ETF Inflows Nearly Halve as Bitcoin Slides Amid Market Caution | ETF News

Bitcoin ETF inflows dropped sharply as BTC slid below $104,000, signaling waning investor confidence. Reduced trading activity and bearish sentiment highlight a cautious outlook.

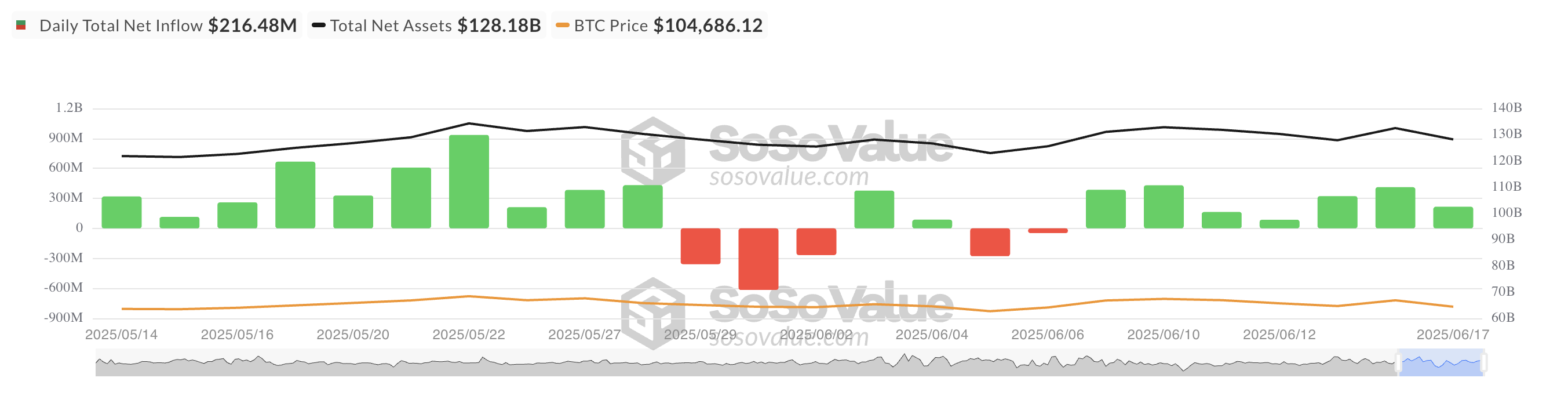

On Tuesday, Bitcoin exchange-traded funds (ETFs) recorded over $200 million in inflows. While this marked a net positive inflow into these funds, it also represented a sharp drop from the $421 million seen the day before.

The cooling interest comes as BTC slid to an intraday low of $103,371 on Tuesday, signaling growing caution among investors. If the decline persists, ETF inflows could weaken further, as institutional sentiment continues to take a hit.

BTC ETFs See Slump in Daily Inflows

On Tuesday, US-listed spot Bitcoin ETFs recorded net inflows of $216.48 million, indicating that investor interest remains intact. However, this marked a steep 47% drop from the $412 million posted the day before, signaling a slowdown in momentum.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

The dip in inflows coincided with BTC’s price decline during the day’s trading session. It fell to an intraday low of $103,371 amid weakening demand. The downturn has weighed on market sentiment and appears to have stalled fresh capital from entering BTC-linked ETFs.

Yesterday, BlackRock’s IBIT led the pack with the highest daily inflows, totaling $639.19 million, bringing its total historical net inflow to $50.67 billion.

On the other hand, Fidelity’s FBTC witnessed the largest net outflow among these ETFs, with $208.46 million exiting the fund.

