GameStop Diversifies with $500 Million Bitcoin Purchase

- GameStop purchases 4,710 BTC, valued at over $500 million.

- Ryan Cohen emphasizes a unique strategy with a strong balance.

- Cohen considers crypto a meaningful hedge against inflation.

GameStop’s large-scale Bitcoin purchase underscores its commitment to safeguarding against economic inflation, impacting both retail and institutional interests.

Ryan Cohen, GameStop’s CEO, announced the company’s significant Bitcoin investment, viewing it as a “hedge against inflation” and not intending to mimic MicroStrategy’s approach. Bitcoin was selected due to its perceived long-term value.

“I look at it as a hedge against inflation and global money printing, and we’ll see what happens.” — Ryan Cohen, CEO, GameStop.

GameStop acquired 4,710 Bitcoin at a time when the cryptocurrency’s price exceeded $120,000, likely fueling further bullish market sentiment. Bitcoin’s role is crucial in the company’s financial strategy, as part of GameStop’s treasury management.

Financial markets reacted to GameStop’s Bitcoin acquisition through positive discussion and speculative activity.

This move aligns with GameStop’s broader strategic vision without explicit regulatory commentary.

The move has reduced immediate liquid reserves, yet potentially enhances future financial stability. This decision could influence how other corporations view cryptocurrency integration, especially concerning risk management.

As new opportunities develop, technological integration of cryptocurrencies within GameStop services may expand, considering macroeconomic contexts. With a strong balance sheet, GameStop maintains fiscal resilience amidst economic volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

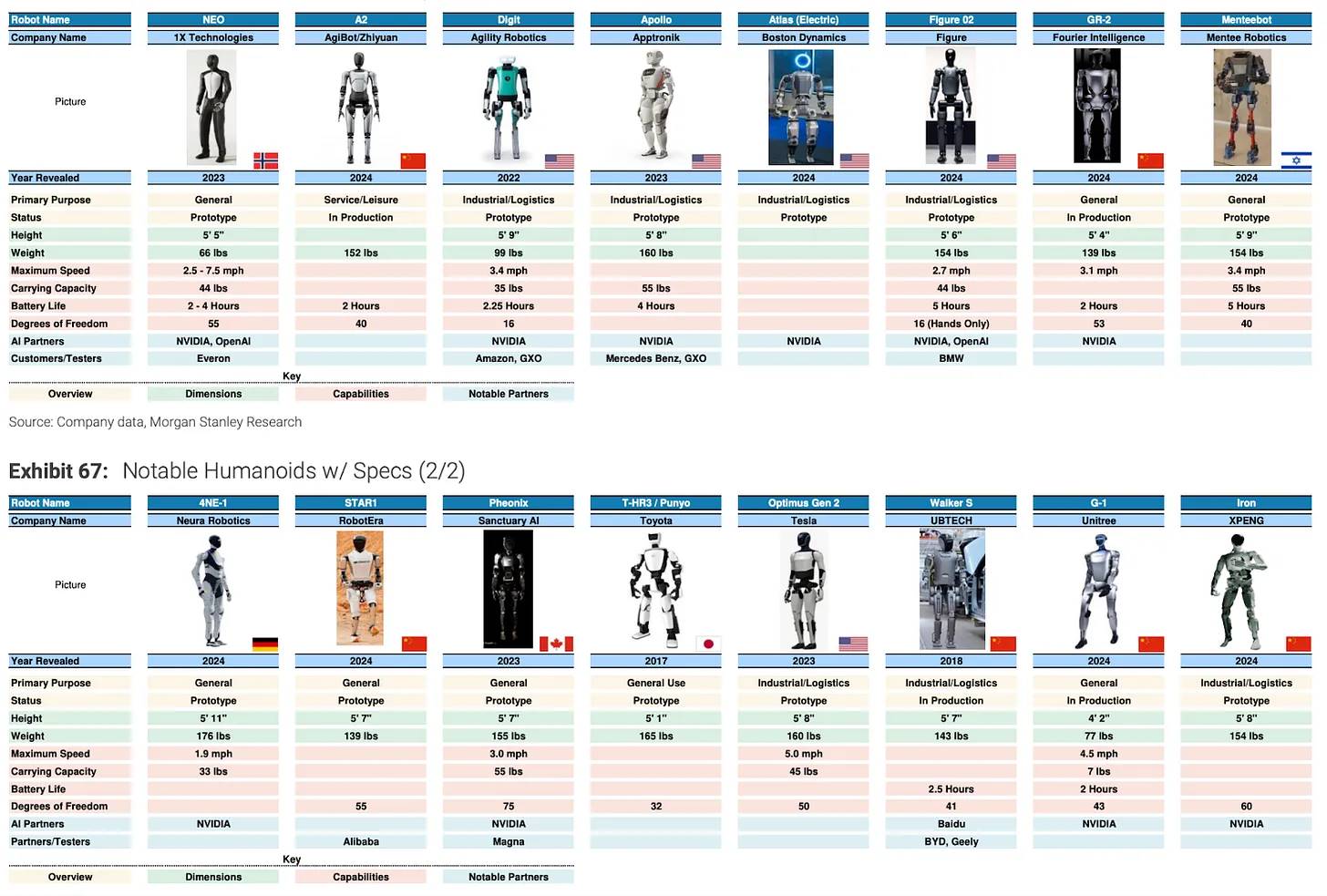

On the Eve of a 5 Trillion Market: Where Are the Investment Opportunities in Embodied Intelligence × Web3?

Embodied intelligence x Web3: Structurally driven solutions create investable opportunities.

$40 million financing, Vitalik participates, Etherealize aims to be Ethereum’s “spokesperson”

The goal of transforming traditional finance with Ethereum does not necessarily have to be achieved through DeFi.

First Pan-European Platform for Tokenized Assets Launched

Mars Morning News | Tether and Circle have minted a total of $12 billion worth of stablecoins in the past month

Tether and Circle have minted $12 billion in stablecoins over the past month; Figma holds $90.8 million in spot bitcoin ETFs; Russia plans to lower the entry threshold for crypto trading; Ethereum ICO participants have staked 150,000 ETH; REX-Osprey may launch a DOGE spot ETF. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.