NY law firm files class action against Strategy over alleged misleading bitcoin investment disclosures

Quick Take New York-based law firm Pomerantz filed a class action lawsuit against Strategy, claiming the company made false and misleading statements about its bitcoin investment strategy. The lawsuit also alleges that Strategy failed to adequately disclose the impact of adopting new accounting standards.

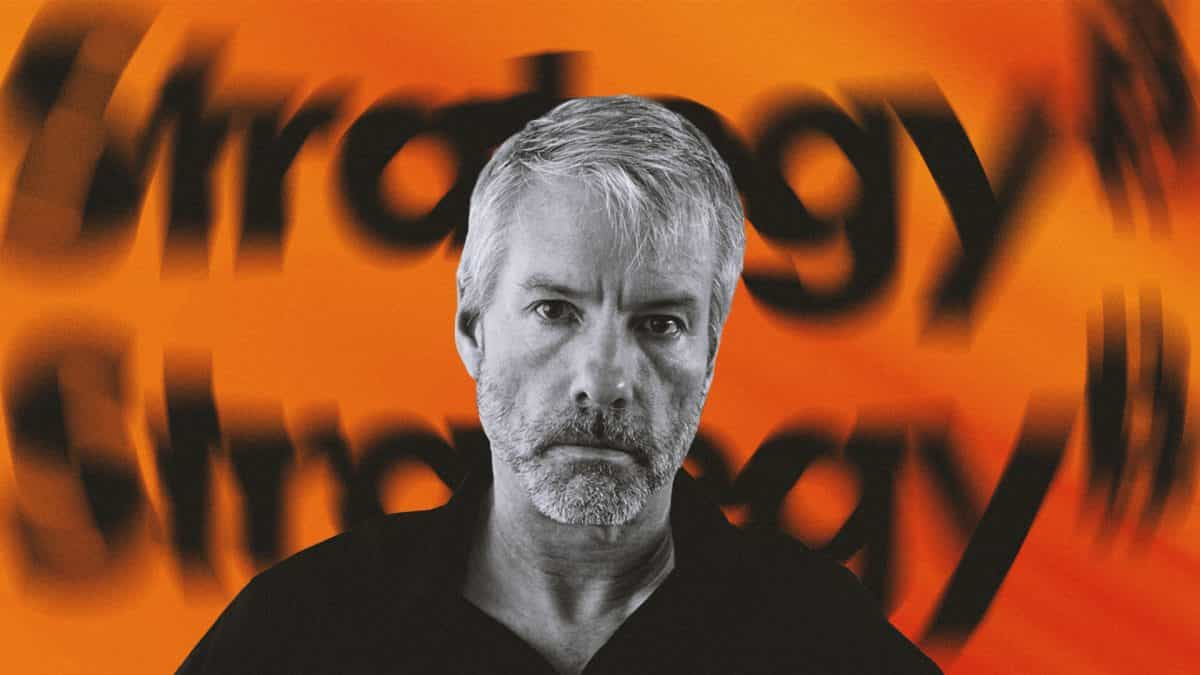

New York-based law firm Pomerantz LLP filed a class action lawsuit against Michael Saylor-led Strategy , alleging that the company violated federal securities laws by making false and misleading statements about the profitability of its bitcoin investment strategy.

The complaint, filed in the Eastern District Court of Virginia, represents investors of Strategy in the period between April 30, 2024, and April 4, 2025. Pomerantz said other investors can join the class action suit until July 15.

It alleges that Strategy overstated the profitability of its bitcoin investment strategy and treasury operations, while downplaying volatility risks associated with bitcoin. This renders the company's public statements "materially false and misleading," the statement said.

The lawsuit also revolves around Strategy's adoption of the Financial Accounting Standards Board's accounting standards — ASU 2023-08 — that require fair value accounting for crypto assets. This replaced the firm's prior cost-less-impairment model, which only recognized impairments for price drops, and didn't mark up assets for price increases until they were sold.

Pomerantz claims that Strategy failed to properly disclose the exact nature or scope of the impact of the new accounting standards on its financial statements, while downplaying risks to investors.

"Defendants consistently provided rosy assessments of Strategy's performance as a bitcoin treasury company following its adoption of ASU 2023-08," the law firm said in a statement. "They did this, in part, by reporting and projecting positive BTC Yield, BTC Gain, and BTC $ Gain results, while omitting the immense losses the Company could realize on its bitcoin assets after accounting for these assets under a fair value accounting methodology."

Specifically, the lawsuit mentions Strategy's $5.9 billion in unrealized loss from digital assets in Q1, 2025, due to the adoption of ASU 2023-08, which caused the stock price to drop over 8% at the time.

Strategy, formerly MicroStrategy, adopted its bitcoin accumulation strategy in 2020 and currently stands as the largest holder of bitcoin among publicly traded companies with 597,325 BTC under its belt.

Its stock price has surged significantly since its bitcoin focus, rising 3,328% in the past five years, according to Yahoo Finance data . Its success prompted other companies, such as Metaplanet , to pursue similar strategies. Strategy (MSTR) closed Wednesday with a 7.76% gain, reaching $402.28.

The Block has reached out to Strategy for comments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.

Ripple raised another $500 million—are investors buying $XRP at a discount?

The company raised funds at a valuation of $40 billions, but it already holds $80 billions worth of $XRP.

CoinShares: Net outflow of $1.17 billion from digital asset investment products last week.

Crypto Jumps On Trump’s $2,000 Dividend Announcement