BTC Faces Renewed Pressure

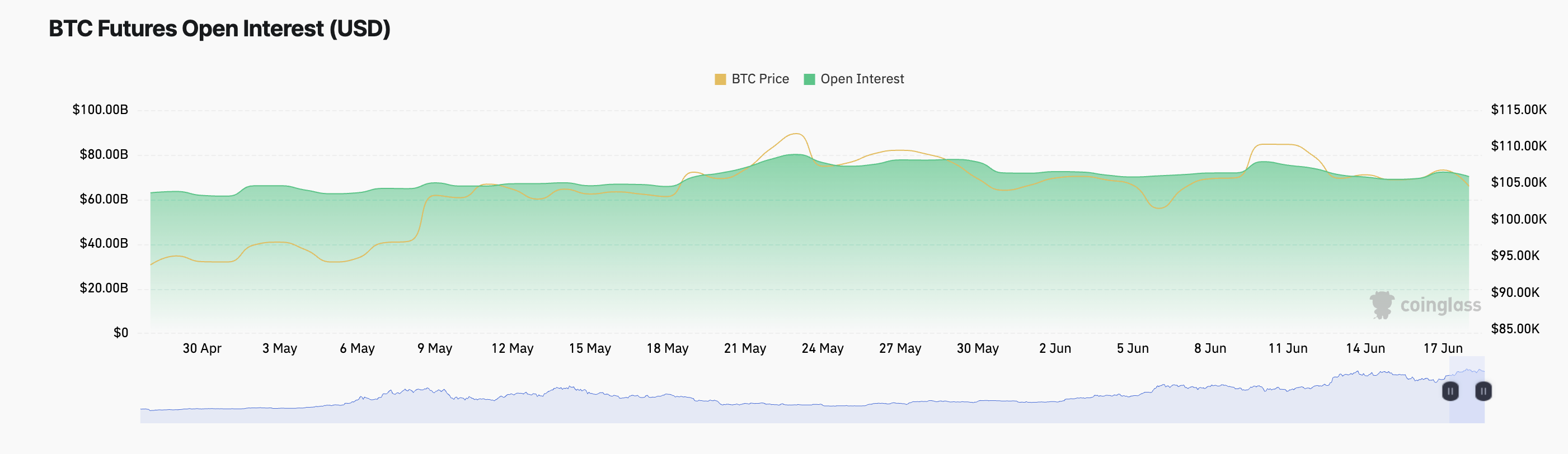

Today, BTC has extended its downward trend, shedding another 2% as the broader crypto market faces renewed selling pressure. The price decline has been accompanied by a dip in the coin’s futures open interest (OI), suggesting a slowdown in leveraged trading activity.

This stands at $70.24 billion at press time, dropping by 3% over the past day. This pullback signals that traders are reducing their exposure and possibly closing out positions, a trend reflecting growing market caution.

BTC Futures Open Interest. Source:

Coinglass

BTC Futures Open Interest. Source:

Coinglass

Open interest refers to the total number of outstanding futures contracts that have not yet been settled. When it falls during a price dip like this, it indicates that traders are exiting positions rather than opening new ones. This is a sign of weakening conviction and reduced speculative appetite among BTC futures traders.

