Bitcoin Bull Trend Remains Intact, According to Crypto Analytics Firm Glassnode – But There’s a Catch

2025/06/27 16:00

2025/06/27 16:00The analytics platform Glassnode says that Bitcoin’s ( BTC ) uptrend remains solid as long as one crucial support area holds.

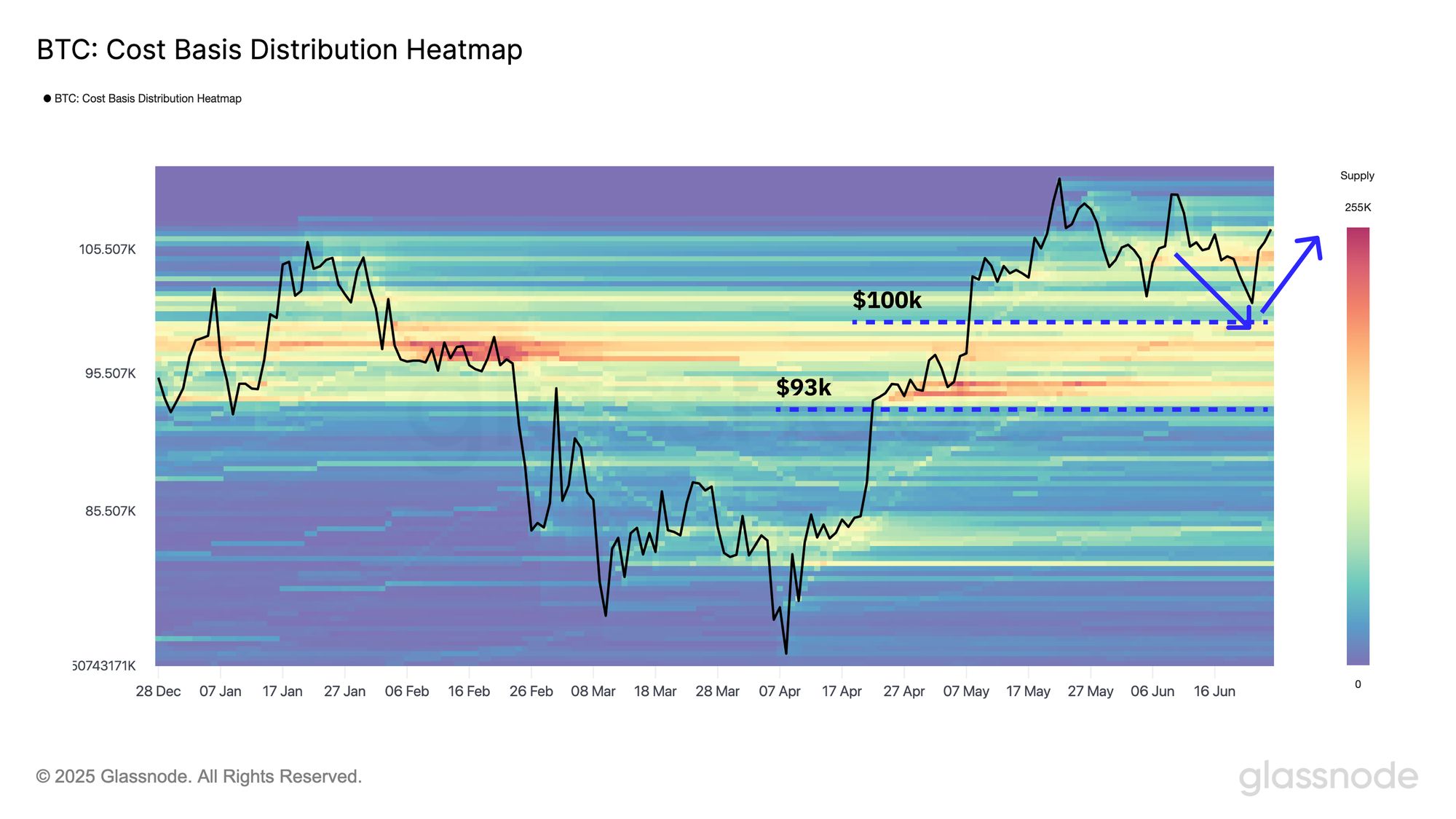

Glassnode says the data visualization tool Cost Basis Distribution (CBD) heatmap shows Bitcoin has strong support at the “structurally important” zone between the $93,000 – $100,000 range.

CBD is an on-chain metric used to show price areas where investors bought their coins and how much they’re holding. Price zones with dense supply clusters could act as support or resistance levels, as they indicate levels where investors tend to accumulate or offload their holdings.

Glassnode says the $93,000 to $100,000 price area is acting as support for BTC and is keeping the crypto king’s bull market structure intact. However, a move below the level could ignite a sell-off event.

“However, a breakdown below could trigger a deeper correction, especially if holders with a cost basis in this zone begin to capitulate and add to the sell pressure.”

Source: Glassnode

Source: Glassnode

For now, Glassnode says that Bitcoin is currently showing “signs of diminishing profitability and sluggish on-chain activity,” signaling that the crypto king is in a consolidation phase as volatility falls and investor engagement weakens.

“Until we see a pickup in profitability and activity metrics, the likelihood of a breakout to new all-time highs remains limited. For now, the market appears to be digesting prior gains, awaiting fresh momentum and an influx of new demand.”

The analytics firm also says that Bitcoin’s push to a new all-time high in May was not accompanied by an increase in BTC spot volume and the volume levels were lower than what was recorded earlier in the current bull market.

Bitcoin is trading at $107,256 at time of writing.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?

Ethereum Raises Its Gas Limit to 60M for the First Time in 4 Years

DeFi: Chainlink paves the way for full adoption by 2030