Goldman Sachs Flips Bearish on US Treasury Yields, Forecasts Fed Rate Cuts Sooner Than Expected: Report

2025/07/06 16:00

2025/07/06 16:00Market strategists at banking giant Goldman Sachs have reportedly lowered their forecasts for US Treasury yields on the basis that the Federal Reserve will most likely begin cutting interest rates sooner than expected.

In a report seen by Bloomberg , analysts, including George Cole, say that they’re lowering their end-of-year targets for yields and are revising their expectations for Fed cuts in 2025.

The analysts say that they see the two and 10-year yields ending 2025 at 3.45% and 4.20%, respectively, dropping from their initial call of 3.85% and 4.50%.

Meanwhile, Goldman’s economists originally believed that the Fed would only achieve one rate cut near the end of the year, but are now expecting cuts in September, October and December.

Even though strong labor numbers challenged the analysts’ forecast, the Goldman analysts are standing firm on their call, noting that the strong data was distorted by the outsized figure of government hiring and a decline in the labor participation rate.

“A benign path to lower short-term rates can dilute a potential source of additional fiscal risk premia and improve the economic appeal [of owning Treasuries.] We see scope for deeper cuts to support lower yields than previously envisioned.”

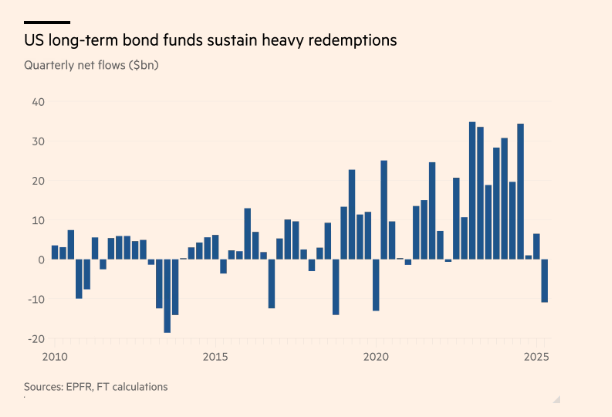

The Financial Times reports that $11 billion in long-term bond funds focused on government and corporate debt have been dumped in just three months.

The Q2 2025 sell-off ends a three-year run of net inflows into long-term US bond funds, with the previous sell-off happening back in the second quarter of 2022.

Source: The Financial Times

Source: The Financial Times

PGIM’s top fixed-income strategist, Robert Tipp, says the shift shows investors are wary of rising inflation and increasing government debt.

“It’s a volatile environment, with inflation still above target and heavy government supply as far as the eye can see. This is driving a skittishness about the long end of the yield curve, and a general uneasiness.”

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s ‘fastest bear market’ hides potentially positive year-end outcome for BTC

Bitcoin’s death cross confirmation may mean BTC is officially in a bear market

How low can XRP price go after falling under $2?

ETH price drops to 4-month low, but Ether futures data hints at $3.2K bounce