Kaspa (KAS) Breaks Key Barrier With 10% Jump, Poised for a Strong Q2 Close

Kaspa (KAS) breaks through resistance and shows strong momentum, with a possible rally toward $0.082 as Q2 ends. However, a pullback to $0.069 could occur if sell-side pressure increases.

Layer-1 coin KAS is today’s crypto market’s top gainer, surging nearly 10% in the past 24 hours. The price rally is accompanied by an uptick in trading volume, signaling that the momentum is backed by strong buyer demand.

The bullish move has seen KAS price break above key resistance levels, hinting at an extended rally as Q2 nears its end.

Kaspa Clears 29-Day Barrier

Readings from the KAS/USD one-day chart show the altcoin trading above its 20-day exponential moving average (EMA), a resistance level it had struggled to break for the past 29 days.

KAS 20-Day EMA. Source:

TradingView

KAS 20-Day EMA. Source:

TradingView

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving more weight to recent prices. When an asset’s price trades above this key moving average, buying pressure exceeds selloffs, and the bias toward the asset turns positive.

Therefore, KAS’s successful breakout above this level suggests a bullish shift in market sentiment as the second quarter draws to a close.

Furthermore, the altcoin’s Moving Average Convergence Divergence (MACD) indicator has just recorded its first bullish crossover in several weeks, reinforcing signs of a bullish resurgence in the market. At press time, KAS’s MACD line (blue) rests above its signal line (orange), confirming the shift in momentum toward buyers.

KAS MACD. Source:

TradingView

KAS MACD. Source:

TradingView

The MACD indicator identifies trends and momentum in its price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

As with KAS, when the MACD line rests atop the signal line, it indicates bullish momentum, suggesting that the asset’s price may continue to rise.

Kaspa Eyes $0.082—Can Bulls Keep Control?

At press time, KAS trades at $0.079. If demand continues to climb, the 20-day EMA could serve as a support floor, potentially pushing the token’s price above its next resistance at $0.082. A successful break above this level may open the door for further gains toward $0.091.

KAS Price Analysis. Source:

TradingView

KAS Price Analysis. Source:

TradingView

However, if sell-side pressure gains momentum, this bullish outlook would be invalidated. In that case, KAS’s price could face a pullback toward $0.069.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VivoPower Plans $300M Ripple Labs Share Vehicle in South Korea

Revealing: Kevin Hassett’s Bold Call for an Interest Rate Cut and What It Means for Crypto

Changpeng Zhao’s Crucial Mission: Talks with 10 Governments on Crypto Regulation

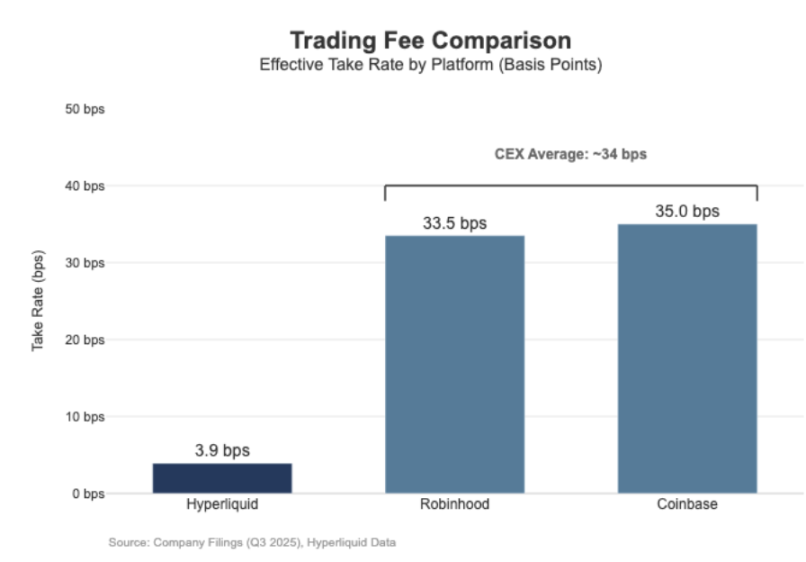

Hyperliquid at a Crossroads: Follow Robinhood or Continue the Nasdaq Economic Paradigm?