Crypto VC funding: H100 Group leads with $54m investment, Agora Finance raises $50m

Venture capital funding in the crypto sector totaled $165.1 million during the week of July 6–12, spread across 10 projects spanning AI, infrastructure, gaming, and financial services.

The largest round went to H100 Group, which raised $54 million, while finance and banking ventures accounted for nearly half of the week’s total deal flow. With activity ranging from seed to Series A rounds, investors are continuing to back real-world utility and infrastructure as the next phase of crypto development takes shape.

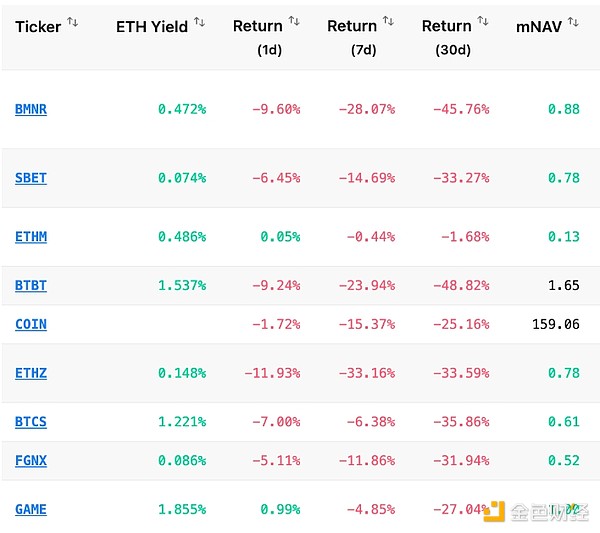

Here’s a complete analysis of this week’s investor activity per data from Crypto Fundraising :

H100 Group

- H100 Group raised $54 million .

- The project is operating in AI and Infrastructure sectors.

- To date, H100 Group has secured over $56.2 million in funding.

Agora Finance

- The project secured $50 million in a Series A round backed by Paradigm.

- Agora Finance is a financial solutions provider, focusing on supplier financing.

- Agora Finance has raised $62 million so far.

DigitalX

- Digital X raised $13.5 million in a Strategic round

- The project operates in categories like Asset Management, Finance/Banking, and Real-World Assets

- Investors include Animoca Brands, UTXO Management, and others

Kuru

- Kuru gathered $11.6 million in a Series A round.

- The project, which raised $13.6 million so far, is an on-chain orderbook exchange on the Monad chain/

- The investment was backed by Paradigm, Electric Capital, and Drivezy Ventures.

NexBridge

- The project raised $8 million in a Series A round.

- NexBridge is a digital asset issuer and trading platform.

- Investors include Falcon Ventures.

Remix (ex Farcade)

- Remix secured $5 million in a Seed round.

- The project operates in categories including AI and gaming.

- The funding was backed by Archetype, Coinbase Ventures, and Variant

Projects <$5 Million

- Velvet Capital, $3.7 million

- BridgePort, $3.2 million

- Uweb (University of Web3), $3 million

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

With the market continuing to decline, how are the whales, DAT, and ETFs doing?

The New York Times: $28 Billion in "Black Money" in the Cryptocurrency Industry

As Trump actively promotes cryptocurrencies and the crypto industry gradually enters the mainstream, funds from scammers and various criminal groups are continuously flowing into major cryptocurrency exchanges.

What has happened to El Salvador after canceling bitcoin as legal tender?

A deep dive into how El Salvador is moving towards sovereignty and strength.

Crypto ATMs become new tools for scams: 28,000 locations across the US, $240 million stolen in six months

In front of cryptocurrency ATMs, elderly people have become precise targets for scammers.