Ripple Seeks National Banking License from U.S. Regulator

- Ripple applies for a national banking license in the U.S.

- Aims for dual oversight of RLUSD stablecoin.

- Potential boost in institutional trust and compliance.

Ripple Labs has filed an application for a national banking license with the U.S. Office of the Comptroller of the Currency , aiming to bring its RLUSD stablecoin under dual regulatory oversight this October.

Securing a national banking license matters due to the potential impact on stablecoin regulation and increasing institutional trust. Ripple’s move has already resulted in a 3.6% rise in XRP’s value.

Ripple Labs, known for its blockchain technology and cross-border payment solutions, pursues a banking license to enhance trust in its RLUSD stablecoin. This application marks a significant step towards increased transparency and compliance in the U.S. financial landscape.

True to our long-standing compliance roots, if approved, we would have both state (via NYDFS ) and federal oversight—a new (and unique!) benchmark for trust in the stablecoin market

— Brad Garlinghouse, CEO, Ripple

Brad Garlinghouse, CEO of Ripple, emphasized the importance of this move, highlighting that if approved, the company would achieve a pioneering position in the stablecoin market with both state and federal oversight. Jack McDonald, SVP for Stablecoins, underlined its potential to set a new compliance standard.

Ripple’s stock price for XRP rose by 3.6% following the announcement, signaling the market’s optimistic view of the potential federal regulation. Institutional partners are likely to appreciate the enhanced regulatory framework anticipated with this dual oversight.

Historically, moves towards federal regulation, like Circle’s similar efforts for USDC, have increased public trust and institutional adoption. Ripple seeks to replicate this success by ensuring RLUSD meets regulatory standards acceptable to both federal and state entities.

Experts suggest these efforts may lead to a broader acceptance of regulated digital assets in traditional financial settings. By aligning with federal standards , Ripple could not only enhance its stablecoin’s appeal but also fortify its position against competitors within the sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

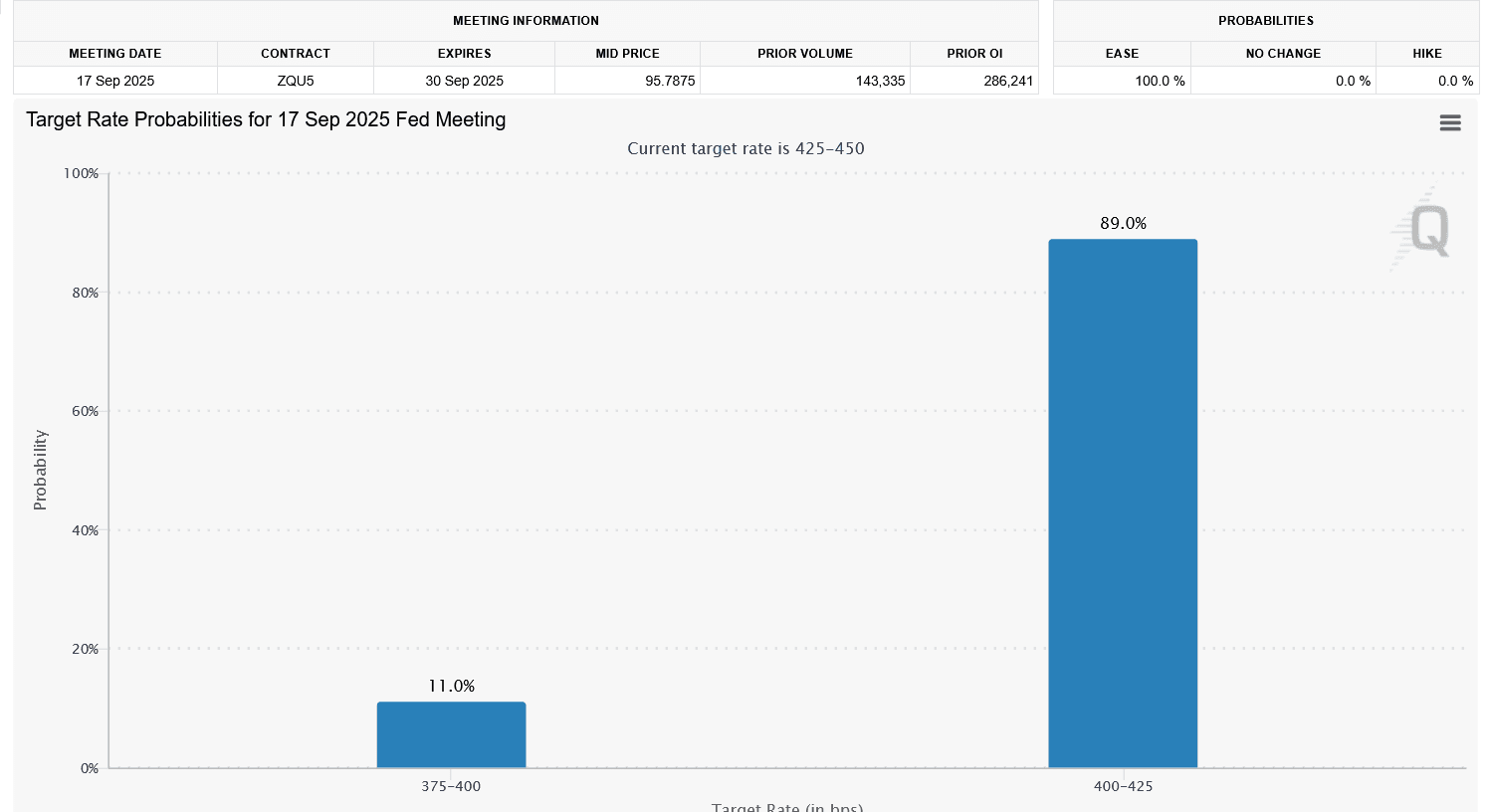

Federal Reserve Rate Cut in September: Which Three Cryptocurrencies Could Surge?

With the injection of new liquidity, three cryptocurrencies could become the biggest winners this month.

Bitcoin drop to $108K possible as investors fly to ‘safer’ assets

AiCoin Daily Report (September 6)

Hyperliquid airdrop project ratings: Which ones are worth participating in?

A wealth of valuable information on the best airdrops coming in the second half of 2025!