Ripple’s RLUSD Integrates With AMINA Bank

- Ripple’s RLUSD integration boosts institutional banking presence.

- AMINA offers custody and trading services.

- Enhancement in regulated digital asset markets.

AMINA Bank has become the first global bank to integrate Ripple’s RLUSD, offering custody and trading services for the USD-backed stablecoin.

Ripple’s RLUSD integration with AMINA Bank represents a significant step in expanding regulated cryptocurrency offerings and may increase stablecoin utility in institutional settings.

Ripple’s USD-backed stablecoin, RLUSD, achieves new milestones with AMINA Bank’s integration , marking the first global bank to adopt it. The integration offers institutional-grade custody and trading services, reflecting an advancement in regulated digital assets.

AMINA Bank, formerly SEBA Bank, has collaborated with Ripple to support RLUSD under the New York Department of Financial Services oversight. This move aligns with their digital asset strategy, emphasizing transparency with institutional clients, according to Myles Harrison.

The integration of Ripple’s RLUSD underscores our commitment to providing institutional clients with secure and compliant access to innovative digital assets. Ripple’s focus on transparency and regulatory compliance made it a natural partner for us as we expand our institutional-grade digital asset services. — Myles Harrison, Chief Product Officer, AMINA Bank

The integration of RLUSD at AMINA Bank could potentially shift market dynamics. With its trading volume now reaching $60 million and its market cap $469 million, RLUSD enhances stablecoin activity within institutional frameworks.

Regulatory scrutiny is crucial for the crypto market, and AMINA’s step with Ripple strengthens institutional ties, opening possibilities for further European adoption. This collaboration is a competitive move against USDC and USDT in the regulated digital asset sector.

AMINA Bank’s involvement highlights enhanced utility for RLUSD, increasing demand in a compliance-focused landscape. The adoption of stablecoins by banks remains limited, making this event notable for future partnerships and financial stability measures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

InfoFi Faces a Slump: Rule Upgrades, Shrinking Yields, and Platform Transformation Dilemma

Creators and projects are leaving the InfoFi platform.

TRON Leads Blockchain Fees in 30 Days, Surpassing Ethereum by 28%

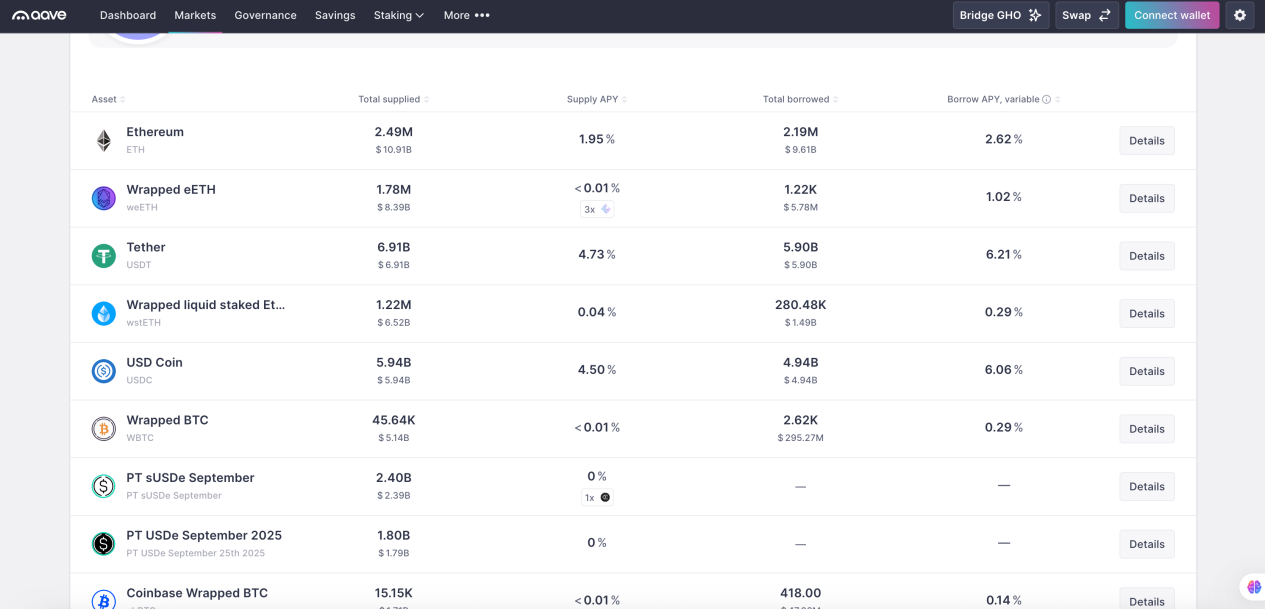

DeFi Beginner’s Guide (Part 1): How AAVE Whales Use $10 Million to Arbitrage Interest Rate Spreads and Achieve 100% APR

A quick introduction to DeFi, analyzing the returns and risks of different strategies based on real trading data from DeFi whales.

![[Bitpush Daily News Selection] Trump Media completes acquisition of 684 million CRO tokens worth about $178 million; Ethena Foundation launches new $310 million buyback plan; Vitalik Buterin: Low-cost stablecoin transactions remain one of the core values of cryptocurrency; Spot gold rises to $3,600, hitting a new all-time high](https://img.bgstatic.com/multiLang/image/social/28ccebdba840f2fa20c951ded37503be1757072702741.png)