Eyenovia Launches $50 Million HYPE Treasury, Announces Rebrand to Hyperion DeFi

Eyenovia is rebranding to Hyperion DeFi (HYPD) and will invest $50 million to fund its Hyperliquid treasury strategy. The company's new strategy aims to capitalize on blockchain growth and bolster shareholder value.

Eyenovia (EYEN), a digital ophthalmic medical technology company, has become the first publicly listed US firm to create a Hyperliquid (HYPE) reserve. The company revealed plans to invest $50 million to fund its HYPE treasury strategy.

Additionally, Eyenovia will undergo a rebranding to Hyperion DeFi, with its stock ticker transitioning from EYEN to HYPD, expected around June 20. Despite this shift, Eyenovia remains committed to its core business, which will now run parallel to the HYPE treasury.

Hyperliquid (HYPE) Gains Traction as the New Institutional Favorite

In its latest press release, Eyenovia announced that it is raising funds through a PIPE financing deal under a securities purchase agreement with institutional accredited investors. The financing involves issuing non-voting convertible preferred stock, convertible into approximately 15.4 million shares of common stock at $3.25 per share.

The firm will also issue warrants to purchase up to 30.8 million shares at the same exercise price. The potential proceeds could reach $150 million if all warrants are exercised. However, this outcome is uncertain.

“The closing of the offering is expected to occur on or about June 20, 2025, subject to the satisfaction of customary closing conditions, with the Company also expected to change its name and ticker to ‘Hyperion DeFi’ and ‘HYPD’, respectively,” the press release read.

The funding will help the company become one of the leading global validators for Hyperliquid by facilitating the acquisition of over 1,000,000 HYPE tokens. It also plans to launch a HYPE staking program.

This initiative supports the company’s long-term goal of providing value for shareholders by capitalizing on the worldwide growth of blockchain technology and digital innovation. To lead the HYPE treasury strategy, the medical technology firm has appointed Hyunsu Jung as its chief investment officer and board member.

Eyenovia now joins several other companies diversifying beyond Bitcoin (BTC) and Ethereum (ETH) to adopt a broader range of altcoins, including XRP (XRP), Solana (SOL), Artificial Superintelligence Alliance (FET), and Bittensor (TAO).

“We are pleased to join the growing number of companies who have adopted similar strategies for the diversification, liquidity and long-term capital appreciation potential that cryptocurrency represents. Following a thorough review of all available alternatives, the Board and I have concluded that this transaction is in the best interests of our shareholders,” Eyenovia’s CEO, Michael Rowe, said.

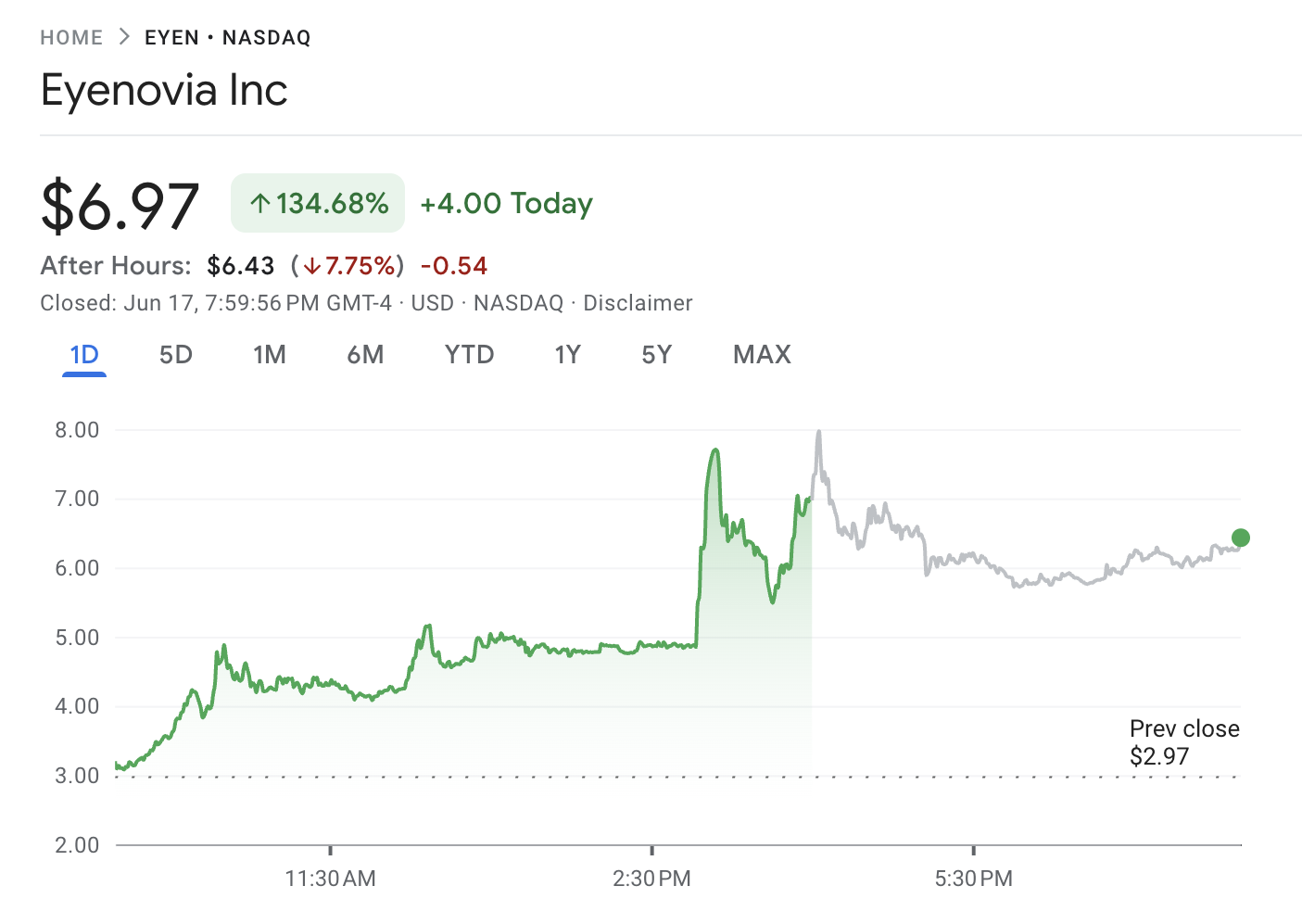

The strategic pivot proved favorable for Eyenovia’s stock. At the market close, the price was up 134.6%, reflecting strong investor confidence. Nonetheless, in after-hours trading, EYEN’s price dipped by 7.7%.

Eyenovia (EYEN) Market Performance. Source:

Google Finance

Eyenovia (EYEN) Market Performance. Source:

Google Finance

Meanwhile, HYPE did not seem to be impacted by the news. BeInCrypto reported that the DeFi token hit an all-time high yesterday.

Hyperliquid (HYPE) Price Performance. Source:

BeInCrypto

Hyperliquid (HYPE) Price Performance. Source:

BeInCrypto

However, the price has since dropped. At the time of writing, HYPE was trading at $41, down 3.5% over the past day.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.

Ripple raised another $500 million—are investors buying $XRP at a discount?

The company raised funds at a valuation of $40 billions, but it already holds $80 billions worth of $XRP.

CoinShares: Net outflow of $1.17 billion from digital asset investment products last week.

Crypto Jumps On Trump’s $2,000 Dividend Announcement