Bitcoin $120,000 All-Time High Imminent as Supply Shock Nears

Bitcoin’s growing demand and tightening supply could push its price past $120,000, with strong investor accumulation and bullish momentum.

Bitcoin has experienced a notable 10% rally this week, driving its price to a new all-time high (ATH). This upward momentum signals a bullish outlook for the cryptocurrency, as investors continue to show strong demand.

Bitcoin is once again on track to set new price records, driven by its growing popularity and investor confidence.

Bitcoin Investors Are Hyper Bullish

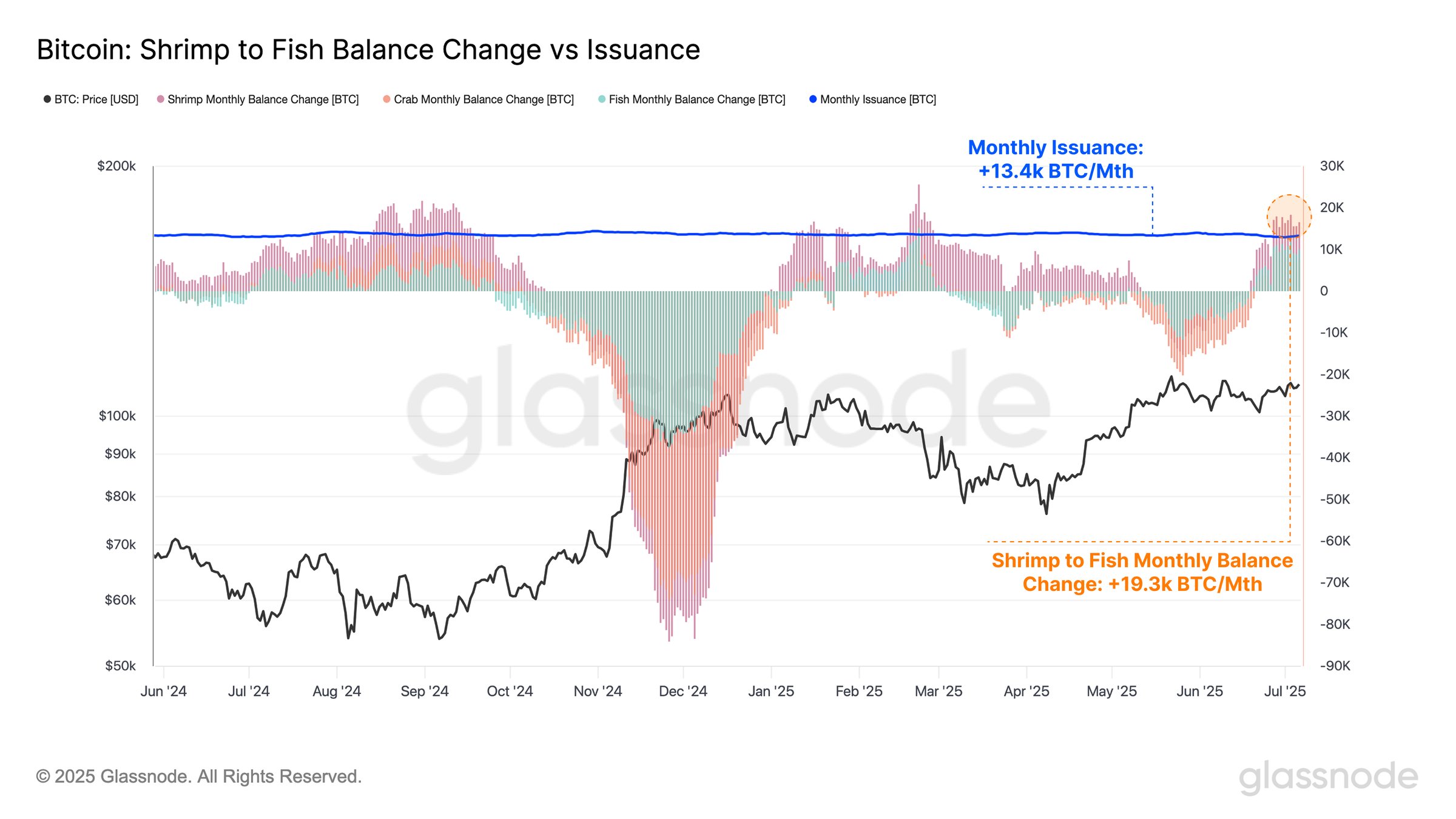

Short-term holders (STHs) are heavily bullish towards Bitcoin, as evidenced by their increasing accumulation behavior. Over the past month, the Shrimp to Fish cohort has added more than 19,300 BTC to its holdings.

Meanwhile, Bitcoin miners have only issued 13,400 BTC, indicating a significant disparity in demand and supply.

The persistent net absorption by STHs, along with a decrease in new BTC issuance, suggests tightening on the supply side. This tightening of supply is a critical factor in Bitcoin’s price action.

