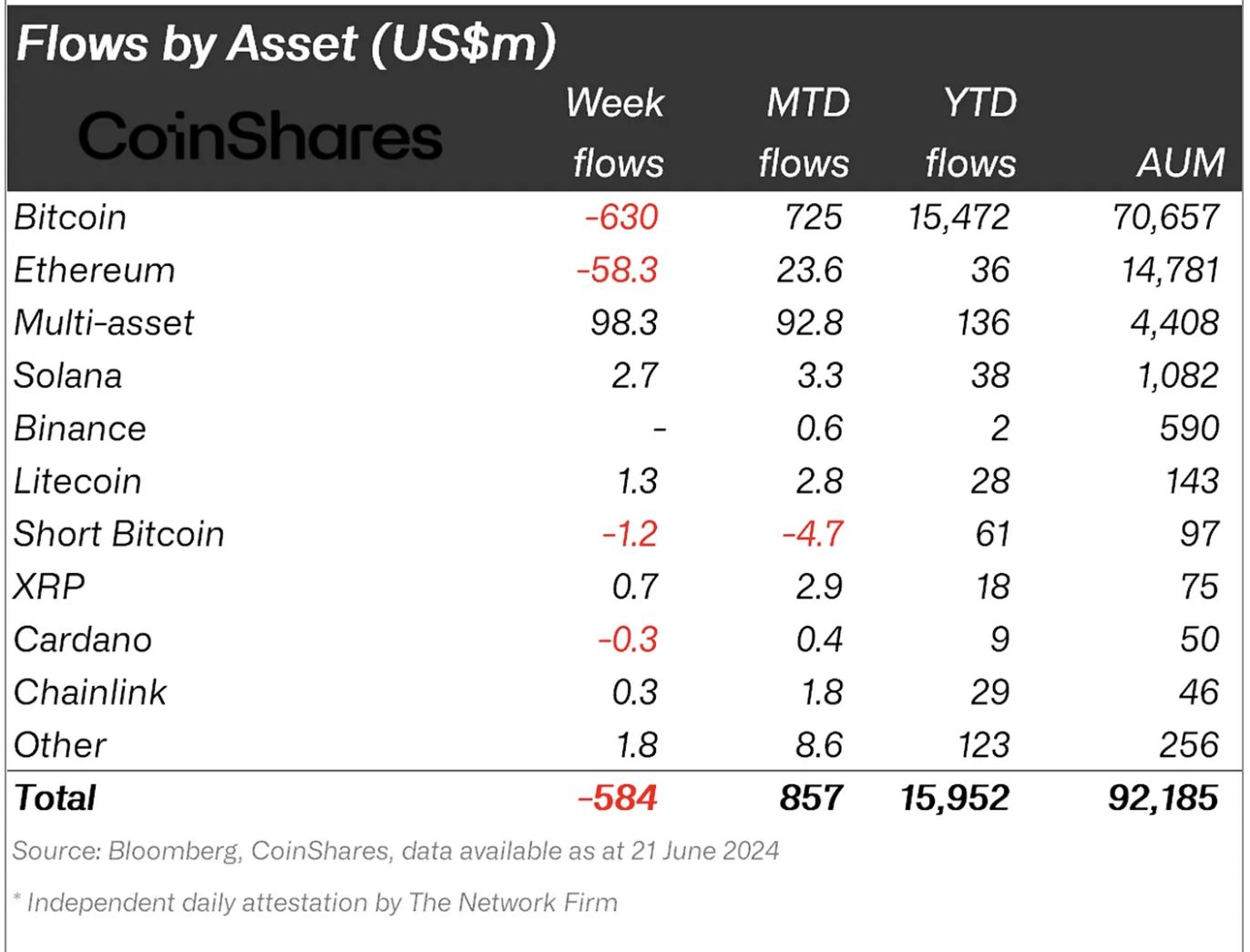

Bitcoin accounted for the majority of this week’s outflows, with $630 million leaving BTC investment products. Despite the significant movement of funds out of long Bitcoin positions, short Bitcoin products also recorded outflows totaling $1.2 million.

This suggests that investors are not currently betting heavily on downside exposure, opting instead to stay on the sidelines amid uncertain market conditions. Ethereum similarly saw negative flow activity, with $58 million in outflows, continuing the trend of cautious investor behavior across major assets.

