Ukraine Sanctions 60 Firms and 73 Individuals Linked to Russia’s Crypto Evasion

2025/07/06 23:57

2025/07/06 23:57Ukraine has imposed sanctions on 60 companies and 73 individuals connected to Russia’s attempts to bypass financial restrictions through crypto.

President Volodymyr Zelenskyy signed the decree on July 6. The move targets both Russian-based and foreign companies involved in the evasion schemes.

Ukraine Sanctions Target Crypto Networks Supporting Russia

According to local media reports, the decision freezes the assets of the involved parties in Ukraine and prohibits them from engaging in economic activities within the country.

“I have just signed a new sanctions package – and these are special sanctions targeting numerous Russian financial schemes, particularly cryptocurrency-related ones,” President Zelenskyy said.

The latest decree impacts 55 companies based in Russia. The targeted entities include 19 cryptocurrency miners, 17 digital financial asset information system operators, and 19 companies in Russia’s financial infrastructure, such as payment equipment manufacturers and international payment intermediaries. Additionally, the list included five crypto exchange operators as well.

The President also sanctioned several foreign companies, including TOKENTRUST HOLDINGS LIMITED from Cyprus, EXMO RBC LTD from Kazakhstan, and three entities from the UAE. The report further noted that some of these companies are already under US sanctions.

Zelenskyy highlighted that these sanctions were not only aligned with international partners but were also an initiative by Ukraine itself to shut down these financial schemes. He added that since the start of this year, a single company that is now included on the sanctions list has helped funnel several billion dollars. The funds were mainly directed towards supporting Russia’s military-industrial complex.

“We will shut down all such schemes. Right now, with many of Russia’s traditional financial channels blocked, they are increasingly shifting to cryptocurrency transactions,” the President added.

In addition to the companies, the decree sanctions 73 individuals. This includes executives and owners of the targeted firms, as well as officials from the Central Bank of Russia.

The President also mentioned that Ukraine will introduce new measures next week to align with EU sanctions. This will ensure that the country effectively enforces all European sanctions packages against Russia.

The sanctions reflect growing concerns about the use of cryptocurrencies in geopolitical conflicts. Digital assets, valued for their anonymity and decentralized nature, have become an attractive tool for circumventing traditional financial restrictions.

In fact, crypto has also gained traction as an espionage tool. BeInCrypto reported that previously, Israel had arrested several individuals suspected of spying for Iran in exchange for crypto payments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges

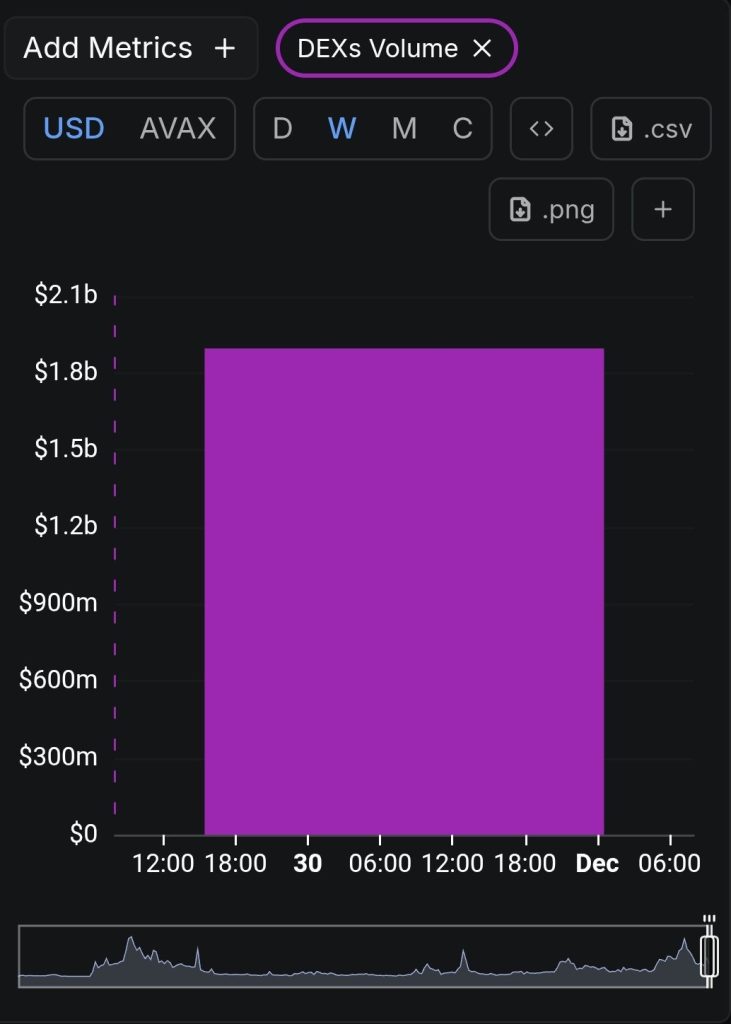

Avalanche (AVAX) Sees DEX Volume Surge as Price Rebounds From Key Support—Is a Major Breakout Near?

CZ Issues Market Warning as Crypto Exits Longest ‘Extreme Fear’ Streak