Michael Saylor Predicts Bitcoin as Modern Finance Backbone

2025/06/29 18:24

2025/06/29 18:24- Bitcoin is touted as a foundational financial asset.

- Institutional adoption is expected to increase.

- MicroStrategy continues to influence corporate finance.

Michael Saylor‘s declaration underscores Bitcoin’s potential as a key financial asset, potentially influencing broader institutional adoption. No immediate market reactions have been noted, but long-term strategic shifts are anticipated.

Michael Saylor, Executive Chairman of MicroStrategy, announced at the Prague conference that Bitcoin is poised to be the future backbone of finance. MicroStrategy has consistently increased its Bitcoin holdings, signaling its commitment to the cryptocurrency.

During his address, Saylor highlighted that Bitcoin should be seen as more than a digital asset. He argued for its role in corporate finance strategies and treasury management, emphasizing its potential in modern financial systems.

Bitcoin could become the backbone of modern finance…serving as a foundational asset for corporate treasury management and financial strategies. – Michael Saylor, Executive Chairman, MicroStrategy

Bitcoin‘s value may see long-term gains, stemming from institutional support following Saylor’s remarks. The financial market looks to see how entities integrate Bitcoin into their treasury models, with a focus on strategic financial instruments like STRK and STRF.

MicroStrategy’s influence on corporate treasury management remains significant, potentially driving other firms to adopt similar strategies. This could lead to more extensive corporate acceptance of Bitcoin as a financial cornerstone.

If Bitcoin becomes the backbone of finance, there could be regulatory implications. Institutions may develop technologies and financial products integrating Bitcoin. These innovations could redefine financial strategies globally, given insights into financial, regulatory, and technological outcomes. Reports from past strategic Bitcoin integration trends underscore potential future impacts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The truth behind BTC's plunge: Not a crypto crash, but a global deleveraging triggered by the yen shock

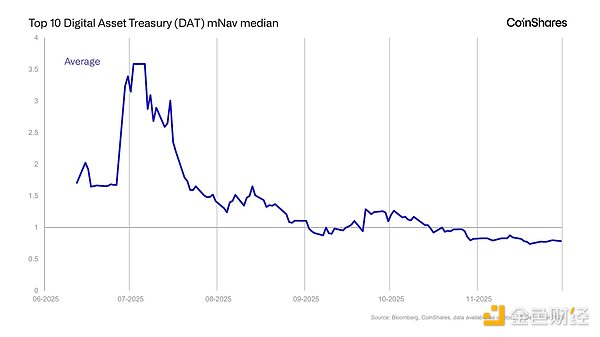

DAT: A Concept in Transition

From traditional market-making giants to core market makers in prediction markets, SIG's forward-looking layout in crypto

Whether it's investing or trading, SIG is always forward-looking.