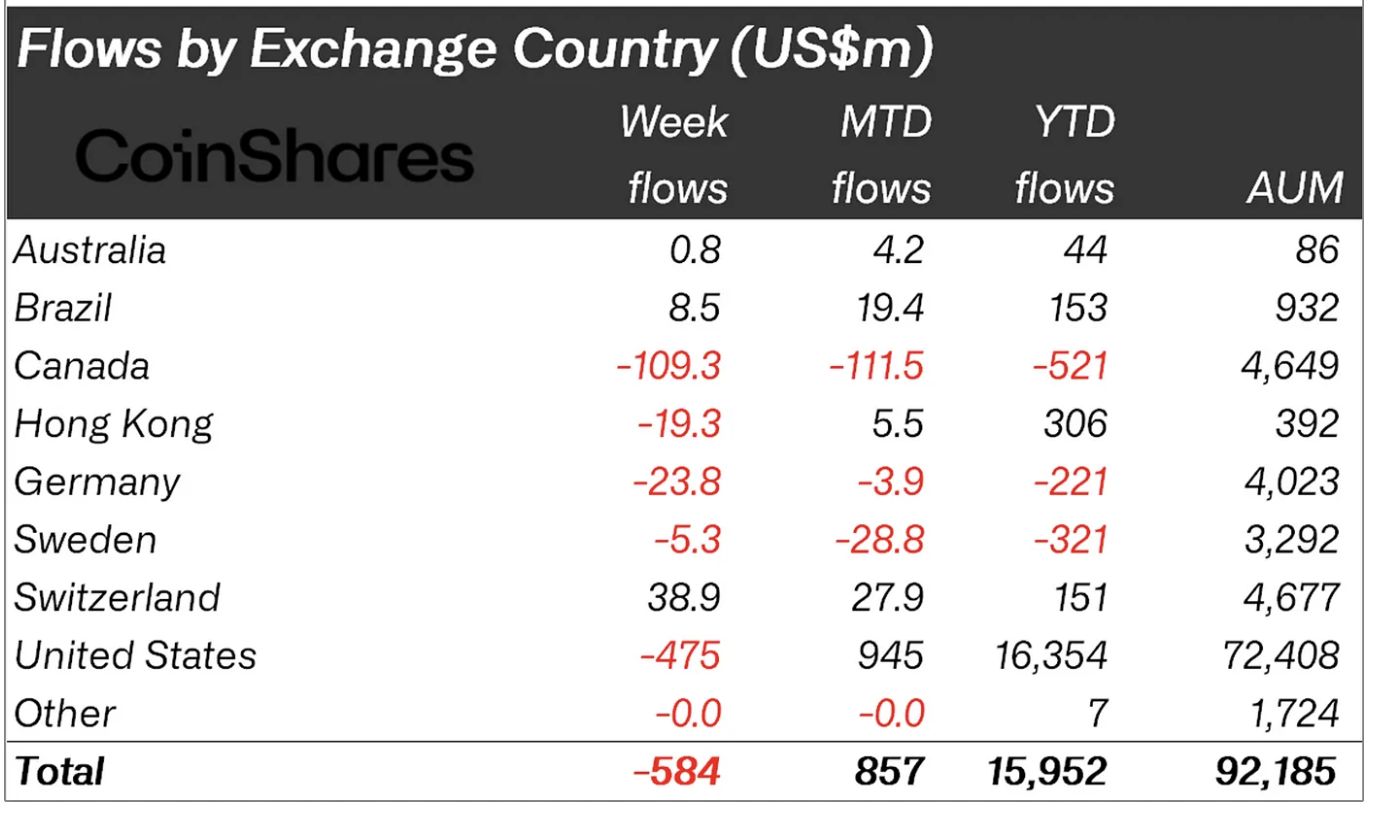

The report also highlighted geographical breakdowns, noting that the United States led all regions with $475 million in outflows, followed by Canada at $109 million. Germany and Hong Kong recorded smaller outflows at $24 million and $19 million, respectively.

In contrast, Switzerland and Brazil stood out as exceptions to the broader trend, bringing in net inflows of $39 million and $48.5 million, respectively. This divergence suggests that local factors or institutional strategies in those regions may be driving different investment behaviors.

Altcoins Draw Selective Support

While sentiment remained bearish for large-cap assets, some altcoins managed to attract capital inflows. Solana, Litecoin, and Polygon saw modest but notable gains of $2.7 million, $1.3 million, and $1 million, respectively.

These inflows may reflect opportunistic positioning by investors seeking exposure to assets that have underperformed recently. Additionally, multi-asset investment products, which spread exposure across various cryptocurrencies, recorded $98 million in inflows.

This signals that some investors are using recent price weaknesses to gain diversified access to the market rather than concentrating bets on single tokens.

The continued divergence in fund flows highlights the complex sentiment currently influencing crypto markets. With macroeconomic uncertainty still dominating investor outlooks, digital asset markets remain reactive to both global monetary policy signals and evolving regional investment trends.

Featured image created with DALL-E, Chart from TradingView

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services