Jito (JTO) Rallies 11% Amid Volume Spike — Is More Upside Ahead?

- Jito (JTO) surged 11.13% intraday, hitting a high of $2.16 on strong buyer interest.

- JTO faces key resistance at $2.20 and support near $1.90.

Jito (JTO) has posted a sharp 11.13% intraday gain, climbing to $2.15 after touching a session high of $2.16. The surge coincided with a notable 188.74% jump in 24-hour trading volume, now standing at $59.29 million.

As of writing, JTO ranks 84th by market cap, with a valuation of $719.17 million. Its market cap ratio sits at 8.25%, signaling healthy liquidity relative to valuation. Despite this rally, JTO trades far below its fully diluted valuation (FDV) of $2.1 billion, implying significant future unlocking risks.

The current circulating supply stands at 341.96 million JTO, with the total supply capped at nearly 1 billion. The absence of a defined maximum supply introduces long-term inflation concerns. However, today’s breakout suggests renewed bullish momentum, at least in the near term.

Will JTO Sustain Its Breakout or Face Rejection?

Technically, JTO rebounded off a recent low and pierced through minor resistance with strong bullish intent. If the price sustains above the $2.20 mark, it may test the next barrier near $2.35.

Conversely, failure to hold above $2.00 could open downside exposure toward $1.90 support. Price action appears guided by rising demand, as seen in the recent long-bodied green candle and expanding volume bars.

On the momentum front, the Relative Strength Index (RSI) has ticked up to 55.03, while the RSI average hovers just below at 54.02. This slight bullish divergence points to renewed strength. Both metrics sit comfortably above the neutral 50 mark, suggesting upward bias remains intact. If RSI accelerates past 60, it may validate a sustained bullish cycle.

Meanwhile, the Chaikin Money Flow (CMF) remains slightly negative at -0.06, hinting at lingering outflows. Although it has improved marginally, CMF must turn positive to fully confirm buying pressure. This divergence between price and volume-based indicators warrants caution despite the bullish surface.

Additionally, moving average crossovers offer mixed signals. The short-term moving average recently crossed above the intermediate one, which can be interpreted as a potential bullish trigger.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ERC-8021: Ethereum’s ‘copy Hyperliquid’ moment, a new way for developers to make a fortune?

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

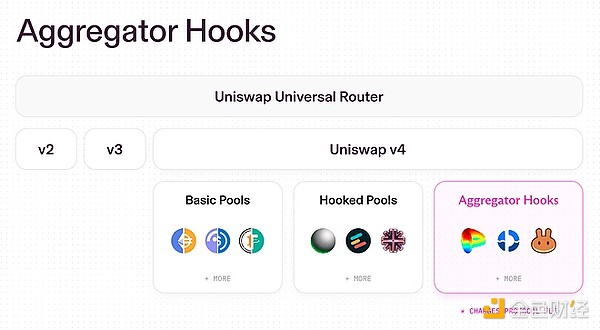

UNI surges nearly 50%: Details of the Uniswap joint governance proposal

Burning is Uniswap's final trump card

Hayden’s new proposal may not necessarily be able to save Uniswap.