Dogecoin Rebounds from Key $0.19 Support Level

- Dogecoin rebounds at $0.19 amidst increased trading volume.

- Supported by institutional liquidity in the market.

- Macro tailwinds from trade tariff extensions.

Dogecoin saw a significant price rebound from its $0.19 support on July 15, 2025, spurred by increased institutional trading activity and broader market positivity linked to U.S. trade tariff developments.

The Dogecoin resurgence suggests positive market sentiment, potentially triggering further price movements, as increased trading volume hints at strong institutional interest.

Market Trends and Institutional Involvement

Dogecoin’s price activity highlighted a critical recovery from a brief plunge, attributed to a sudden increase in trading volumes. Market analysis indicates strong liquidity from major institutional participants, lifting prices post-decline around the $0.19 zone.

Notable figures like Elon Musk have not released new statements, yet market trends reflect institutional traders’ confidence. As per the current absence of statements:

Billy Markus, Co-Creator, Dogecoin, – “No recent comment on the $0.19 bounce.”

Economic factors, like the U.S. tariff deadline extension, boosted sentiment for risk assets, aiding the rally.

Implications for the Cryptocurrency Market

The rally impacts memecoins and similar tokens, showing a strong correlation within the cryptocurrency market. Broader financial trends remain unaffected, with no direct influence from DeFi or Layer 1 ecosystems.

Previous rallies show Dogecoin’s potential for significant price swings. The current environment, characterized by robust liquidity and strong market interest, suggests a continuation of such volatility scenarios following key price level engagements .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

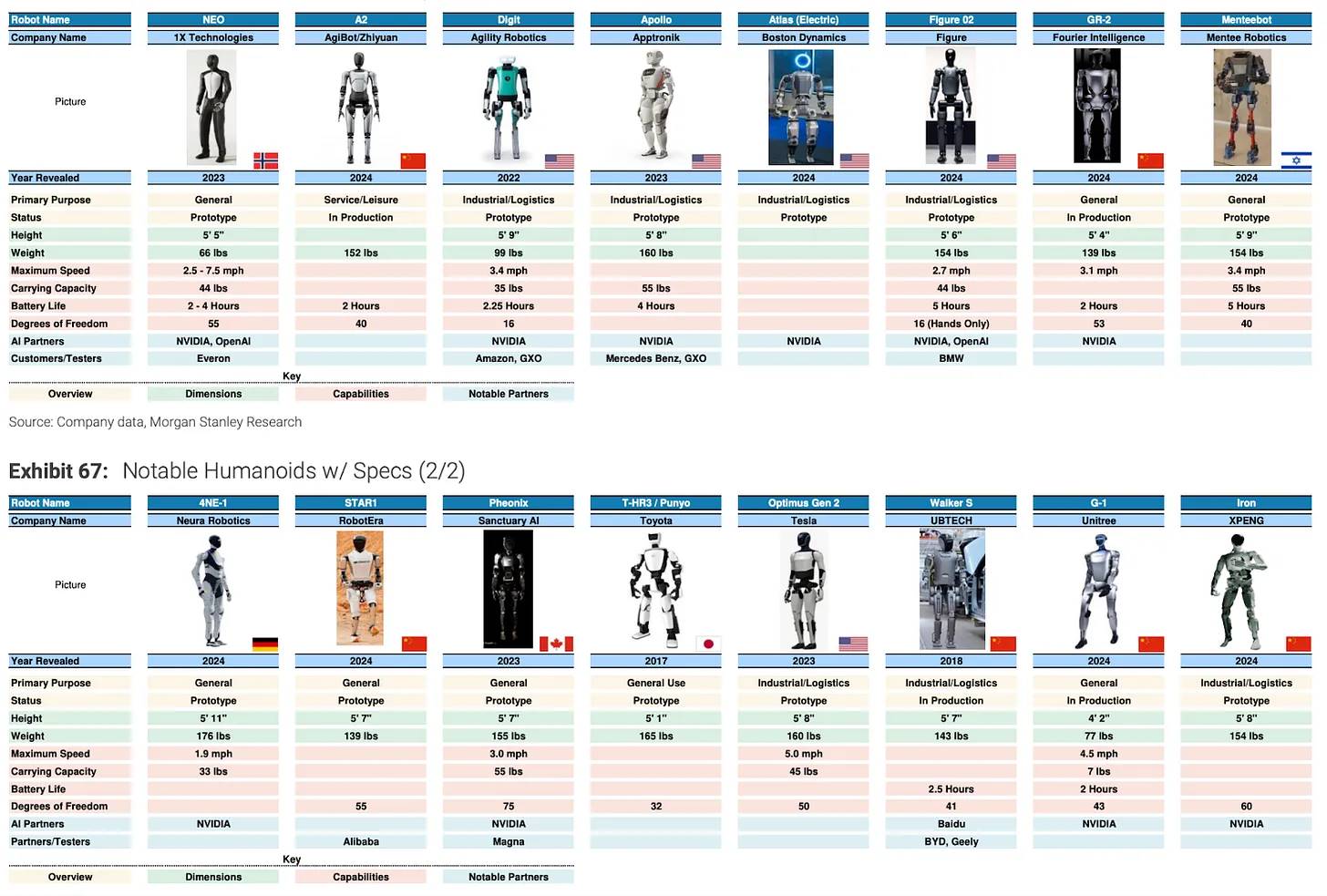

On the Eve of a 5 Trillion Market: Where Are the Investment Opportunities in Embodied Intelligence × Web3?

Embodied intelligence x Web3: Structurally driven solutions create investable opportunities.

$40 million financing, Vitalik participates, Etherealize aims to be Ethereum’s “spokesperson”

The goal of transforming traditional finance with Ethereum does not necessarily have to be achieved through DeFi.

First Pan-European Platform for Tokenized Assets Launched

Mars Morning News | Tether and Circle have minted a total of $12 billion worth of stablecoins in the past month

Tether and Circle have minted $12 billion in stablecoins over the past month; Figma holds $90.8 million in spot bitcoin ETFs; Russia plans to lower the entry threshold for crypto trading; Ethereum ICO participants have staked 150,000 ETH; REX-Osprey may launch a DOGE spot ETF. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.