Grayscale Disputes SEC’s ETF Conversion Pause

- Grayscale challenges SEC over ETF delay.

- CEO asserts SEC’s lack of authority.

- Market accessibility for major tokens affected.

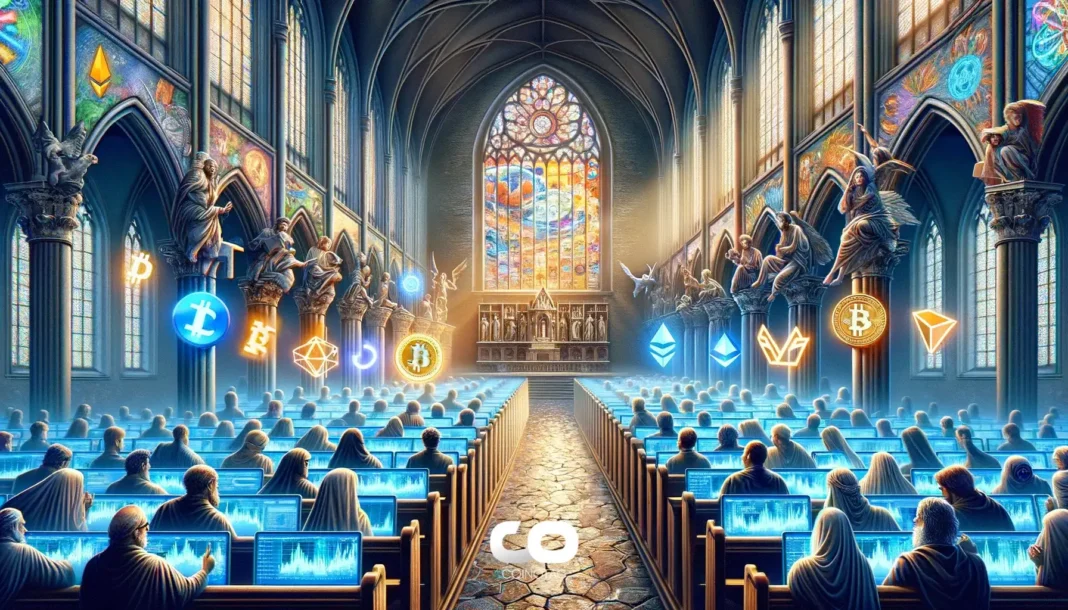

Grayscale Investments is disputing the SEC’s decision to delay its conversion of the Grayscale Bitcoin Trust into a spot ETF. Grayscale’s legal response questions the SEC’s authority to extend the deadline, as cited by Michael Sonnenshein’s continued advocacy for crypto ETFs. Previously, Grayscale succeeded in a legal battle over its Bitcoin spot ETF , enabling further market advancements.

The SEC’s stay affects various financial entities by delaying potential ETF market expansion. Notable assets like Bitcoin, Ethereum, and Solana , primarily held in Grayscale’s trust, face accessibility hurdles. Regulatory setbacks often lead to short-term price volatility, with long-term market adoption contingent on resolution of the legal impasse in favor of Grayscale’s aims.

ETF listings impact trading volumes and regulatory actions shape token market dynamics. Financial models may shift, depending on Grayscale’s ability to overcome these legal barriers. However, Grayscale remains steadfast in its position against the SEC, potentially setting further legal precedents. Historical wins against the SEC suggest an enduring clash that requires careful observation from market participants.

This contentious issue reverberates across regulatory and industry sectors, with Grayscale seeking clear guidelines for crypto ETFs . In summary, impacts center on delayed access to critical crypto assets, with Grayscale’s legal strategy challenging existing regulatory frameworks and influencing market evolution.

“The statute provides no authority to the Commission to extend [the deadline], by rule or otherwise,” said Michael Sonnenshein, CEO, Grayscale Investments, emphasizing that internal SEC rules cannot override congressional deadlines.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Mystery: Massive 7,880 BTC Transfer Stuns Crypto World

GameSquare Raises $70M for Ethereum Expansion

300% DOGE price rally expected if this key price level is reclaimed