Ripple CTO David Schwartz sees Bitcoin as the bedrock of the digital asset ecosystem

Ripple Chief Technology Officer David Schwartz said Bitcoin’s value may lie in its foundational role as a secure, trust-minimized settlement layer, rather than in its direct utility on its base chain. He suggested this role could support its long-term relevance, even as newer blockchains offer more advanced features.

“The set of actual real-world problems being solved by cryptocurrencies today is really small. But I think the hope for Bitcoin is that its solid layer one and early start will secure it a position as a currency of choice in an evolving digital asset ecosystem even if the vast majority of its transactions don’t take place on Bitcoin’s layer one,” Schwartz responded to an X user’s question about what problem Bitcoin is solving today.

“Perhaps a robust, healthy proof of work backbone that people always have the option of using will continue to protect Bitcoin’s place even if it can’t match the native functionality of competing digital assets,” he added.

Schwartz also pointed to the growing use of Bitcoin on other layers and platforms as evidence that Bitcoin’s utility extends far beyond the main chain.

He likened this to XRP being used on an EVM-compatible sidechain, where it retains currency utility even if not transacted directly on the XRP Ledger.

“A good analogy is XRP being used as a currency on the EVM sidechain. It’s not a direct use of XRP on XRPL, but it’s still part of the utility and value or XRP as a currency,” Schwartz explained. “Bitcoin is being used in far more places than just on the Bitcoin blockchain itself.”

Bitcoin surged past $123,000 on Monday, lifting its market capitalization to a record $2.4 trillion. It now ranks as the sixth most valuable asset globally by market cap, trailing only gold, NVIDIA, Microsoft, Apple, and Amazon, according to CompaniesMarketCap.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

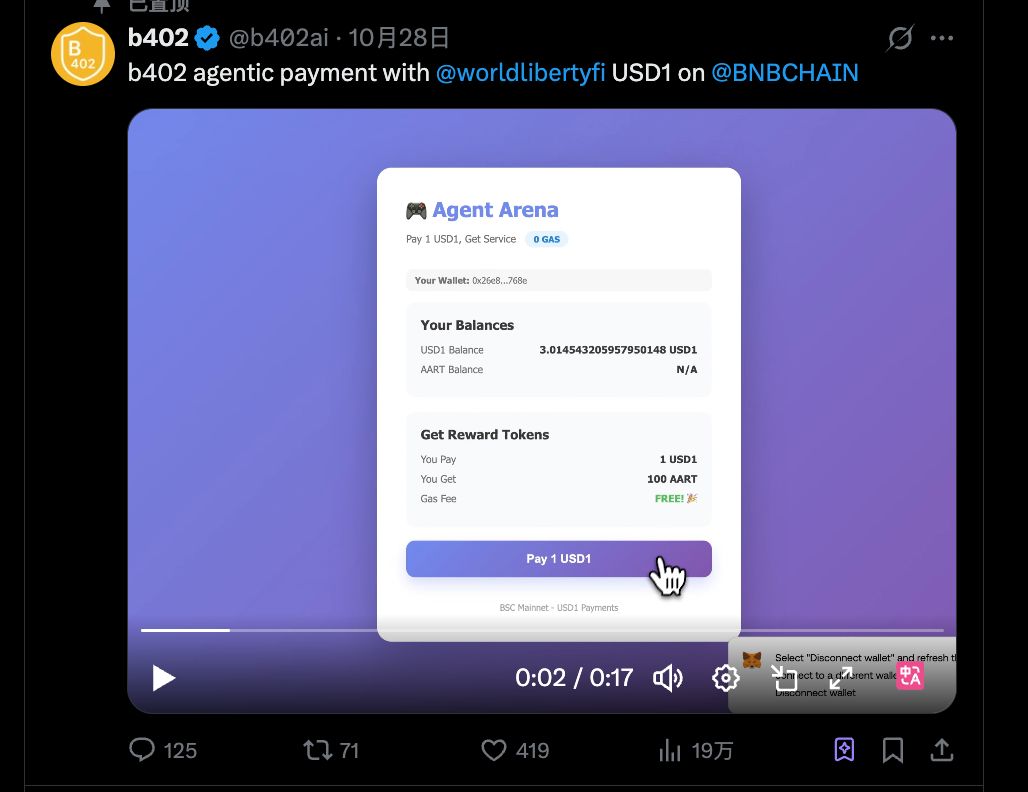

Interpretation of b402: From AI Payment Protocol to Service Marketplace, BNBChain's Infrastructure Ambitions

b402 is not just an alternative to x402 on BSC; it could be the starting point for a much bigger opportunity.

Shutdown Leaves Fed Without Key Data as Job Weakness Deepens

Institutional Investors Turn Their Backs on Bitcoin and Ethereum

Litecoin LTC Price Prediction 2025, 2026 – 2030: Can Litecoin Reach $1000 Dollars?