SkyBridge Founder: Public Companies Imitating MicroStrategy’s BTC Hoarding Is Only a Short-Term Phenomenon, the Hype Is Expected to Fade in the Coming Months

2025/07/02 16:05

2025/07/02 16:05ChainCatcher reports, citing Bloomberg, that SkyBridge Capital founder Anthony Scaramucci recently stated that the trend of public companies adding Bitcoin to their balance sheets is only a temporary phenomenon, predicting that this strategy will lose momentum in the coming months. “Right now, companies are blindly copying (MicroStrategy’s) Bitcoin hoarding strategy, but this craze will eventually fade,” he said.

Scaramucci noted that investors will ultimately question: why pay a premium for companies holding Bitcoin instead of simply buying it themselves? This trend began in 2021, when software company MicroStrategy (MSTR), led by CEO Michael Saylor, took the lead in aggressively purchasing Bitcoin. Its stock price subsequently soared nearly 3,000%, attracting imitators such as medical device maker Semler Scientific (SMLR) and Japanese-listed company Metaplanet (3350).

The craze is not limited to well-known companies; many small-cap firms have also sought to attract capital by increasing their holdings of Bitcoin or other cryptocurrencies such as Ethereum and XRP. However, Scaramucci emphasized that Saylor’s success is unique—MicroStrategy has diversified business lines beyond Bitcoin, and “other copycat companies must bear additional management costs and valuation premiums.”

Although he remains bullish on Bitcoin in the long term, Scaramucci cautioned investors to consider the hidden costs of “Bitcoin concept stocks.” With the U.S. SEC’s approval of spot ETFs, institutional investors can now allocate directly to Bitcoin, undermining the scarcity logic of corporate Bitcoin hoarding. Data shows that in the second quarter of 2024, the growth rate of corporate Bitcoin holdings has dropped 37% compared to the same period last year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

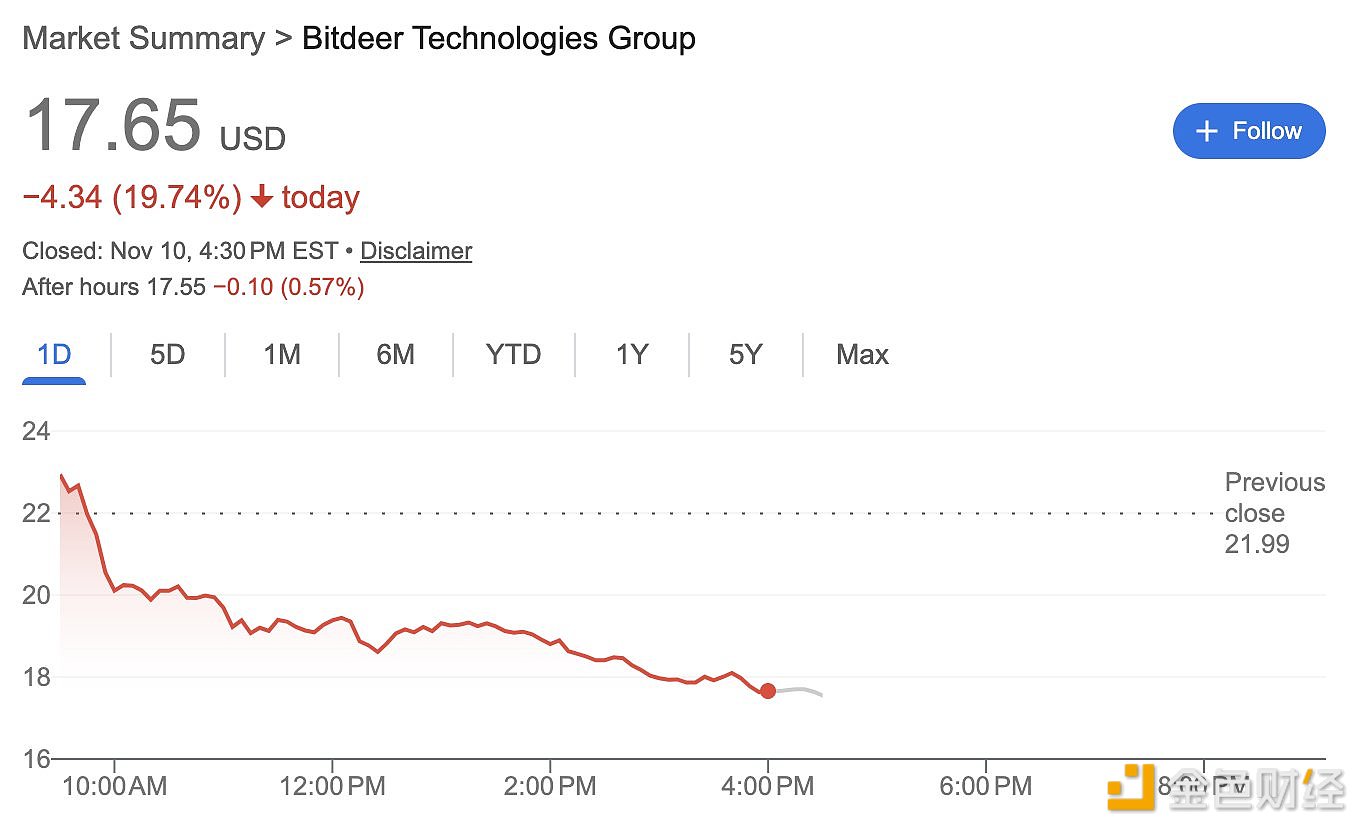

Bitdeer posts a net loss of $266 million in Q3, stock price plunges 20%

"ZEC's largest long position" has an unrealized loss of $2.4 million

The US Senate Agriculture Committee's crypto bill grants new powers to the CFTC, but key issues remain unresolved