Semler Scientific stacks another 187 bitcoin for $20 million, bringing total holdings to 4,636 BTC

2025/07/06 16:00

2025/07/06 16:00

Nasdaq-listed healthcare tech firm Semler Scientific (ticker SMLR) acquired an additional 187 BTC for approximately $20 million at an average price of $106,906 per bitcoin between June 4 and July 2, according to an 8-K filing with the U.S. Securities and Exchange Commission on Monday.

Semler's latest bitcoin purchases were made with proceeds generated from the issuance and sale of its common stock. In April, Semler entered into an agreement with Barclays Capital, Cantor Fitzgerald, Canaccord Genuity, Needham & Company, Craig-Hallum Capital Group, and Lake Street Capital Markets to sell up to $500 million of its common stock through an at-the-market (ATM) program. As of July 2, Semler has sold 4,116,735 shares under the agreement, generating approximately $156.6 million in net proceeds, the firm said in the filing.

Semler now holds a total of 4,636 BTC, worth approximately $502 million, bought at an average price of $92,753 per bitcoin, for a total cost of around $430 million, including fees and expenses — implying around $72 million worth of paper gains. It currently sits 15th by holdings in the corporate bitcoin accumulation race, according to The Block's data dashboard .

The corporate bitcoin accumulation race

According to Bitcoin Treasuries data, there are now 135 public companies that have adopted some form of bitcoin treasury, with Tether-backed Twenty One , Nakamoto , Trump Media , and GameStop , recently joining the likes of Semler Scientific in adopting the bitcoin acquisition model pioneered by Michael Saylor and Strategy.

Strategy paused its bitcoin buying spree for the first time in three months last week. Meanwhile, Japanese investment firm Metaplanet is ramping up its bitcoin purchases, announcing Monday it had bought an additional 2,205 BTC for $239 million, bringing its total holdings to 15,555 BTC.

Like many of those firms, Semler uses a key performance indicator known as BTC Yield to assess the effectiveness of its bitcoin acquisition strategy in driving shareholder value. BTC Yield represents the percentage change period-to-period of the ratio between Semler's bitcoin holdings and its assumed diluted shares outstanding. Year-to-date, Semler said it has achieved a BTC Yield of 29% — up from 26.7% last month.

Semler Scientific's shares are currently trading down 4.5% on Monday, according to The Block's SMLR price page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The truth behind BTC's plunge: Not a crypto crash, but a global deleveraging triggered by the yen shock

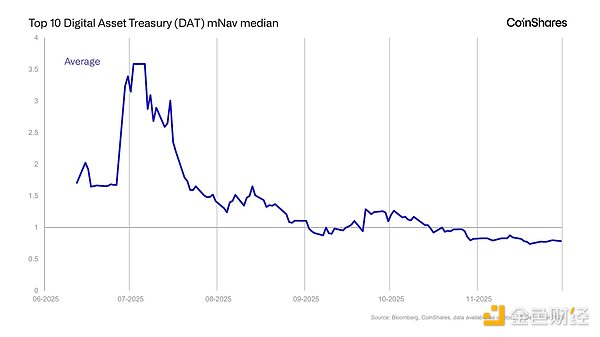

DAT: A Concept in Transition

From traditional market-making giants to core market makers in prediction markets, SIG's forward-looking layout in crypto

Whether it's investing or trading, SIG is always forward-looking.