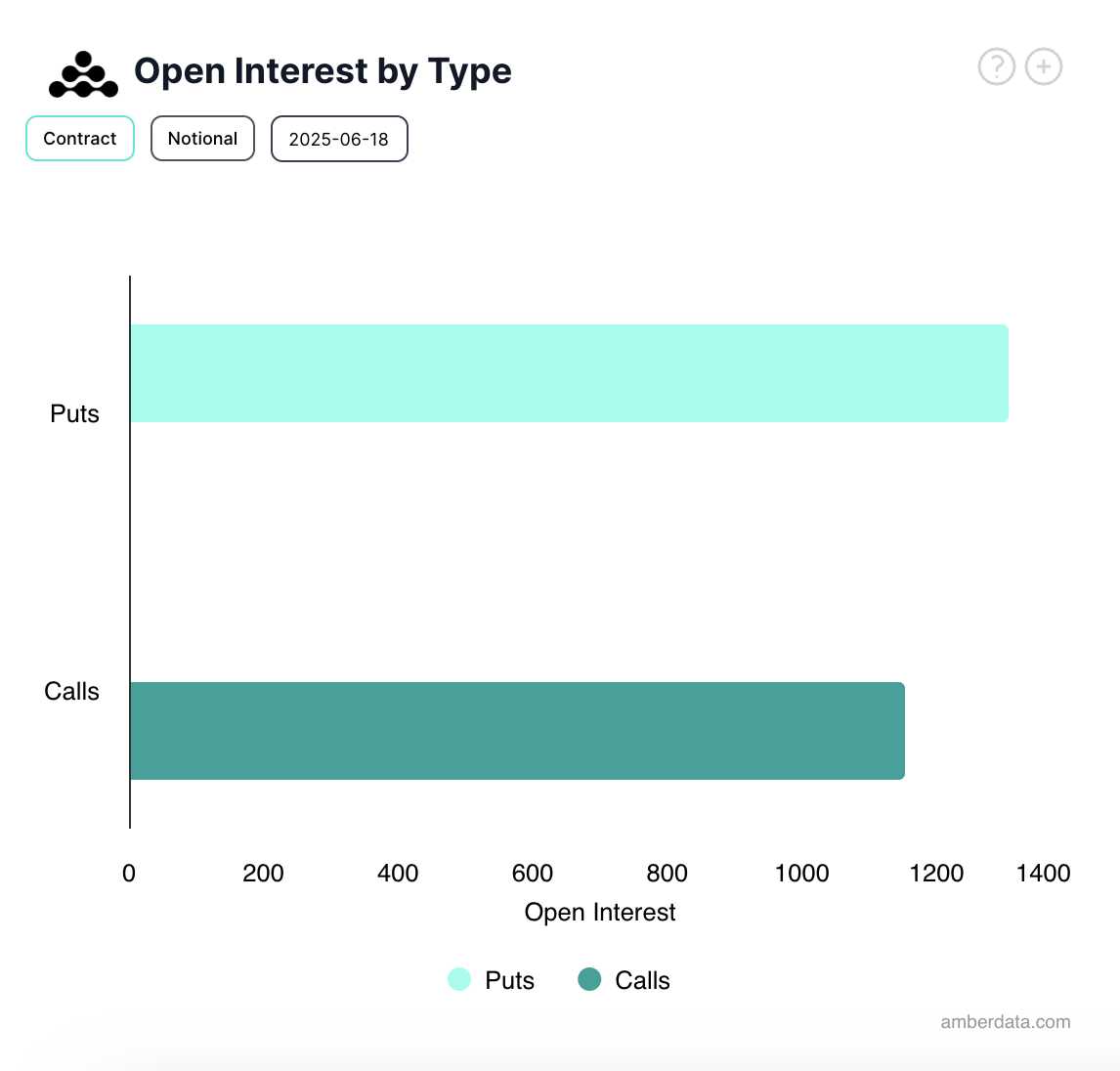

Furthermore, bearish sentiment continues to dominate the options market, as evidenced by the heightened demand for put contracts over calls, per Deribit. This imbalance suggests that a growing number of traders are positioning themselves to profit from further downside in BTC’s price.

Bitcoin Options Open Interest. Source:

Deribit

Bitcoin Options Open Interest. Source:

Deribit

The combination of cooling ETF inflows, declining open interest, and a bearish tilt in the options market suggests that while institutional interest has not vanished, the drop in capital flows and trading behavior means many investors are gearing for further downside, or at least waiting for clearer signals before re-entering the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$PING rebounds 50%, a quick look at the $PING-based launchpad project c402.market

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

Crypto Capitalism, Crypto in the AI Era

A one-person media company, ushering in the era of everyone as a Founder.

Interpretation of the ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid’s Developer Wealth Creation Myth?

The platform serves as a foundation, enabling thousands of applications to be built and profit.

Data shows that the bear market bottom will form in the $55,000–$70,000 range.

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.