Lido DAO Approves Dual Governance Mechanism, Granting Stakers Veto Power

According to Jinse Finance, as the governance DAO of the largest Ethereum liquid staking protocol, Lido currently manages over a quarter of all staked Ethereum. The organization recently passed a decision with near-unanimous support to grant stakers the power to delay or veto governance decisions. This "dual governance" mechanism is designed to prevent situations where Lido token holders—currently the only group with the authority to create and pass Lido DAO governance proposals—might introduce and approve proposals that could negatively impact stakers or Ethereum itself. Under the new mechanism, Lido stakers (users holding stETH tokens) can object to DAO proposals by depositing stETH into an escrow contract. If at least 1% of the total staked ETH in Lido is deposited as stETH into this escrow contract, the proposal will be delayed by five days, and the delay period will increase further as more stETH is deposited.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The total on-chain holdings of US spot Bitcoin ETFs have surpassed 1.32 million BTC.

Yesterday, the net inflow of US spot Ethereum ETFs was $76.6 million.

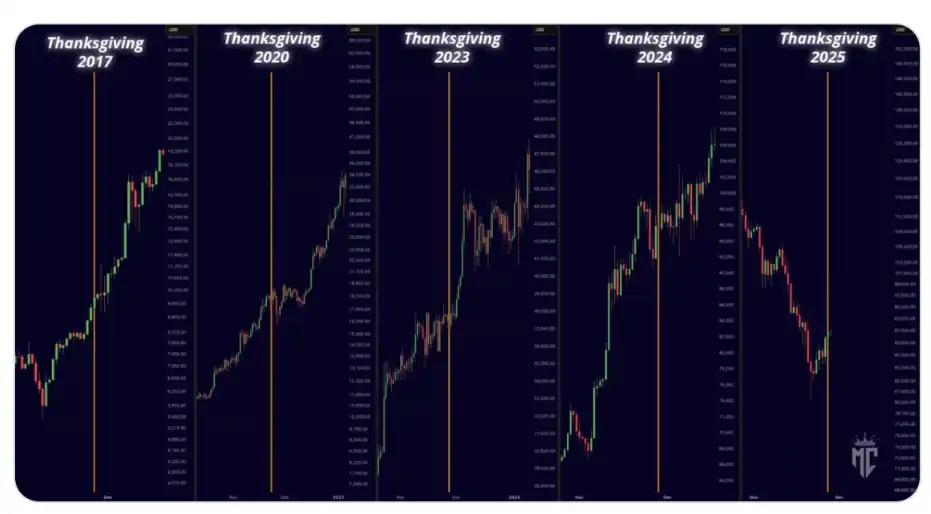

Analyst: Bitcoin has bottomed out in the short term, a rebound towards $100,000 may occur

BlackRock IBIT holdings drop to 777,700 BTC