Trump’s crypto ventures worth at least $620M, report claims

Trump’s crypto assets make up roughly 9% of his $6.9 billion net worth, a Bloomberg report claims.

Crypto ventures represent a sizeable portion of U.S. President Donald Trump’s wealth. According to a Bloomberg report published on Wednesday, June 2, Trump’s crypto-related businesses are worth $620 million. This amounts to about 9% of the $6.9 billion in Trump’s personal wealth.

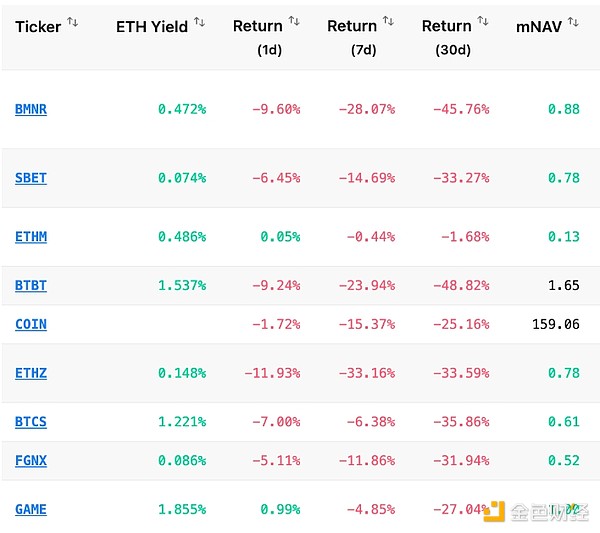

Trump’s assets as of June 25 | Source: Bloomberg

Trump’s assets as of June 25 | Source: Bloomberg

Trump’s 60% stake in digital assets company World Liberty Financial is worth around $460 million. The business, in which Trump’s sons Eric Trump and Donald Trump Jr. are actively involved, invests in digital assets. It also launched its own stablecoin, USD1.

Trump also netted a sizeable return on his memecoin, the Official Trump (TRUMP) token. His holdings of the token are worth $150 million. Most recently, the President promoted his memecoin by offering a private dinner to the top tokenholders.

Trump’s crypto wealth prompts conflict of interest concerns

Trump and his family’s crypto ventures have drawn significant criticism from political opponents. Among the most vocal are Rep. Maxine Waters and Senator Elizabeth Warren, who raised concerns about potential conflicts of interest and opportunities for bribery.

Waters stated that Trump’s stake in WLFI opens the door for foreign entities to buy access to the President. She also criticized the launch of the Trump memecoin, claiming that it lost investors at least $2 billion, while Trump and his family pocketed at least $350 million.

Trump’s sons also have stakes in his crypto firms, meaning crypto could account for an even larger share of the Trump business empire. Still, the bulk of Trump’s personal wealth remains in his various real estate holdings and media ventures. Notably, Trump’s stake in Trump Media and Technology, the company that owns Truth Social, is estimated at $2 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

With the market continuing to decline, how are the whales, DAT, and ETFs doing?

The New York Times: $28 Billion in "Black Money" in the Cryptocurrency Industry

As Trump actively promotes cryptocurrencies and the crypto industry gradually enters the mainstream, funds from scammers and various criminal groups are continuously flowing into major cryptocurrency exchanges.

What has happened to El Salvador after canceling bitcoin as legal tender?

A deep dive into how El Salvador is moving towards sovereignty and strength.

Crypto ATMs become new tools for scams: 28,000 locations across the US, $240 million stolen in six months

In front of cryptocurrency ATMs, elderly people have become precise targets for scammers.