Trump’s Tariff Notifications Set to Shake Global Trade and Finance

- Trump initiates new tariffs, affecting global trade dynamics.

- Immediate mixed market reactions observed.

- Potential shifts in U.S.-Canada trade relations.

The U.S. tariff notifications may heighten global trade uncertainty , impacting markets and economic relations.

Donald Trump, President of the United States, plans to send tariff notifications as of Friday, reflecting a consistent theme of trade renegotiation. Tariff rates will apply to numerous countries, continuing his previous strategies. President Trump stated that:

“We’re probably going to be sending some letters out, starting probably tomorrow, maybe 10 a day to various countries saying what they’re going to pay to do business with the US.”

The initial market response exhibited caution. The U.S. Dollar saw mixed trading, and North American stock exchanges experienced both declines and recoveries. Trade talks with Canada ended sharply, affecting the USD/CAD rate. Financial markets are monitoring potential spillovers into other fiscal sectors.

Past actions under similar tariff regimes have caused market volatility and risk-off moves. Historical impacts like these suggest potential inflows into safe-haven assets like BTC. Institutional responses remain to be clarified by major economic authorities.

No explicit reactions from cryptocurrencies like BTC or ETH have been officially recorded at the time of this announcement. Regulatory bodies have yet to release statements regarding potential market implications or regulatory adjustments. Historical trends suggest possible increases in crypto trading volumes.

The regulatory and market outlook will develop as governments and market participants respond to these tariff measures. The potential effect on financial, regulatory, or technological aspects remains under evaluation, with a keen eye on broader macroeconomic indicators.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

InfoFi Faces a Slump: Rule Upgrades, Shrinking Yields, and Platform Transformation Dilemma

Creators and projects are leaving the InfoFi platform.

TRON Leads Blockchain Fees in 30 Days, Surpassing Ethereum by 28%

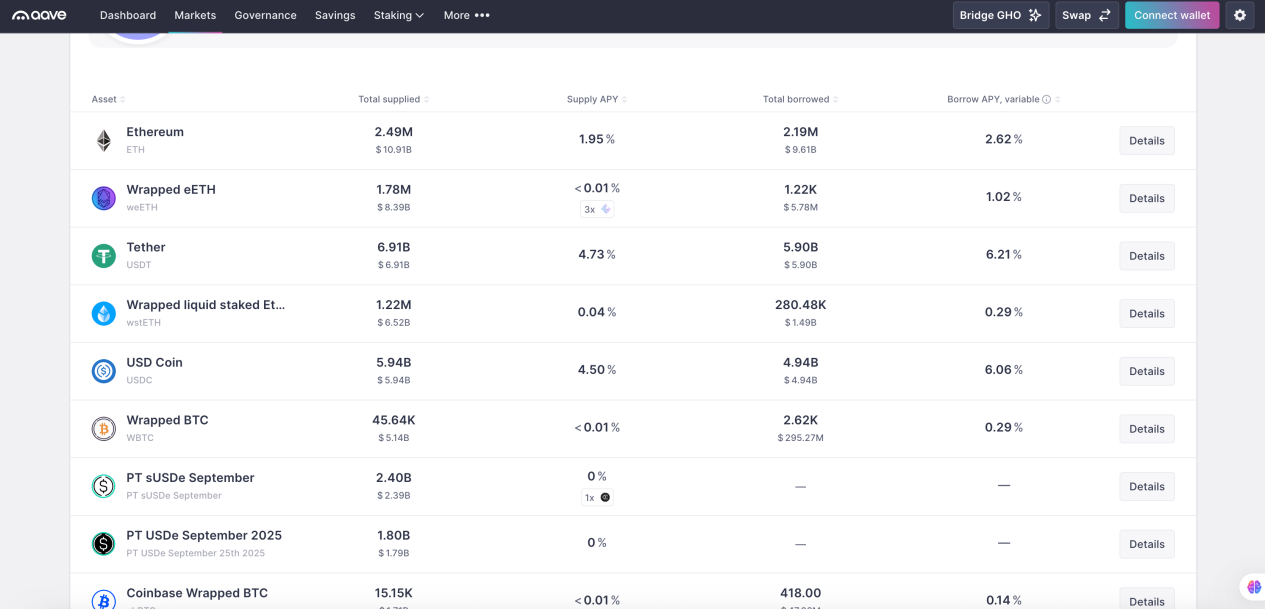

DeFi Beginner’s Guide (Part 1): How AAVE Whales Use $10 Million to Arbitrage Interest Rate Spreads and Achieve 100% APR

A quick introduction to DeFi, analyzing the returns and risks of different strategies based on real trading data from DeFi whales.

![[Bitpush Daily News Selection] Trump Media completes acquisition of 684 million CRO tokens worth about $178 million; Ethena Foundation launches new $310 million buyback plan; Vitalik Buterin: Low-cost stablecoin transactions remain one of the core values of cryptocurrency; Spot gold rises to $3,600, hitting a new all-time high](https://img.bgstatic.com/multiLang/image/social/28ccebdba840f2fa20c951ded37503be1757072702741.png)