Bitcoin steadies above $108,000 as traders brace for key macro data and Powell remarks

2025/06/29 16:00

2025/06/29 16:00

Bitcoin held steady above the $108,000 level, while ether briefly rose above $2,500 over the weekend, as traders prepare for a week of key macroeconomic data releases.

The world's largest cryptocurrency traded up 1% in the past 24 hours at $108,423 at the time of writing, and either gained 2.8% to change hands at $2,499, according to The Block's price page. The cryptocurrency market appears to have recovered much of the losses triggered by the Iran-Israel conflict, which had pushed bitcoin below $100,000.

Traders will closely watch several upcoming macroeconomic data releases and remarks from major central bank officials speaking at the European Central Bank forum this week, analysts said.

Federal Reserve Chair Jerome Powell is expected to speak on Tuesday at an ECB forum panel alongside central bank governors from the UK, South Korea and Japan. While Powell told lawmakers last week that the Fed was in no rush to lower interest rates, U.S. President Donald Trump accused Powell on Sunday of keeping rates "artificially high."

Peter Chung, head of research at Presto Research, told The Block that this week "will be important," with a slew of labor market data scheduled for release. That includes May job openings from the U.S. Job Openings and Labor Turnover Survey, as well as June nonfarm payrolls and the unemployment rate.

"Crypto-specific fundamentals this year have never been stronger, driven by policy tailwinds and mainstream adoption," Chung said. "If these data show weakness, the expectation of rate cuts could strengthen, driving risk asset prices, including crypto, higher."

Investors are also watching developments in tariff negotiations ahead of the July 8 and 9 deadlines, along with movements in the U.S. dollar. "Tariff talks ahead of the July 8 deadline and continued dollar weakness will keep markets' attention this week," said Vincent Liu, CIO of Kronos Research.

"Crypto’s climbing, but conviction may be tested. Momentum builds as macro winds ease and risk appetite returns," Liu said. With the bitcoin fear and greed index at 66, he added that the market sentiment "looks elevated," but one major macro shift "could reset the board."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Open Campus and Animoca Brands Partner with Rich Sparkle Holdings to Drive EduFi Adoption

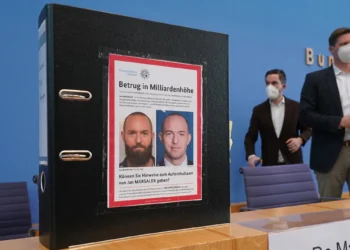

Russian Spy Ring Funds Espionage Through Crypto Laundromat, UK Police Reveal

Cardano Price Prediction 2025, 2026 – 2030: Will ADA Price Hit $2?

65+ Crypto Firms Press Trump: Act Now to Protect U.S. Crypto Innovation