Key Notes

- The crypto market has seen 125,578 traders liquidated, with the total liquidations valued at approximately $469 million.

- Bitcoin price went from hitting an all-time high of over $122,000 to now trading at $116,689.35.

- Dormant Satoshi-era whale wallet suddenly reemerged as broader altcoin market faces reset.

Within the last 24 hours, the crypto market has seen 125,578 traders liquidated, with the total liquidations valued at approximately $469 million.

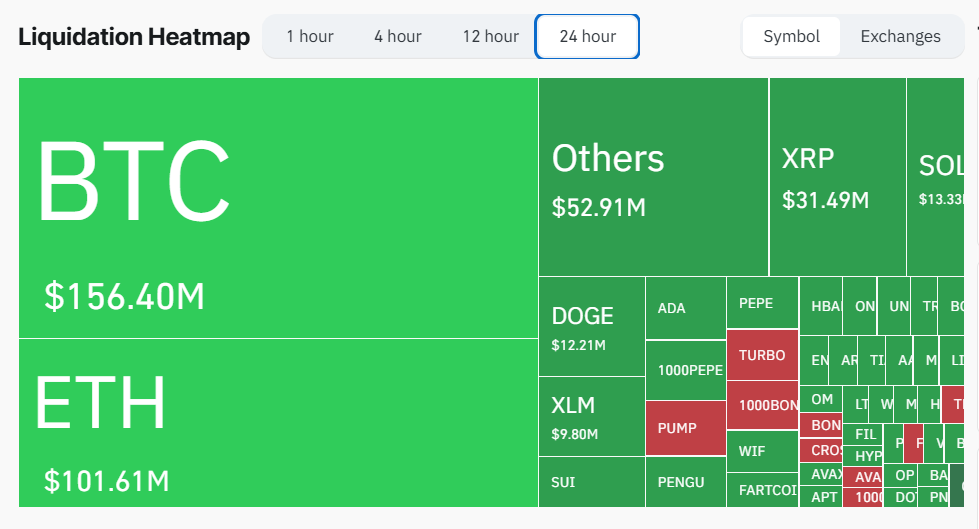

According to the Coinglass liquidation heatmap, Bitcoin BTC $116 748 24h volatility: 4.6% Market cap: $2.32 T Vol. 24h: $70.83 B leads 24-hour liquidations, impacting short traders the most. The largest single liquidation, valued at $3.15 million, occurred on Hyperliquid.

Bitcoin Price Drops From $122,000 to $116,900

The crypto market liquidation has now hit $469 million, affecting short traders the most. Bitcoin liquidation was capped at $156.40 million, while that of Ethereum ETH $2 974 24h volatility: 1.7% Market cap: $358.77 B Vol. 24h: $38.79 B was pegged at $101.61 million.

Similarly, XRP XRP $2.84 24h volatility: 3.4% Market cap: $167.61 B Vol. 24h: $11.40 B , Dogecoin DOGE $0.19 24h volatility: 7.7% Market cap: $28.62 B Vol. 24h: $7.18 B , Cardano ADA $0.72 24h volatility: 4.2% Market cap: $25.95 B Vol. 24h: $1.38 B , and several other cryptocurrencies were caught in the massive liquidation.

It is worth noting that this outlook coincides with a significant fluctuation in the prices of digital assets. The Bitcoin price, which had reached an all-time high of over $122,000, is now trading at $116,689.35, down 3.99% in the last 24 hours.

Ethereum also took a sharp price hit, now trading at $2,971.42 after dropping 3%. The sudden reversal in the prices of these digital assets has prompted many investors to begin selling their holdings. A Bitcoin whale, which had lain dormant for a while, has suddenly reemerged.

This wallet, thought to have acquired BTC in the network’s early days, suddenly became active and transferred 9,000 BTC worth over 1 billion dollars to Galaxy Digital, a major digital asset manager. Blockchain analytics firm Spot On Chain flagged the move, identifying it as part of an over-the-counter deal.

Meanwhile, the wallet still holds around 11,000 BTC, worth roughly $1.3 billion. This large transfer likely pushed the coin’s price down to $116,900.

This liquidation is a sign of overheating in the general market and might see most altcoins face rebalancing in the long term.