Dow Jones up 500 points on Iran-Israel ceasefire, Powell to wait with rate cuts

U.S. stocks are up as lowering tensions in the Middle East create more positive, risk-on sentiment.

Major U.S. stock indices rose after the announced ceasefire between Israel and Iran. On Tuesday, June 24, Dow Jones was up 470 points or 1.1%, reclaiming its levels before the 12-day war started. At the same time, the S&P 500 was up 1.05%, and the tech-focused Nasdaq was up 1.43%.

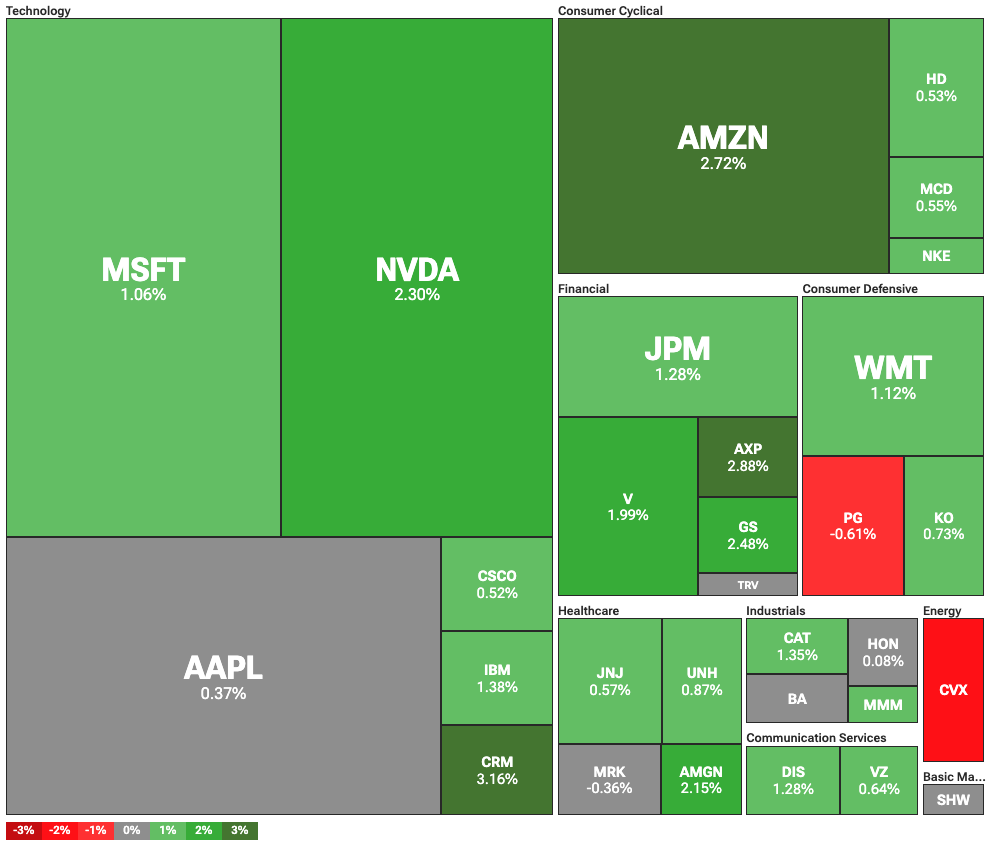

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Driving the markets were hopes that the conflict between Iran and Israel would cease for now. U.S. President Donald Trump announced a ceasefire between the two countries. Moreover, he pressured Israel to stop its attacks against Iran, which promised hope for an end to the war.

The escalation of a broader conflict threatened the global oil economy. This was particularly true after the U.S. got directly involved with its own strikes on Iran’s nuclear facilities. After these strikes, Iran even threatened to push the price of oil to its historic levels by closing the Strait of Hormuz.

The price of crude oil dropped back down to $64 per barrel, down 5.33% in just one day. Crude oil traded near $75 at the height of the crisis, the highest price since January this year. Lower oil prices are good news for the global macro outlook as they could lead to cooling inflation.

Fed can afford to wait with rate cuts: Powell

With de-escalating tensions in the Middle East, focus is once again on the Federal Reserve and interest rates. In his testimony before Congress, Fed Chair Jerome Powell said that the Fed will wait for more information before making changes to the interest rates.

In particular, Powell is concerned by the potential effects of Trump’s tariffs, which could both push inflation up and lower growth. What is more, effects on inflation could be either short-lived or persistent, which would require a different response.

In any case, Powell stated that rate cuts could come sooner if inflation stays low or if the unemployment rate picks up.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.