Bitcoin Shrimp To Fish Balance. Source:

Glassnode

Bitcoin Shrimp To Fish Balance. Source:

Glassnode

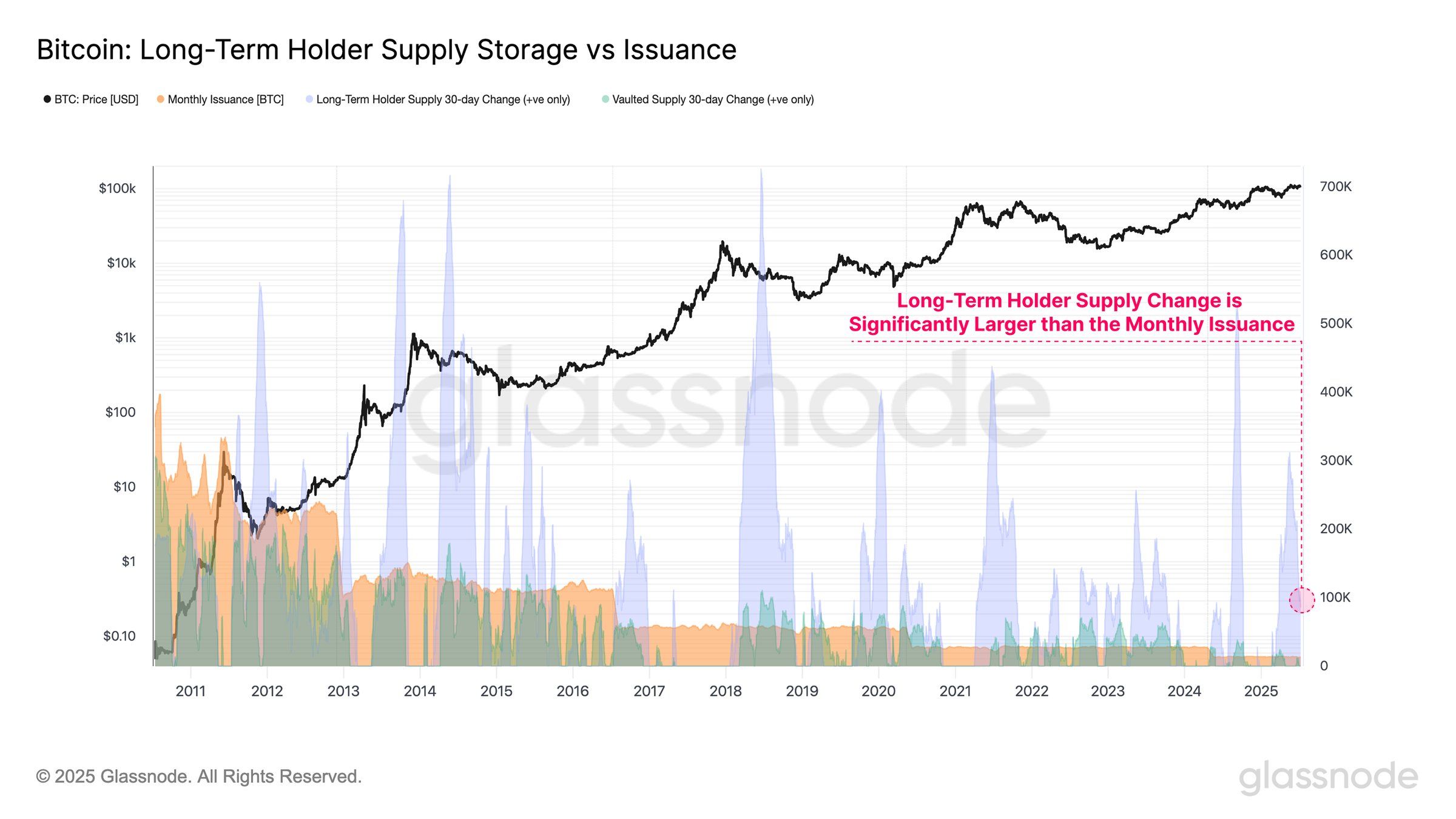

Long-term holders (LTHs) also show strong accumulation behavior, further contributing to the tightening supply.

LTHs are currently absorbing more Bitcoin than miners can issue, creating an environment where the demand for BTC surpasses its supply. This uniform behavior across all major investor cohorts signals that Bitcoin may soon experience a supply shock.

This scenario is historically a bullish signal for Bitcoin, as it suggests that a significant portion of the circulating supply is being taken off exchanges, reducing market liquidity. The current trend of net absorption could lead to sustained upward pressure on Bitcoin’s price.

Bitcoin LTH Supply Change. Source:

Glassnode

Bitcoin LTH Supply Change. Source:

Glassnode

BTC Price May Form A New High

Bitcoin’s price has increased by 9.7% over the past week, trading at $118,712, just under its ATH of $118,869. With strong accumulation trends and tightening supply, Bitcoin is well-positioned to continue its bullish run in the coming days.

The growing investor confidence and market momentum indicate that BTC could easily push past its current ATH.

Given the persistent demand and limited supply, Bitcoin is poised to reach the $120,000 mark. This would act as a crucial bullish trigger for further inflows into the market.

If Bitcoin manages to secure this level, it would set a new ATH and pave the way for more substantial gains.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

While the chances of a decline are relatively low due to the strong accumulation behavior of investors, Bitcoin could face challenges on Monday when the stock markets open.

The potential impact of Donald Trump’s recent 30% tariffs on the European Union could create short-term volatility. If Bitcoin reacts negatively to the market conditions, a drop to $115,000 is likely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?